- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

More Unpleasant Surprises Could Be In Store For Navitas Semiconductor Corporation's (NASDAQ:NVTS) Shares After Tumbling 34%

Unfortunately for some shareholders, the Navitas Semiconductor Corporation (NASDAQ:NVTS) share price has dived 34% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

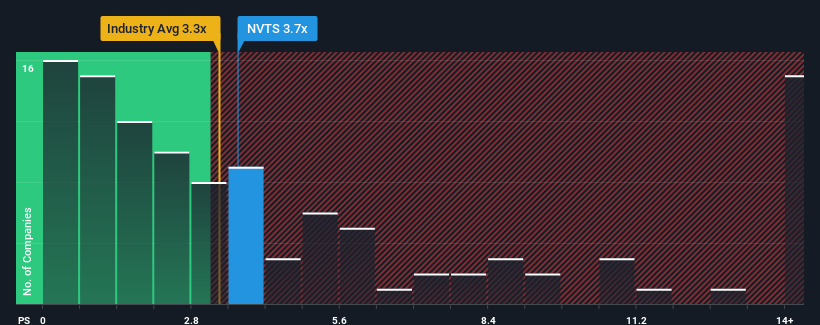

In spite of the heavy fall in price, given close to half the companies operating in the United States' Semiconductor industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider Navitas Semiconductor as a stock to potentially avoid with its 3.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Navitas Semiconductor

What Does Navitas Semiconductor's P/S Mean For Shareholders?

Recent times haven't been great for Navitas Semiconductor as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Navitas Semiconductor .How Is Navitas Semiconductor's Revenue Growth Trending?

Navitas Semiconductor's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. Pleasingly, revenue has also lifted 251% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the eight analysts watching the company. That's shaping up to be materially lower than the 23% per annum growth forecast for the broader industry.

In light of this, it's alarming that Navitas Semiconductor's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Navitas Semiconductor's P/S?

Despite the recent share price weakness, Navitas Semiconductor's P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Navitas Semiconductor trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Navitas Semiconductor is showing 3 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.