- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Is Nova (NVMI) Leveraging Its Metrology Momentum to Strengthen Its Long-Term Technology Advantage?

Reviewed by Sasha Jovanovic

- Nova Ltd. recently reported its third quarter 2025 earnings, posting US$224.61 million in revenue and US$61.42 million in net income, alongside updated guidance for the fourth quarter and management's participation in key global technology conferences.

- Management emphasized strong demand in advanced semiconductor nodes and memory applications, with record service revenues and increasing adoption of Nova's materials metrology platforms highlighted as growth drivers.

- We'll explore how Nova's confident outlook, especially in advanced semiconductor demand, affects its longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nova Investment Narrative Recap

To be a shareholder in Nova, you need to believe in the long-term uptrend of advanced semiconductor complexity and manufacturing investments, with Nova delivering critical metrology solutions at the industry forefront. The Q3 results and Q4 guidance reinforce the ongoing strength in demand from memory and logic segments, yet the biggest short-term catalyst, adoption momentum of the new ELIPSON and METRION platforms, remains steady, while customer concentration continues to be the most important risk; recent news has not materially changed either factor.

Among recent announcements, Nova’s ELIPSON platform achieving Tool of Record status at a leading global foundry stands out, underlining a growth catalyst as customers transition to gate-all-around architecture. This selection not only supports the current earnings momentum but also demonstrates Nova’s ability to win product placements in advanced logic, a key validation as industry demand migrates toward cutting-edge nodes.

But in contrast, investors should be aware of increasing concentration risk as Nova's largest customers continue to drive a...

Read the full narrative on Nova (it's free!)

Nova's outlook anticipates $1.1 billion in revenue and $293.1 million in earnings by 2028. This scenario assumes a 9.8% annual revenue growth rate and a $58.2 million earnings increase from the current $234.9 million.

Uncover how Nova's forecasts yield a $321.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

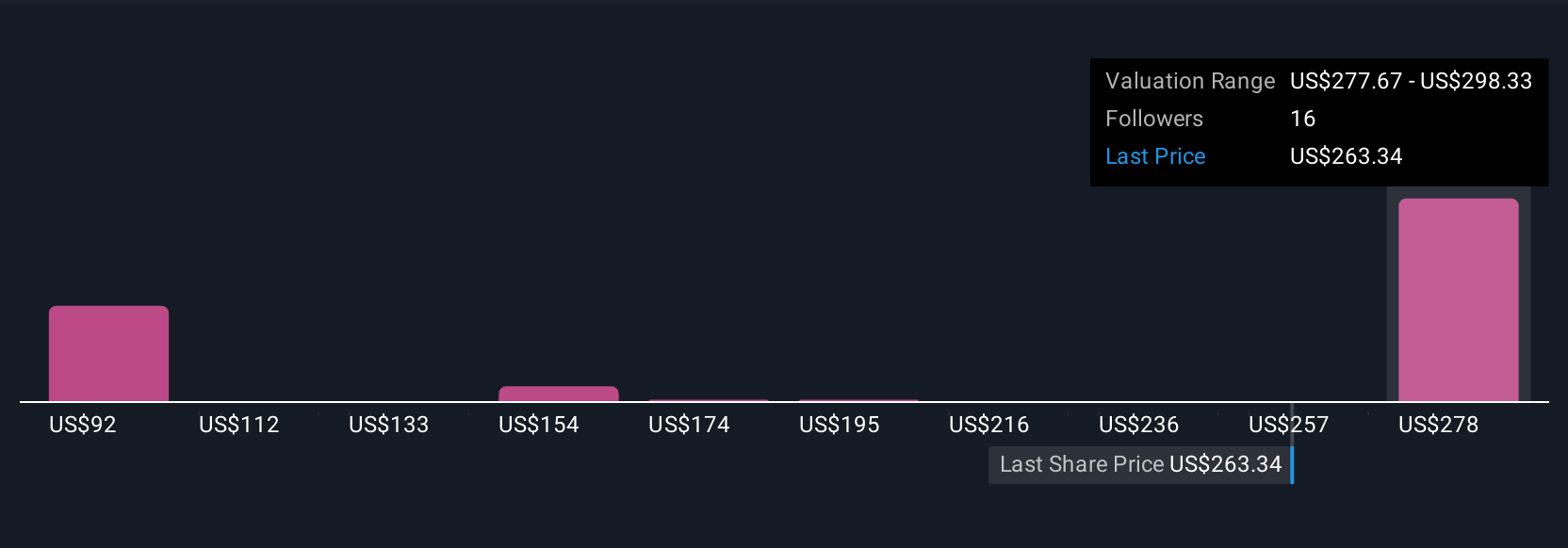

Five members of the Simply Wall St Community valued Nova shares between US$81.70 and US$321.67, showing strong differences in outlook. As advanced node customer concentration remains high, consider how expectations around client spending cycles could sway future performance.

Explore 5 other fair value estimates on Nova - why the stock might be worth less than half the current price!

Build Your Own Nova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nova research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Nova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nova's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives