- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Partners With Accenture And AdaCore For AI And Automotive Innovations

Reviewed by Simply Wall St

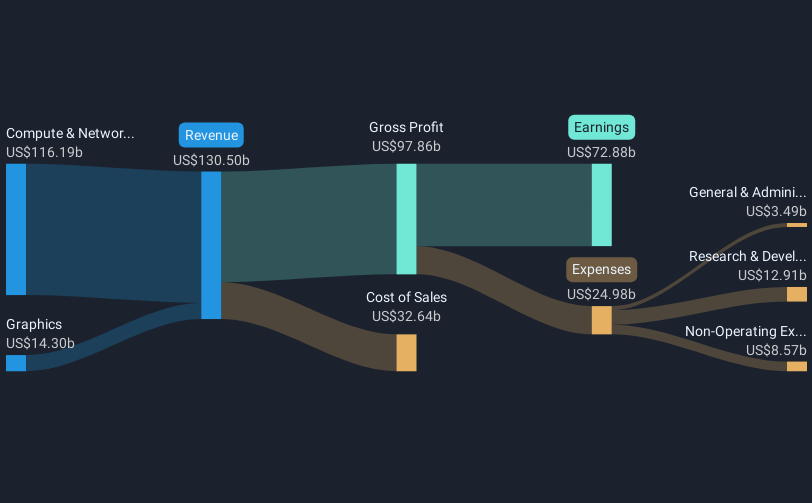

NVIDIA (NVDA) recently expanded its influence in both artificial intelligence and the automotive sectors through collaborations with Accenture and AdaCore, respectively. These initiatives, which include supporting AI startups and introducing programming languages for autonomous vehicles, underscore the company's commitment to innovation. Over the past quarter, NVIDIA's stock price increased by 28%, which significantly outpaced the broader market's 13% rise over the past year. The company's revenue growth aligned with strong earnings reports further supports this momentum, reflecting positive investor sentiment amid generally flat market conditions in the last week. These key developments likely added weight to NVIDIA's stock performance.

Every company has risks, and we've spotted 1 possible red flag for NVIDIA you should know about.

NVIDIA's recent collaborations with Accenture and AdaCore could significantly enhance its presence in artificial intelligence and automotive sectors. These initiatives may position the company to further capitalize on AI and autonomous vehicle markets, potentially leading to increased revenue streams and improved earnings forecasts. Over a span of five years, NVIDIA's total shareholder return, encompassing both share price and dividends, was very large at 1420.04%. In comparison, the company outperformed the broader US semiconductor industry over the last year, with an annual return of 80% compared to the industry’s 11.7%.

The recent advancements have directly impacted investor sentiment, potentially reinforcing expectations for NVIDIA's financial trajectory. Despite trading above the current share price, NVIDIA's stock is still at a 30.4% discount to the analyst consensus price target of US$163.12, indicating potential upside. Analysts' expectations of a 21.2% annual earnings growth offer a strong basis for the company’s future valuation, assuming the operational challenges tied to Blackwell systems and regulatory uncertainties are managed effectively. Overall, the company's strategic developments suggest promising implications for its business outlook in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion