- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Expands 3D Interoperability With Tech Soft 3D Collaboration

Reviewed by Simply Wall St

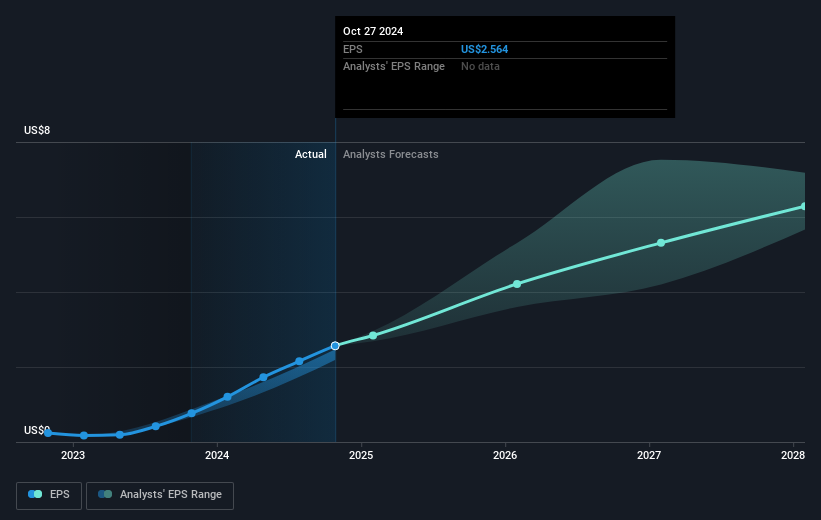

NVIDIA (NasdaqGS:NVDA) recently announced a collaboration with Tech Soft 3D to enhance its Universal Scene Description and Omniverse platform, positioning the company at the forefront of 3D technology. Over the last quarter, NVIDIA’s share price increased 24%, reflecting broader interest in tech and 3D interoperability advancements. Earnings from Q1 2026 showed significant growth, with sales jumping to $44 billion, potentially supporting this move. Meanwhile, market fluctuations, including geopolitical tensions and oil price shifts, had little sustained impact. The company's push into AI and strategic partnerships aligns with prevailing trends boosting tech stock valuations.

You should learn about the 1 weakness we've spotted with NVIDIA.

NVIDIA's collaboration with Tech Soft 3D to enhance its Universal Scene Description and Omniverse platform may bolster its positioning in 3D technology, which can feed into the narrative of its broader growth strategy across the data center and AI workloads. The partnership supports NVIDIA's push into AI and could potentially lead to increased demand and adoption of NVIDIA's AI capabilities, further boosting revenue projections from this sector.

Over the past five years, NVIDIA's total shareholder return, including share price appreciation and dividends, was very large, highlighting significant long-term growth. In comparison, over the past year, NVIDIA's performance exceeded that of the US Semiconductor industry, showcasing resilience and strong positioning in the market. The partnership with major players like Toyota and Uber also highlights potential revenue streams from expanding into the automotive sector, which aligns with the Blackwell architecture's capabilities.

In terms of financial forecasts, the news may positively impact future revenue and earnings estimates as NVIDIA leverages its advancements in AI and GPU technology to capitalize on growing market demands. With a current share price around $113.54, compared to the analyst consensus price target of $163.12, there remains a significant discount to the anticipated valuation. This indicates potential upside as the company navigates challenges such as U.S. regulatory issues and production costs associated with its next-gen systems. Investors may view these developments as steps towards sustaining growth and profitability in emerging markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives