- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Inception Program Welcomes Edera's Hardened Runtime Security Solution

Reviewed by Simply Wall St

NVIDIA (NVDA) recently witnessed a 60% increase in its share price over the last quarter. Edera's acceptance into the NVIDIA Inception Program and its availability on AWS Marketplace are likely to have positively influenced investor sentiment. Additionally, NVIDIA's robust Q1 financials, including a notable rise in sales and net income, and collaborations with Eaton and Saudi Arabia's AI initiatives, may have strengthened the company's market position. The overall market also experienced an upward trend, rising 18% over the past year, suggesting broader positive market dynamics reinforced NVIDIA's strong performance.

Recent announcements like Edera's participation in the NVIDIA Inception Program and availability on AWS Marketplace play a crucial role in shaping investor perceptions, reinforcing the narrative of NVIDIA's expansion in AI and cloud services. These collaborations, aligned with NVIDIA's ongoing partnerships with Toyota and Uber, could bolster its revenue and earnings forecasts by potentially opening up new AI and automotive revenue streams. These developments exemplify NVIDIA's commitment to innovation and market diversification, characteristics that investors find appealing.

Over the past five years, NVIDIA's total shareholder return, a combination of share price appreciation and dividends, was very large at over 1537.22%. This long-term performance is notable, particularly when compared to broader market indices which showed comparatively moderate growth. In the past year alone, NVIDIA outperformed the US semiconductor industry, which experienced a 33.9% increase, by exceeding that rate of return. This steeper incline suggests robust investor confidence and the company's dominant position in its industry.

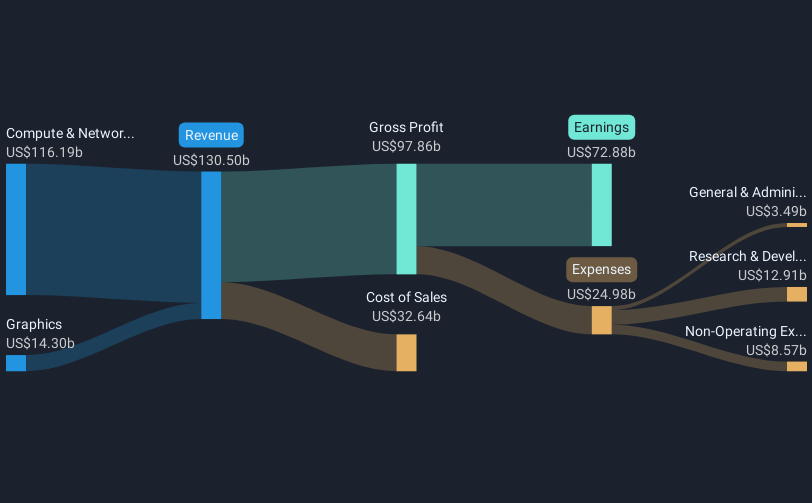

Currently trading at US$170.78, NVIDIA stock is priced near the consensus analyst price target of US$179.55. This modest differential suggests analysts generally view the company as fairly valued, assuming projected revenue growth and margin improvement are realized. Given NVIDIA's revenue of $148.52 billion and earnings of $76.77 billion, maintaining its growth trajectory while addressing challenges like regulatory hurdles and system costs will be vital for sustaining investor enthusiasm. The stock's performance relative to its price target serves as a benchmark for evaluating future potential amidst anticipated industry shifts and ongoing strategic initiatives.

Our valuation report unveils the possibility NVIDIA's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives