- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Should You Reconsider NVIDIA After Microsoft Taps Its Latest AI Chips for Data Centers?

Reviewed by Bailey Pemberton

Trying to figure out whether to buy, hold, or cash out of NVIDIA stock? You’re not alone. Whether you’ve been along for the ride since the stock’s jaw-dropping 1,395.7% gain over the past three years, or you’re sizing up an entry after a 30.2% year-to-date climb, the stakes feel high. Recent weeks have been more of a roller coaster, with a dip of 4.8% in the past week erasing some of the 1.3% uplift from the past month.

What’s driving the action? NVIDIA is at the heart of the AI revolution. Fresh headlines show Microsoft planning to rent more cutting-edge data center power built on NVIDIA’s chips, while other players like Oracle eye up alternatives to NVIDIA’s dominant GPUs. Meanwhile, regulatory moves in China and big export licenses from the U.S. show the risks and opportunities tied to global demand for NVIDIA’s hardware. The story of demand for AI chips is not slowing down; if anything, it is getting more intense, with NVIDIA’s place at the center looking secure even as competitors make bold moves.

Despite all the attention, the big question is whether NVIDIA is actually undervalued, overpriced, or somewhere in between. Based on six widely used valuation checks, NVIDIA scores a 3, meaning it looks undervalued on half of them. But strict valuation ratios are just the starting line. Let’s break down exactly how these checks add up and, more importantly, tease an even smarter way to size up NVIDIA’s true value before we’re done.

Why NVIDIA is lagging behind its peers

Approach 1: NVIDIA Discounted Cash Flow (DCF) Analysis

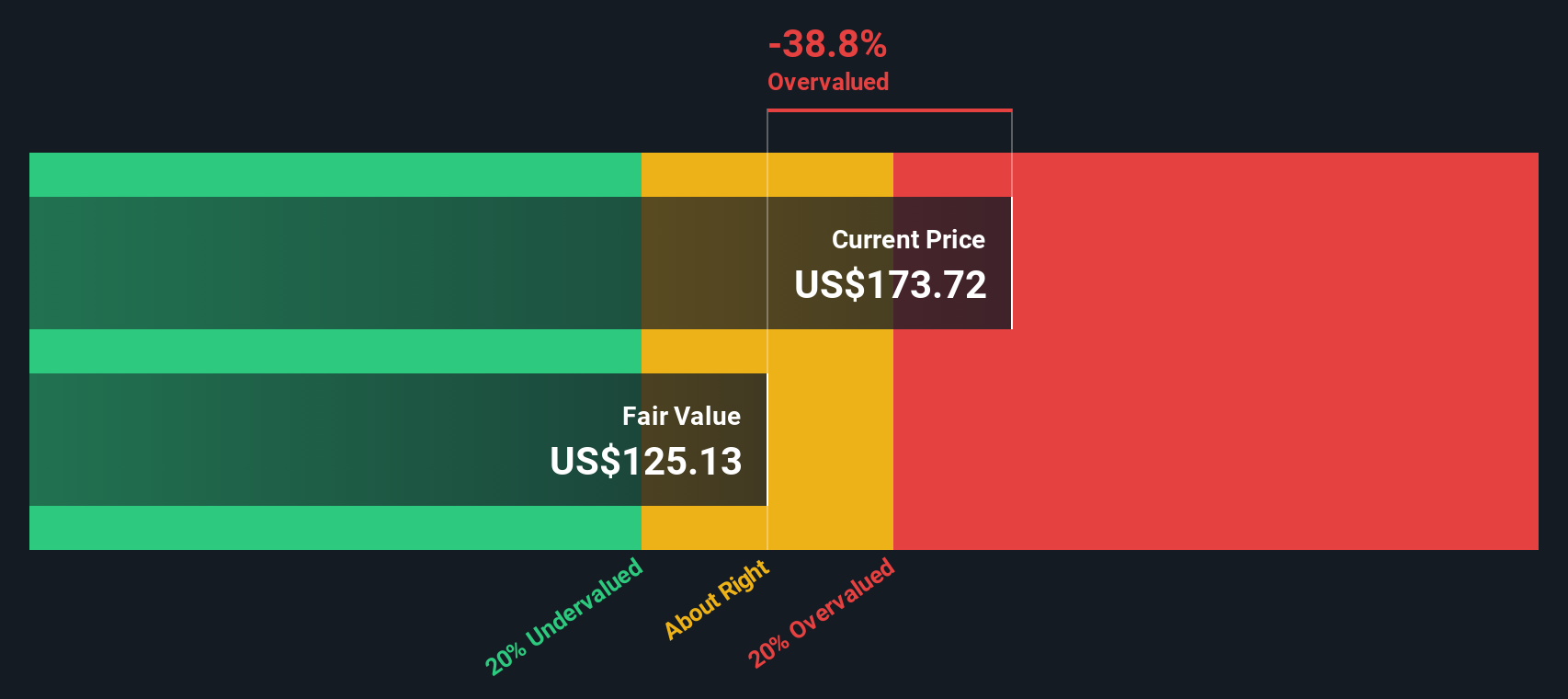

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to present value. For NVIDIA, this means looking at the company’s ability to generate free cash each year, both now and in the future, to arrive at an intrinsic value for the stock.

NVIDIA’s current Free Cash Flow stands at $72.28 Billion, and analyst estimates suggest strong ongoing growth. By 2030, projected Free Cash Flow is expected to reach $249.21 Billion. Analysts have provided detailed cash flow predictions for the next five years, with projections beyond that extrapolated based on NVIDIA’s historical performance and sector trends.

Using these forecasts and a standard 2 Stage Free Cash Flow to Equity approach, NVIDIA’s intrinsic value is calculated at $141.59 per share. This implies the stock is trading at a 27.2% premium compared to what the DCF analysis suggests is fair value. In other words, based on projected cash flows and today’s price, NVIDIA currently appears overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NVIDIA may be overvalued by 27.2%. Find undervalued stocks or create your own screener to find better value opportunities.

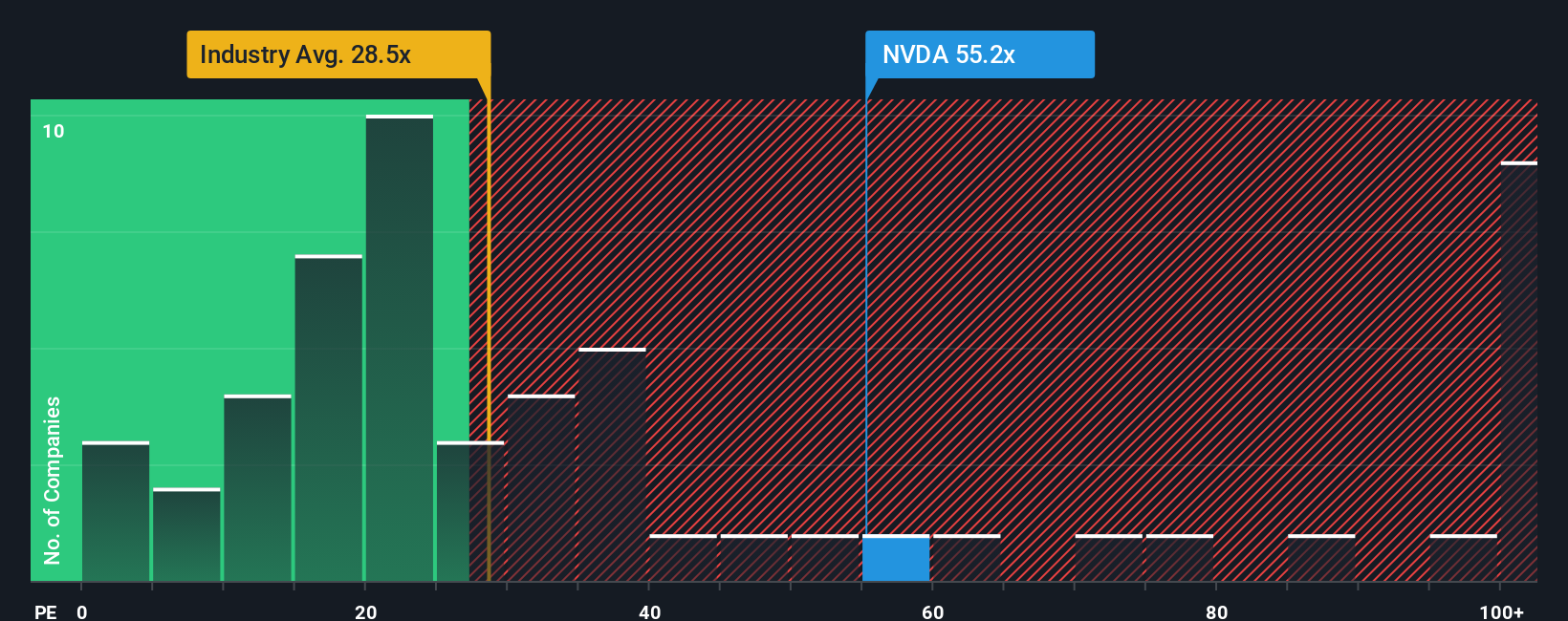

Approach 2: NVIDIA Price vs Earnings

When it comes to valuing profitable technology companies like NVIDIA, the price-to-earnings (PE) ratio is often the metric of choice. That’s because it allows investors to compare what they’re paying for each dollar of current earnings, making it an intuitive and widely trusted benchmark.

The “right” PE ratio for a stock depends on more than just trailing profits. Growth expectations, risk, profit margins, and competitive dynamics all play a part in determining what a fair multiple should be. High-growth companies may deserve loftier PE ratios than mature or slower-growth peers, while added risk can justify a lower figure.

Right now, NVIDIA trades at a PE ratio of 50.5x. That is notably higher than the broader semiconductor industry, which averages 34.9x, and also above the peer average of 63.9x. To cut through the noise, however, Simply Wall St calculates a “Fair Ratio,” in NVIDIA’s case 57.9x, which blends in key factors like earnings growth rate, profit margins, market capitalization, sector trends, and company-specific risks. This proprietary metric goes beyond basic peer or industry comparisons to offer a tailored benchmark for each stock.

Comparing NVIDIA’s current multiple of 50.5x to its Fair Ratio of 57.9x, the stock actually appears slightly undervalued by this measure, as it is trading below where you might expect given its financial profile and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NVIDIA Narrative

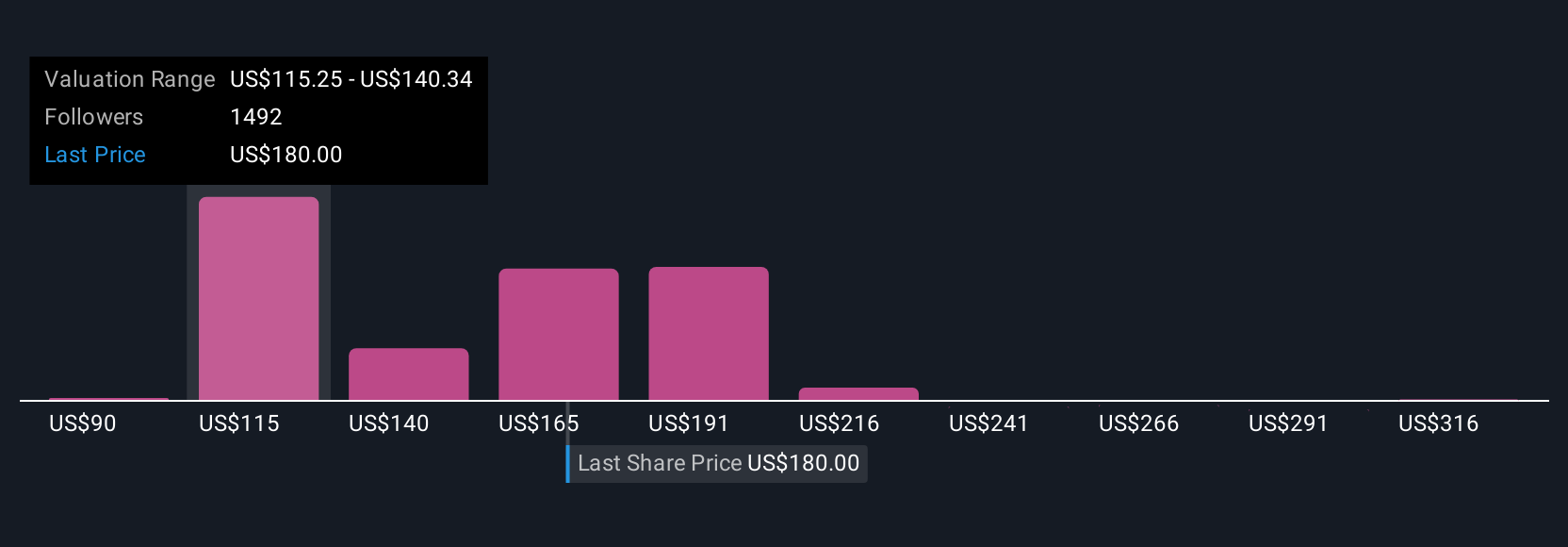

Earlier, we shared there’s a smarter way to assess valuation, so let’s introduce you to Narratives: a powerful yet simple method where you create your own story about NVIDIA and connect it directly to financial forecasts and fair value estimates.

A Narrative is more than just a number; it begins by outlining what you believe about a company’s future, then translates those beliefs into assumptions about revenue, margins, and fair value. This approach bridges the traditional gap between a company’s story and its numbers, empowering you to see how your expectations play out in dollars and cents.

On Simply Wall St’s Community page, Narratives are easy to build and update, used by millions of investors to shape, share, and refine their outlooks. They help you decide if NVIDIA is a buy or sell by directly comparing the Fair Value from your Narrative to today’s share price, and automatically refresh when major news or earnings arrive.

For example, on NVIDIA, some investors project a fair value below $70 per share, focusing on increasing competition and cyclical risks, while others see fair value well above $340, banking on relentless AI adoption and software dominance. This highlights how your unique Narrative shapes your investment decision.

For NVIDIA, however, we'll make it really easy for you with previews of two leading NVIDIA Narratives:

Fair Value: $213.99

Current Price is 15.9% below this fair value

Forecast Revenue Growth: 26.86%

- Explosive AI adoption and infrastructure digitization are driving strong, diversified, and multi-year revenue growth for NVIDIA. Continuous innovation sustains the company’s technological lead and solid margins.

- Long-term success is supported by expanding AI platform offerings, deepening customer reliance, broadening recurring software revenues, and a growing presence across multiple sectors beyond data centers.

- Key risks include geopolitical tensions, customer vertical integration, supply chain fragility, and energy constraints. Analysts’ consensus still supports substantial upside if forecast earnings and margins are delivered.

Fair Value: $141.74

Current Price is 27% above this fair value

Forecast Revenue Growth: 17.2%

- NVIDIA’s leadership in AI hardware and data centers is translating into strong sales, but the stock price more than reflects this dominance, with significant upside already priced in.

- Expansion into gaming, automotive, and industrial AI sectors offers additional growth avenues. However, competition is intensifying and could impact future market share and margins.

- Risks include rising competition (especially from AMD and Intel), potential consumer resistance to high hardware prices, regulatory hurdles to growth, and ongoing supply chain challenges that could hinder future performance.

Do you think there's more to the story for NVIDIA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion