- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Can Impinj's (PI) Margin Gains Offset Slower Sales and Guide Its Profit Story Forward?

Reviewed by Simply Wall St

- Impinj, Inc. recently released its second-quarter 2025 results, reporting US$97.89 million in sales and US$11.55 million in net income, alongside issuing guidance for a potential net loss and revenue between US$91 million and US$94 million for the third quarter.

- An interesting aspect is that despite year-over-year sales decreasing, the company managed to improve its net income and earnings per share for the quarter, suggesting operational changes or margin improvements.

- With the company forecasting a potential third-quarter net loss, we will consider how this updated outlook may influence its broader investment narrative.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Impinj Investment Narrative Recap

To be a shareholder in Impinj, you need to believe in the company's ability to maintain its leading position in RFID endpoint ICs, drive adoption of cutting-edge products like the M800 series, and convert market leadership into profitable, stable growth. The recent Q2 results, highlighting improved net income despite lower sales, do not materially alter the central short-term catalyst of ramping the new M800 IC, which remains vital. However, with updated guidance calling for a possible Q3 net loss, the biggest risk continues to be margin and inventory volatility, especially if product mix improvements stall or demand fails to meet elevated channel inventory levels.

Among recent company announcements, Impinj's third-quarter earnings guidance issued on July 30 is the most relevant; it points to expected revenue between US$91 million and US$94 million and a potential net loss. This update directly reflects ongoing margin pressures and inventory risk, reminding investors that sustained profitability will likely depend on how well Impinj can match production and demand while maintaining cost controls and operational improvements.

In contrast, many investors may not realize how much the company’s outlook still hinges on managing channel inventory...

Read the full narrative on Impinj (it's free!)

Impinj's narrative projects $563.7 million revenue and $65.3 million earnings by 2028. This requires 15.7% yearly revenue growth and an earnings increase of about $66.2 million from the current earnings of -$957,000.

Uncover how Impinj's forecasts yield a $171.29 fair value, a 4% upside to its current price.

Exploring Other Perspectives

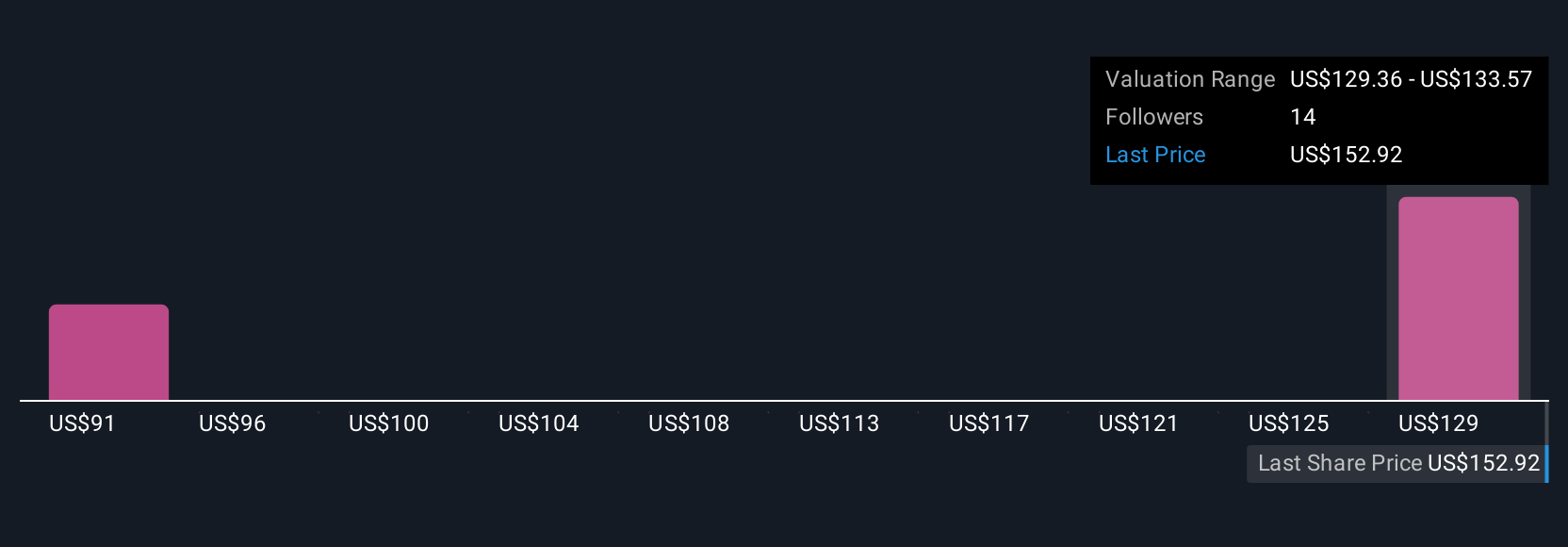

Two fair value estimates from the Simply Wall St Community currently range from US$85.63 to US$171.29, reflecting a nearly twofold difference in investor outlooks. As you consider these perspectives, keep in mind that future performance will also be shaped by Impinj’s ability to manage product mix and margin risk.

Explore 2 other fair value estimates on Impinj - why the stock might be worth 48% less than the current price!

Build Your Own Impinj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Impinj research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Impinj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Impinj's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives