- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

Slammed 28% ON Semiconductor Corporation (NASDAQ:ON) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the ON Semiconductor Corporation (NASDAQ:ON) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

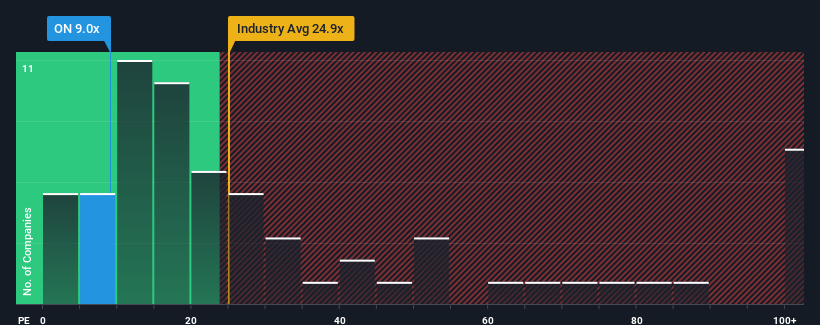

After such a large drop in price, ON Semiconductor's price-to-earnings (or "P/E") ratio of 9x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 30x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

ON Semiconductor could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for ON Semiconductor

Is There Any Growth For ON Semiconductor?

There's an inherent assumption that a company should underperform the market for P/E ratios like ON Semiconductor's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 57% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 9.7% per annum over the next three years. With the market predicted to deliver 11% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that ON Semiconductor's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

ON Semiconductor's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ON Semiconductor currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for ON Semiconductor with six simple checks on some of these key factors.

If you're unsure about the strength of ON Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives