- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

Could Weebit ReRAM’s Integration Signal a New Era for ON Semiconductor’s (ON) Product Strategy?

Reviewed by Sasha Jovanovic

- Weebit Nano recently announced the successful tape-out of test chips with its embedded ReRAM module at ON Semiconductor’s 300mm fab in East Fishkill, New York, developed on the Treo 65nm BCD platform.

- This move marks important progress toward integrating advanced, ultra-low-power memory into ON Semiconductor’s next-generation products and underscores the company’s ongoing efforts to advance intelligent power and sensing technologies for key markets.

- We'll look at how the advancement of Weebit ReRAM integration could influence ON Semiconductor’s long-term growth thesis in critical sectors.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ON Semiconductor Investment Narrative Recap

To be a shareholder in ON Semiconductor, you need to believe in the company's leadership in advanced power and sensing technologies, especially amid its push into automotive, industrial, and AI data center sectors. The recent tape-out of Weebit Nano’s ReRAM at ON Semiconductor’s 300mm fab is a technical milestone, but given the near-term pressure from manufacturing underutilization and soft demand, its impact on immediate catalysts or risk profile appears limited for now.

Among recent announcements, the collaboration between ON Semiconductor and Xiaomi, integrating ON’s EliteSiC M3e technology into Xiaomi’s latest electric SUVs, stands out. This partnership highlights ON Semiconductor’s expanding footprint in next-generation automotive platforms, a key growth driver as the company seeks to offset near-term revenue headwinds tied to its exit from legacy businesses and margin challenges in core segments.

However, as promising as technology advances may be, investors should not overlook the continued risk of underutilized capacity and pressure on gross margins if...

Read the full narrative on ON Semiconductor (it's free!)

ON Semiconductor's narrative projects $7.5 billion revenue and $1.9 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $1.43 billion earnings increase from $465.8 million currently.

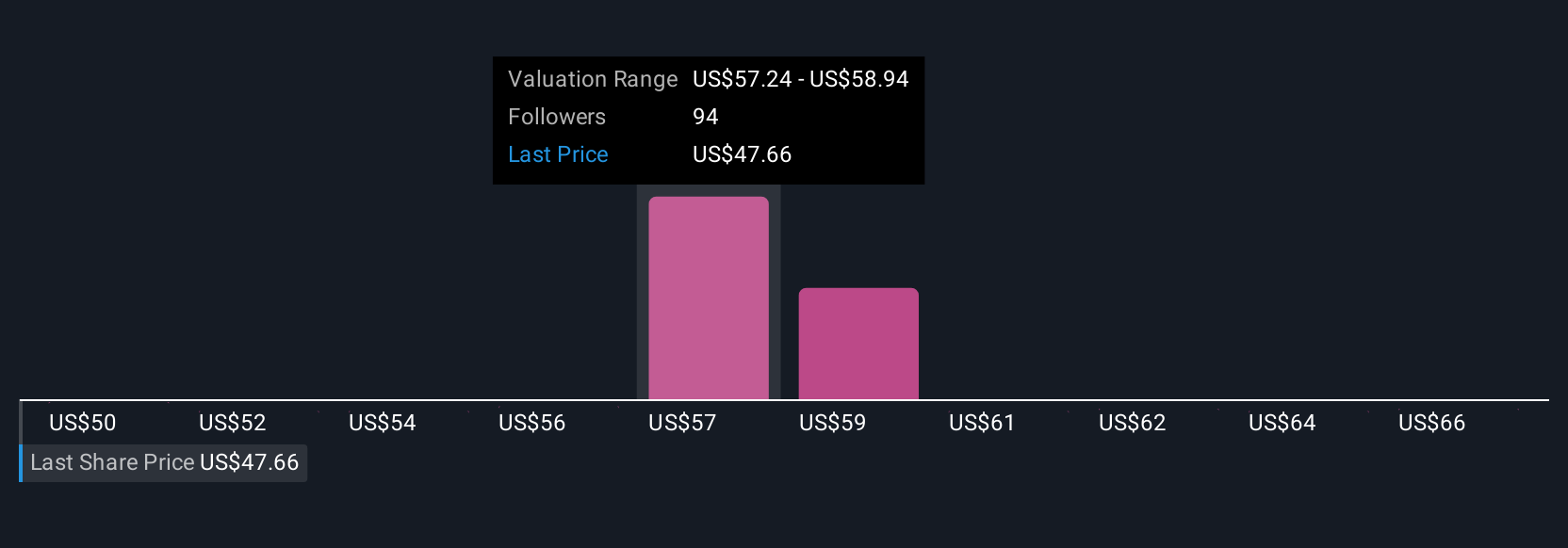

Uncover how ON Semiconductor's forecasts yield a $57.53 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Fourteen Simply Wall St Community members estimate fair values between US$49.59 and US$70 per share, reflecting broad differences in expectations. While investors weigh these varied outlooks, ongoing margin pressures from underutilization remain a key consideration for ON Semiconductor’s future performance.

Explore 14 other fair value estimates on ON Semiconductor - why the stock might be worth 6% less than the current price!

Build Your Own ON Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ON Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ON Semiconductor's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives