- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

Some Confidence Is Lacking In Navitas Semiconductor Corporation (NASDAQ:NVTS) As Shares Slide 26%

Navitas Semiconductor Corporation (NASDAQ:NVTS) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

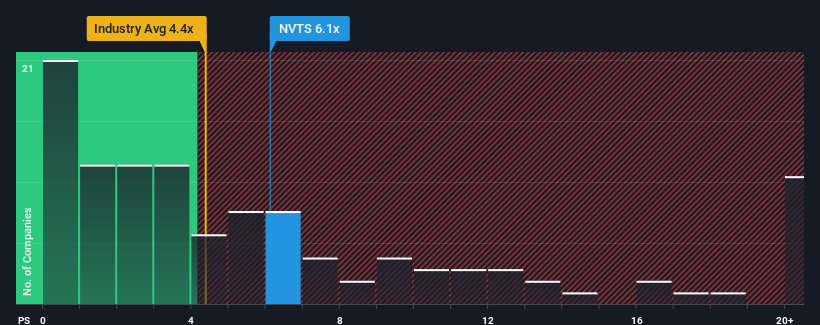

In spite of the heavy fall in price, Navitas Semiconductor may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 6.1x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4.1x and even P/S lower than 1.6x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Navitas Semiconductor

What Does Navitas Semiconductor's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Navitas Semiconductor has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Navitas Semiconductor.Is There Enough Revenue Growth Forecasted For Navitas Semiconductor?

The only time you'd be truly comfortable seeing a P/S as high as Navitas Semiconductor's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 22% per year over the next three years. That's shaping up to be similar to the 25% per annum growth forecast for the broader industry.

In light of this, it's curious that Navitas Semiconductor's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Navitas Semiconductor's P/S Mean For Investors?

Despite the recent share price weakness, Navitas Semiconductor's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Navitas Semiconductor currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Navitas Semiconductor (at least 2 which are significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.