- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NasdaqGS:NXPI) Partners With Clavister For AI-Driven Cybersecurity

Reviewed by Simply Wall St

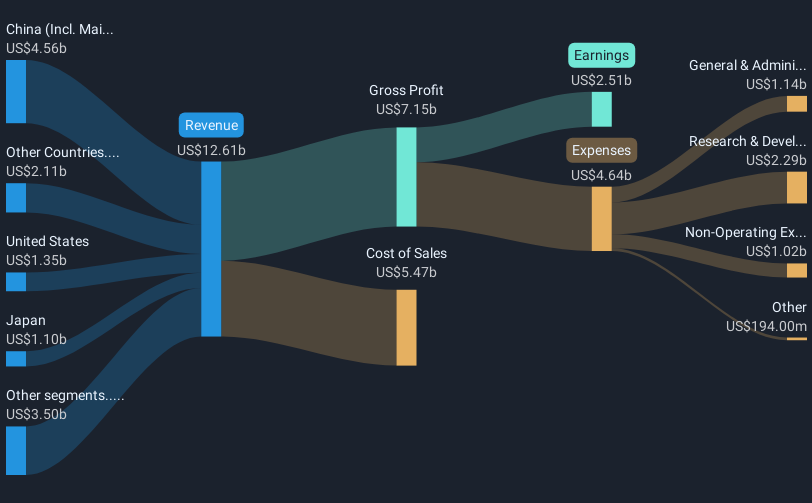

NXP Semiconductors (NasdaqGS:NXPI) recently entered into a significant partnership with Clavister to develop AI-driven cybersecurity applications for the automotive industry. This collaboration aligns with industry needs as vehicles increasingly rely on digital systems, demanding advanced cybersecurity. NXP's stock saw a price move of 13%, potentially influenced by the partnership news amid a broader market upswing with a 4% gain, driven by strong earnings from tech giants and positive market sentiment. While market trends contributed to the rise, NXP's strategic positioning in addressing automotive cybersecurity may have added weight to its substantial stock increase.

The recent partnership between NXP Semiconductors and Clavister could enhance NXP’s positioning in the software-defined vehicle sector and address growing cybersecurity needs in the automotive industry. This development potentially supports the revenue and earnings forecasts by expanding NXP's reach in cutting-edge automotive applications, which are anticipated to drive future growth. Analysts already expect NXP's earnings to grow to US$3.3 billion by April 2028, with a projected revenue of $14.3 billion, suggesting a favorable impact from such partnerships.

Over the past five years, NXP's total shareholder return, including dividends, was 111.15%, showcasing a robust performance over this longer-term period. However, it's important to note that NXP's recent one-year performance lagged behind both the U.S. Market, which returned 7.9%, and the U.S. Semiconductor industry, which saw a 9.9% increase in returns.

Despite a current share price of US$174.66, the consensus analyst price target for NXP is US$241.29, reflecting an expected increase of 24.7%. This target is contingent upon sustained revenue growth supported by strategic investments and partnerships like the one with Clavister. Investors should carefully consider these underlying factors as they could influence NXP’s ability to meet or exceed these growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives