- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

PDF Solutions (PDFS): Evaluating Valuation After Exensio Studio AI Launch and Strategic Intel Partnership

Reviewed by Kshitija Bhandaru

PDF Solutions (PDFS) has just unveiled Exensio Studio AI, its latest AI and machine learning platform built with technology licensed from Intel. This move expands the company’s product offerings and brings a well-known semiconductor client to its roster.

See our latest analysis for PDF Solutions.

After a string of product launches and pivotal contracts, including its latest AI partnership with Intel and a major multi-year agreement with a global chipmaker, PDF Solutions’ momentum is turning a few heads. While the past year’s total shareholder return is slightly negative at -0.13%, its five-year total return of over 30% hints at resilient long-term growth potential despite recent choppy trading.

If innovations like Exensio Studio AI have you curious about the broader tech landscape, now is the perfect time to explore See the full list for free.

With new product momentum and a major partnership fueling renewed interest, the key question now is whether PDF Solutions’ potential is still underappreciated in the current stock price or if the market has already factored in the next wave of growth.

Most Popular Narrative: 12.9% Undervalued

The most popular narrative sees fair value at $30, noticeably above the last close of $26.14, and suggests that analysts anticipate further upside based on robust business transformation. These growth estimates set the stage for an ambitious case.

Accelerated enterprise adoption of PDF's secure, cloud-based supply chain orchestration and analytics solutions, including secureWISE, Sapience Manufacturing Hub, and Exensio, positions the company to capitalize on the industry's growing need for integrated data traceability and resilient manufacturing networks. This supports robust recurring revenue growth and higher earnings stability.

Want to see the drivers behind this bold target? The real story lies in sharply higher profit margins and aggressive growth projections that underpin this valuation. Which financial assumptions shape these numbers? Find out what’s fueling optimism in the full narrative.

Result: Fair Value of $30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions or a slowdown in SaaS transition could challenge PDF Solutions’ bullish outlook and could also temper future growth expectations.

Find out about the key risks to this PDF Solutions narrative.

Another View: What Do Market Ratios Say?

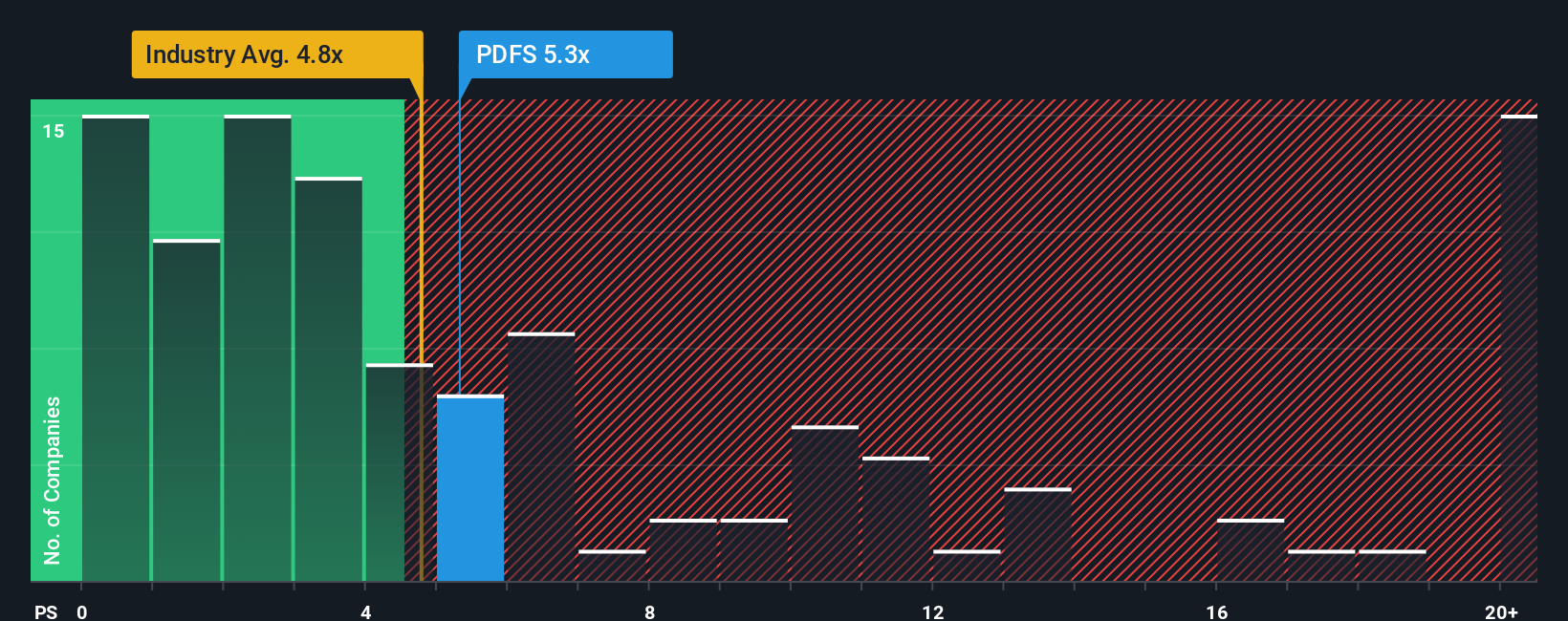

While the popular narrative suggests PDF Solutions is undervalued, market ratios paint a different picture. Compared to peers, the company’s current sales multiple of 5.3 times is higher than both the peer average (5.4x) and the industry average (4.8x). However, the fair ratio is estimated to be 5.9x. This hints that the market could still re-rate the stock upward, though there is less margin for safety. Does this premium suggest optimism, or does it expose investors to higher valuation risk if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PDF Solutions Narrative

If you see things differently or want to investigate the details yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your PDF Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your research to just one opportunity. Discover additional ways to grow your wealth and identify trends that many investors may be missing right now.

- Capture reliable income streams by finding these 19 dividend stocks with yields > 3% with attractive yields and strong balance sheets to support your long-term goals.

- Capitalize on rapid technological advances by selecting these 23 AI penny stocks that are driving innovation and expanding the frontiers of artificial intelligence.

- Stay ahead by focusing on these 914 undervalued stocks based on cash flows before the broader market recognizes their full potential in cash flow and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives