- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Strong Financial Prospects Keep NVIDIA (NASDAQ:NVDA) Up and Ahead of Regulatory Pressures

The last 2 quarters of 2020 were frustrating for NVIDIA's ( NASDAQ:NVDA ) investors, as the stock kept ranging. However, in 2021 it rallied over 50%, creating new highs and quickly reversing any dips.

Given that the market rewards strong financials in the long term, we wonder if that is the case in this instance. Notably, we will be paying attention to NVIDIA's return on equity (ROE) today.

Arm Holdings Deal is Up to the Regulators

Nvidia is facing a delay with Chinese regulators regarding the US$40b acquisition of chip designer Arm Holdings. Given the recent regulatory crackdowns, this doesn’t surprise, although the market remains optimistic. Citi estimates the probability of the deal at 30% , up from only 10% in April.

Meanwhile, China is not the only problem. The U.K’s regulatory agency – Competition and Markets Authority (CMA), expressed concerns about the deal on national security issues . The U.K is likely going to do a further examination of the deal.

Regardless of the market cap over US$500b, a US$40b deal is still significant. The stock remains unphased and it is on the verge of making a new all-time high.

What is ROE?

A shareholder's return on equity or ROE is an essential factor to consider because it tells them how effectively their capital is being reinvested.In simpler terms, it measures the profitability of a company concerning shareholder's equity.

See our latest analysis for NVIDIA .

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for NVIDIA is:

28% = US$5.3b ÷ US$19b (Based on the trailing twelve months to May 2021).

The 'return' is the income the business earned over the last year.So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.28.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability.Based on how much of its profits the company chooses to reinvest or "retain," we can evaluate a company's future ability to generate profits.Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the company's growth rate compared to companies that don't necessarily bear these characteristics.

NVIDIA's Earnings Growth And 28% ROE

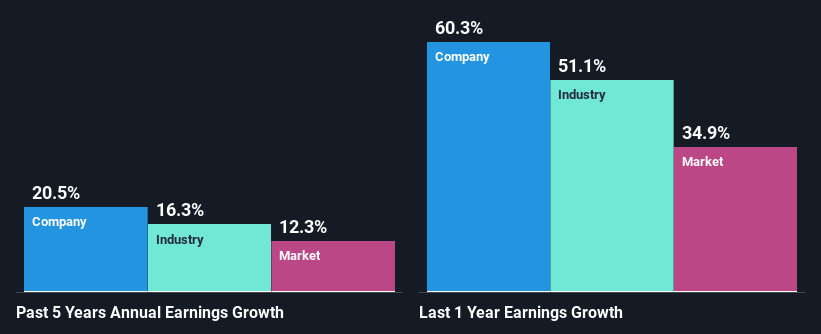

First thing first, we like that NVIDIA has an impressive ROE.Secondly, even when compared to the industry average of 14%, the company's ROE is quite remarkable.As a result, NVIDIA's exceptional 21% net income growth was seen over the past five years doesn't come as a surprise.

We then compared NVIDIA's net income growth with the industry, and we're pleased to see that the company's growth figure is higher than the industry, which has a growth rate of 16% in the same period.

Earnings growth is an important factor in stock valuation.Investors need to determine next if the expected earnings growth, or the lack of it, is already built into the share price.By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about NVIDIA's valuation, check out this gauge of its price-to-earnings ratio , as compared to its industry.

Is NVIDIA Making Efficient Use Of Its Profits?

NVIDIA's three-year median payout ratio to shareholders is 11%, which is relatively low. This implies that the company is retaining 89% of its profits.This suggests that the management is reinvesting most of the profits to grow the business, as evidenced by the growth seen by the company.

Additionally, NVIDIA has paid dividends for nine years, which means that it is pretty serious about sharing its profits with shareholders.Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 3.9% over the next three years.Regardless, the ROE is not likely to change much despite the lower expected payout ratio.

Summary

On the whole, we feel that NVIDIA's performance has been quite good.Specifically, we like that the company is reinvesting a considerable chunk of its profits at a high rate of return. This, of course, has caused the company to see substantial growth in its earnings.However, the company's earnings growth is expected to slow down, as the current analyst estimates forecast. To know more about the latest analyst's predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives