- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Collaborates With Eaton To Enhance AI Data Center Power Solutions

Reviewed by Simply Wall St

NVIDIA (NVDA) lately captured headlines with its collaboration with Eaton to accelerate AI data center infrastructure development. The company's stock rose 46% last quarter, which aligns with several positive developments, including new strategic partnerships and major earnings growth, reporting Q1 sales of $44 billion. Amidst broader market conditions that saw mixed trading influenced by inflation data and earnings reports, NVIDIA also benefited from plans to resume chip sales to China, sparking a tech rally. These strategic initiatives and market dynamics provide added context to this robust share price growth, reflecting investor optimism amidst a generally buoyant tech sector.

We've identified 1 risk for NVIDIA that you should be aware of.

The recent partnership between NVIDIA and Eaton to advance AI data center infrastructure reflects the company's continued focus on expanding its AI capabilities, which aligns with its past strategic moves involving Toyota and Uber in the automotive sector. These collaborations indicate NVIDIA’s ongoing efforts to diversify its revenue streams and capitalize on AI-driven growth, which could further bolster future revenue and earnings projections. With NVIDIA's Blackwell architecture geared towards AI model scaling, this latest development may positively influence NVIDIA’s long-term earnings potential by enhancing its presence in critical tech sectors.

Over the past five years, NVIDIA has delivered a very large total shareholder return of 1466.12%, highlighting remarkable share price appreciation. In the past year, NVIDIA's share performance outpaced both the US Semiconductor industry and broader market indices, evidencing investor confidence and the company's robust strategic framework.

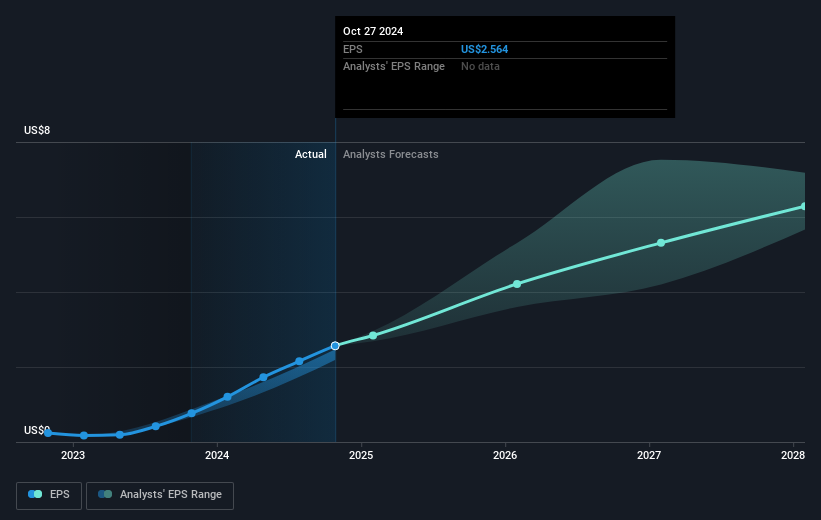

Looking at future revenue and earnings, the Eaton collaboration underscores NVIDIA's potential to increase its competitive edge in AI, possibly driving sales further as AI infrastructure demand rises. Current forecasts suggest continued growth, with expectations of revenue reaching US$288.5 billion and earnings at US$158.2 billion by 2028. Moreover, with the current share price at $164.07, close to the consensus price target of $175.48, the company's strategic initiatives appear to be factored into its valuation, although analysts still see moderate upside potential.

Explore historical data to track NVIDIA's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives