- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Drives Innovation With Expanded PTC Collaboration And Avathon Partnership

Reviewed by Simply Wall St

NVIDIA (NVDA) recently expanded its collaboration with PTC and integrated new technologies with Avathon, marking significant advancements in AI and video intelligence. Over the last quarter, NVIDIA's share price surged 61%, a move likely underpinned by these key strategic initiatives. While broader market trends, buoyed by robust earnings from tech giants like Microsoft and Meta, saw an upward trajectory, NVIDIA's announcements enhanced its innovation profile, potentially supporting this impressive share performance. These developments, alongside NVIDIA's ongoing investments in AI and collaboration with industry leaders, could have added weight to the company's substantial price gain amidst the tech-driven market optimism.

We've discovered 1 possible red flag for NVIDIA that you should be aware of before investing here.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

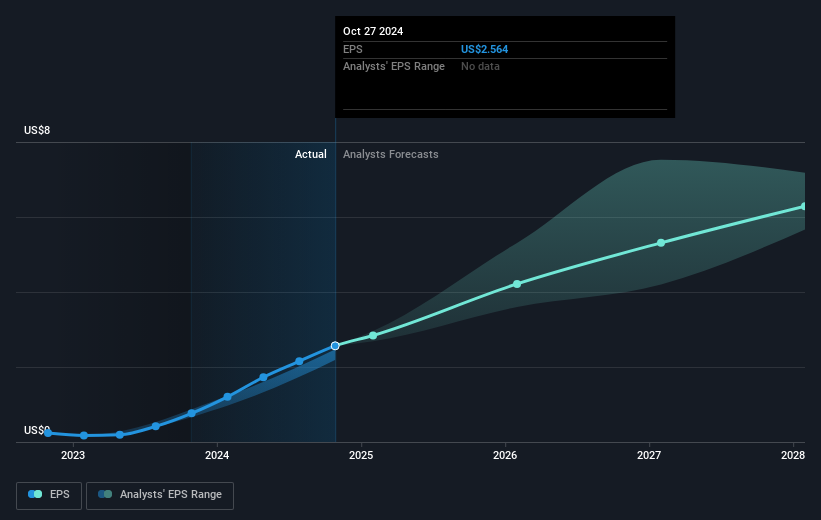

The expansion of NVIDIA's collaboration with PTC and its integration with Avathon could reinforce its position in AI and video intelligence, likely impacting future revenue streams and earnings forecasts. By enhancing its innovation profile, this development may further stimulate growth, particularly in data center and AI workloads. The progress in areas like autonomous vehicles and GPU products foretells potential revenue increases across gaming and automotive sectors. Over the past five years, NVIDIA's total shareholder return has been very large, reflecting its robust growth trajectory. This performance provides a compelling backdrop, even as it outperformed the US Semiconductor industry’s 39.1% return over the past year.

The recent price surge of NVIDIA's shares, reaching US$179.27, shows alignment with analyst expectations but remains slightly below the consensus price target of US$181.56. This proximity indicates analysts view the company's current valuation as reasonable, given its projected growth. Ongoing advancements, such as partnerships with industry leaders like Toyota and Uber, position NVIDIA well for future success but also impose challenges, including U.S. regulatory issues and the complexity of its Blackwell systems. It remains crucial for investors to consider these factors when evaluating NVIDIA's potential in meeting or exceeding the projected price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives