- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Joins Forces With Tech Giants To Pioneer AI-Driven Solutions In Multiple Sectors

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) saw a 4.9% decline in share price over the past quarter, against a backdrop of significant industry collaborations and broader market challenges. The company's recent strategic partnerships, such as the groundbreaking collaborations with SynaXG, Cisco, and Foresight Autonomous Holdings, highlight advances in AI and wireless communications. Despite impressive technological achievements, these developments coincided with a broader decline in tech stocks, including NVIDIA, as seen in the 1.9% drop in the Nasdaq Composite and a 1% decline in the S&P 500. Investors' concerns about the economic outlook and weak consumer confidence data compounded the pressure on the tech sector. Significant market fluctuations, alongside the negative sentiment impacting tech stocks like Microsoft, Alphabet, and Amazon, contributed to NVIDIA's overall stock performance. Amidst these challenges, the company's continued focus on advancing AI and partnerships remains noteworthy as it navigates a volatile market landscape.

Get an in-depth perspective on NVIDIA's performance by reading our analysis here.

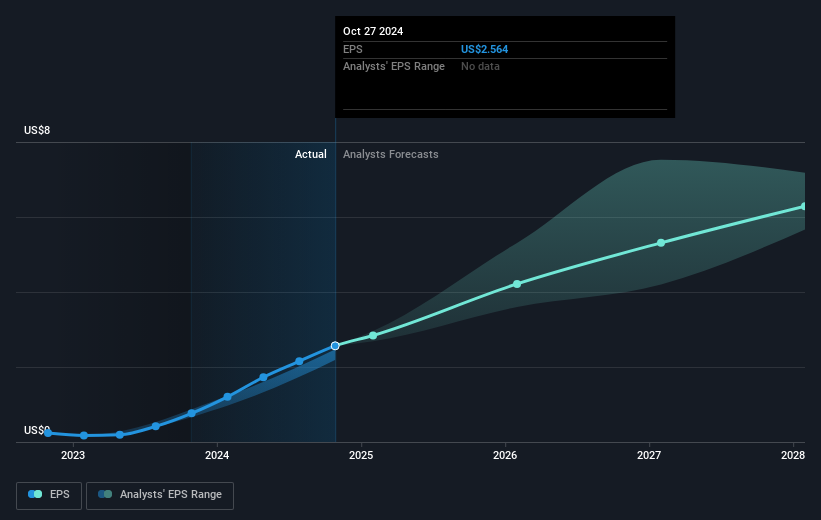

The last five years have seen NVIDIA's total shareholder return soar significantly, achieving an impressive 1791.95% over this period. This monumental growth outpaced many peers in the semiconductor industry. Key factors contributing to this increase include substantial earnings growth, with earnings expanding by 60.2% annually. NVIDIA's net income reached US$12.3 billion as of March 21, 2024, showcasing a stark contrast from previous years. Additionally, product innovation played a major role, with launches like the NVIDIA GeForce RTX 50 Series setting benchmarks for graphics performance. The integration of NVIDIA's AI solutions into various industries, including healthcare and automotive, further fortified its market position.

Another driving force was NVIDIA's successful strategic partnerships and collaborations, such as its alliance with Cisco to enhance AI workload integration. These efforts, combined with its notable share repurchase programs, which added value and demonstrated confidence in the company's growth trajectory, have been essential in navigating and capitalizing on a rapidly evolving market landscape.

- Discover whether NVIDIA is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the downside scenarios for NVIDIA with our risk evaluation.

- Already own NVIDIA? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives