- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Collaborates With Tech Soft 3D And Trend Micro For AI Solutions

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) recently announced a collaboration with Tech Soft 3D and a partnership with Dell Technologies and Trend Micro, focusing on enhancing interoperability and AI-powered cybersecurity solutions, respectively. These strategic moves likely supported the company's notable 23% price increase over the last quarter. Additional factors such as the company's Q1 earnings report, which revealed significant revenue and net income growth, might have also bolstered this trend, despite a broadly flat market. NVIDIA's proactive expansions in AI and digital innovation align with industry growth forecasts, contributing positively to its market performance.

Every company has risks, and we've spotted 1 possible red flag for NVIDIA you should know about.

The recent collaborations NVIDIA announced, focusing on enhancing AI-powered cybersecurity and interoperability solutions, could substantially impact the company's future revenue and earnings potential. These partnerships aim to expand NVIDIA's presence in the cybersecurity and AI sectors, aligning with trends that support growth in data center and AI workloads. The quarterly price increase of 23% is influenced by these strategic alliances, adding to the company's robust performance over the past five years, where total returns reached a very large percentage.

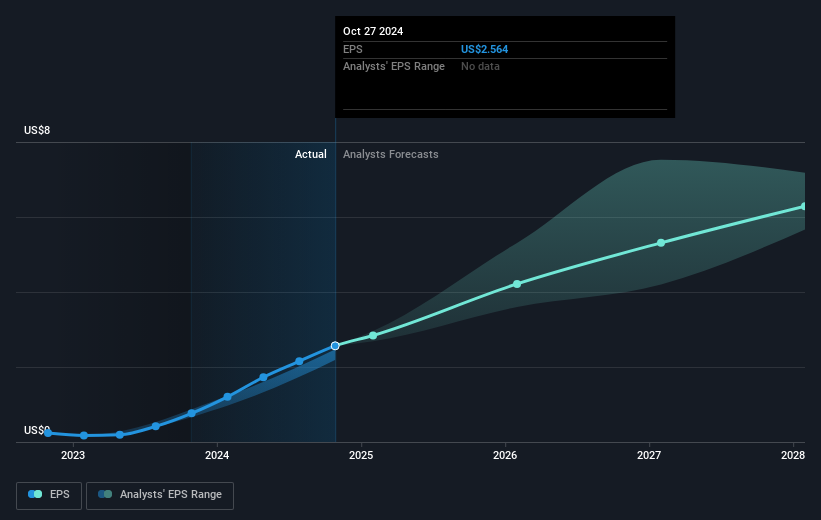

Over this longer period, NVIDIA's shares exhibited phenomenal growth, outpacing many within the broader market. Over the past year, NVIDIA's returns contrasted with the broader US market, which saw a more modest 9.9% gain. Analysts anticipate these partnerships with Tech Soft 3D and Dell Technologies, combined with NVIDIA's expansion into the automotive sector through alliances with Toyota and Uber, will positively influence revenue and earnings forecasts. With revenue at US$148.52 billion and earnings at US$76.77 billion, the projected growth trends appear promising.

As analysts predict future growth trajectories, the current share price indicates expectations of further price appreciation. Based on the consensus analyst price target of US$172.65, the share price reflects a discount, highlighting potential upside. This price movement demonstrates optimism around the anticipated financial performance, driven by NVIDIA's strategic initiatives and continued innovation across its key sectors.

Our valuation report unveils the possibility NVIDIA's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives