- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Powers India's First AI Cloud With New Blackwell Servers

Reviewed by Simply Wall St

Novacore Innovations launched India's first GPU cloud platform with NVIDIA Blackwell servers, signifying a major advancement in AI infrastructure. Over the last quarter, NVIDIA (NVDA) saw a price increase of 29%, amidst several impactful developments. Key events included the company's Q2 earnings report with strong financial results and a raised buyback program. The stock, however, faced pressure from broader tech sector declines and underwhelming earnings expectations. Additionally, collaborations with major firms like Disney and Infineon, along with expanded use of NVIDIA products in AI and robotics, reinforced its technological influence, although the chip sector's broader slump countered some of these gains.

We've spotted 2 risks for NVIDIA you should be aware of, and 1 of them doesn't sit too well with us.

NVIDIA's partnership with Novacore Innovations, launching India's first GPU cloud platform, highlights its technological influence in AI infrastructure. This development potentially enhances NVIDIA's revenue streams by expanding its GPU cloud offerings, which could positively impact future earnings, given the raised focus on AI and compute capabilities. As it collaborates with major firms like Disney and Infineon, this platform launch might bolster NVIDIA's data center revenue and contribute to both short-term and longer-term growth narratives.

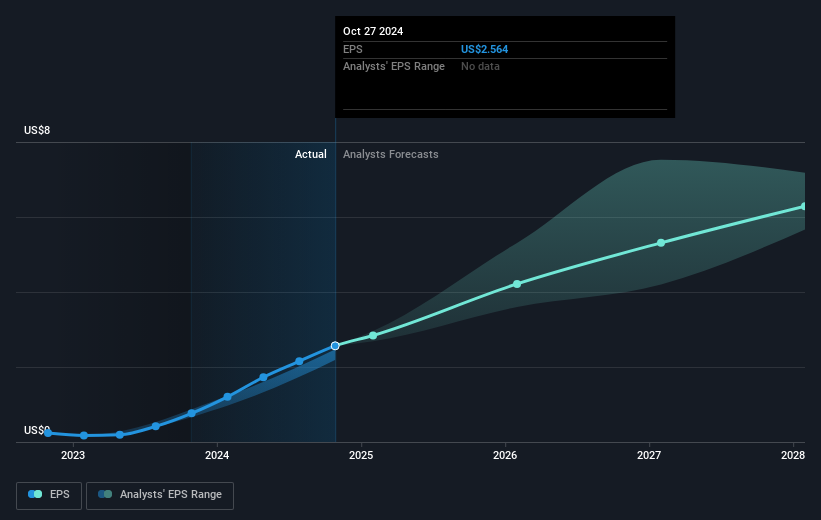

Over a five-year period, NVIDIA's shares experienced a very large total return of 1284.05%. This impressive performance illustrates strong investor confidence and the company's ability to capitalize on growth opportunities, significantly outperforming the broader market and semiconductor industry in recent years. Notably, in the past year, NVIDIA's earnings growth exceeded both the US market and the semiconductor industry, reflecting its robust performance in a challenging market environment.

The recent 29% increase in NVIDIA's share price amidst strategic expansions underscores the market's favorable view of its future prospects. However, with a current price of US$174.18 and an analyst consensus price target of US$204.92, the shares trade at a discount of about 17.65% to the target. This gap suggests that the market might be temporarily undervaluing NVIDIA's growth potential, given its continued innovation in AI platforms and expanded partnership ecosystem.

Get an in-depth perspective on NVIDIA's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives