- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

How Investors May Respond To NXP Semiconductors (NXPI) Q4 2025 Dividend and Acquisition Moves

Reviewed by Sasha Jovanovic

- NXP Semiconductors announced the board-approved payment of a US$1.014 per ordinary share interim dividend for Q4 2025, to be paid on January 7, 2026, reflecting confidence in its capital structure and outlook.

- This decision follows continued business strength and comes as the company pursues acquisitions in AI edge compute and automotive/industrial segments.

- We'll examine how the recent dividend affirmation and acquisition activity shape NXP's investment narrative amid upcoming earnings and sector changes.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

NXP Semiconductors Investment Narrative Recap

For investors considering NXP Semiconductors, the long-term narrative hinges on a sustained rebound in end-market demand, particularly in automotive and industrial semiconductors, and disciplined cost management through sector cycles. The recent affirmation of a consistent US$1.014 per share interim dividend signals continued confidence but does not materially change the near-term focus on operational catalysts, such as progress in automotive revenue growth and risks from competitive pressures in China or delayed inventory normalization.

Among the flurry of corporate updates, NXP’s Q3 2025 earnings stand out as most relevant. They continue to highlight modest year-over-year declines in both revenue and net income, reinforcing that short-term momentum for the stock still depends on the pace and quality of automotive end-demand normalization and not solely on shareholder returns. In contrast, investors should remain alert to ...

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors is forecasted to achieve $15.5 billion in revenue and $3.5 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.7% and a $1.4 billion increase in earnings from the current $2.1 billion level.

Uncover how NXP Semiconductors' forecasts yield a $258.19 fair value, a 35% upside to its current price.

Exploring Other Perspectives

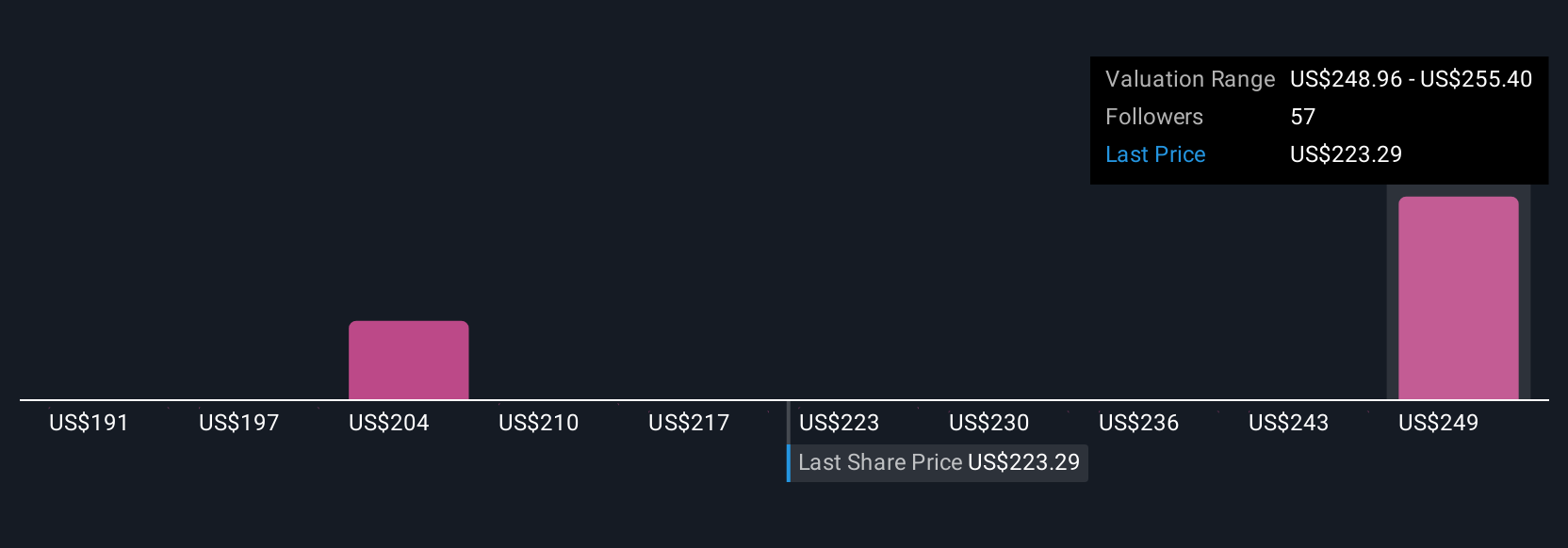

Ten different fair value views from the Simply Wall St Community place NXP’s worth anywhere between US$187.08 and US$294.09 per share. While opinions vary widely, inventory normalization in automotive and potential headwinds in China remain critical for NXP’s trajectory, so make sure you weigh how each of these factors could shape future outcomes.

Explore 10 other fair value estimates on NXP Semiconductors - why the stock might be worth as much as 54% more than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success