- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Assessing Nova (NVMI) Valuation Following Renewed AI-Driven Market Optimism

Reviewed by Simply Wall St

Nova (NasdaqGS:NVMI) shares climbed 6% as a new wave of enthusiasm for artificial intelligence stocks fueled a broader market rebound. Investors are watching to see if this rally brings lasting momentum or signals a shift in sentiment.

See our latest analysis for Nova.

Nova’s 1-day share price return of 1.68% adds to a robust year-to-date run, with the stock up over 54% since January and clocking a one-year total shareholder return of more than 70%. While near-term volatility has been clear, momentum continues to build as investor appetite in the AI and semiconductor space surges.

If this wave of AI enthusiasm has you looking for similar opportunities, consider exploring the latest top tech and AI movers in our curated list in the following section: See the full list for free.

The real question now is whether Nova’s strong gains indicate that the stock remains undervalued, or if the market has already priced in the company’s growth potential. This could mean there is little room for further upside.

Most Popular Narrative: 14.5% Undervalued

Compared to Nova’s latest close of $312.84, the most followed narrative sets a fair value far higher, suggesting that market optimism around advanced metrology and semiconductor investments could have additional potential. This creates a compelling debate about how future industry shifts might reshape Nova’s outlook.

The accelerating complexity of semiconductor devices, driven by AI, larger die sizes, advanced nodes, and heterogeneous packaging, continues to fuel demand for Nova's advanced metrology solutions across both logic/foundry and memory segments. This is expected to support long-term revenue growth as global digitization trends expand.

Want to know what lies beneath this bullish outlook? One key detail is future growth assumptions, which might surprise you. The narrative's math hinges on a significant projected swing in both revenue and profit margin. Curious how this stacks up to Nova's past performance? Dive deeper to uncover the number crunching that powers this valuation.

Result: Fair Value of $365.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Nova’s reliance on key customers and ongoing changes in global trade policies could quickly derail the company’s currently optimistic outlook.

Find out about the key risks to this Nova narrative.

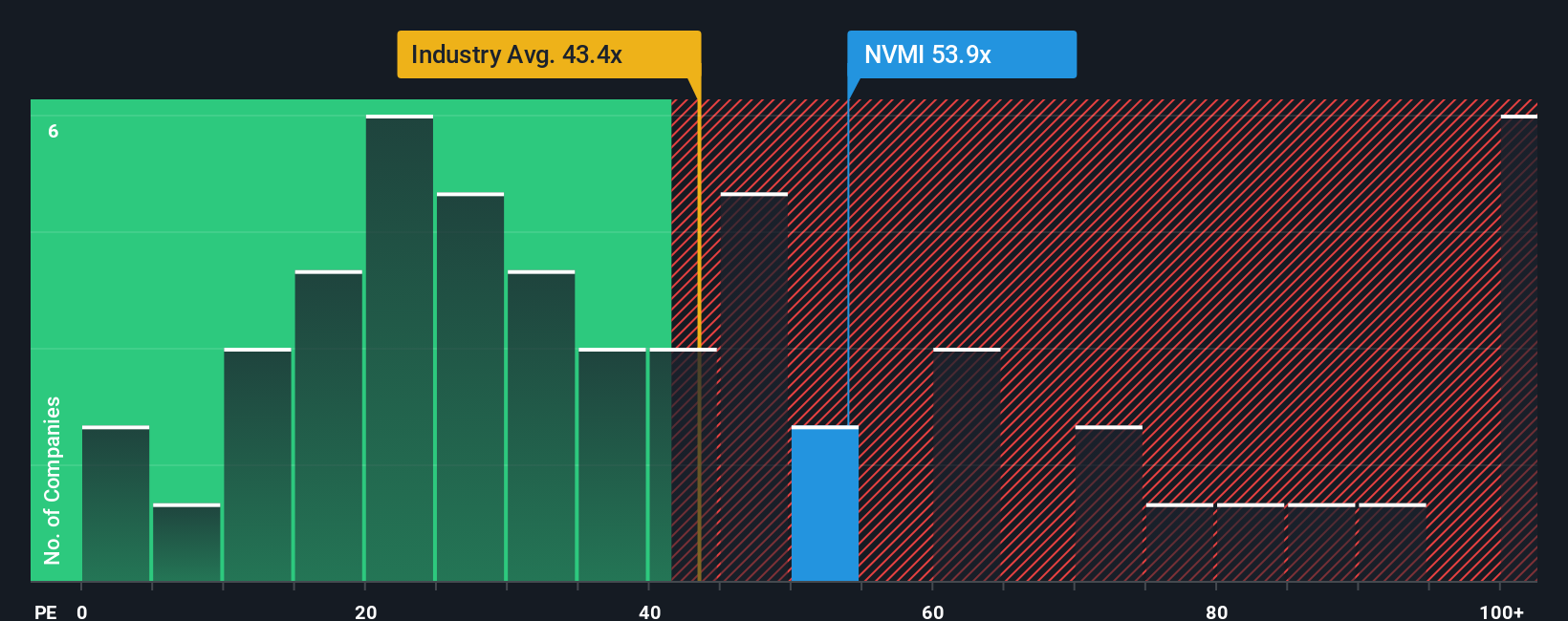

Another View: Multiples Paint a Pricier Picture

Looking through the lens of price-to-earnings ratios, Nova’s shares seem more expensive than both the US semiconductor industry and its peer group. With a ratio of 37.9x compared to the sector average of 36.1x and well above the fair ratio of 26.5x, investors face a clear valuation gap. Could this elevate expectations, or is it a sign of growing risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nova Narrative

If you have a different perspective or want to test your own assumptions, it only takes a few minutes to build your personal narrative around Nova. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nova.

Looking for more investment ideas?

Smart investors never sit still. Broaden your portfolio by finding exciting, overlooked stocks and emerging opportunities using the Simply Wall Street Screener. You do not want to miss out on what others are discovering right now.

- Capitalize on robust cash flows and value by checking out these 913 undervalued stocks based on cash flows that the market may be underestimating.

- Power up your portfolio with breakthrough companies at the forefront of artificial intelligence by starting with these 25 AI penny stocks today.

- Secure steady income potential when you target these 15 dividend stocks with yields > 3% consistently yielding above 3% for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026