- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

How Major Global AI Partnerships at NVIDIA (NVDA) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent weeks, global enterprises including Samsung, SK Group, Hyundai Motor Group, and Deutsche Telekom announced wide-ranging collaborations with NVIDIA to build advanced AI factories, data centers, and digital twin platforms powered by tens of thousands of NVIDIA GPUs. These initiatives are accelerating AI research, manufacturing automation, and infrastructure transformation across sectors such as automotive, semiconductor, and telecom, with deployments spanning Asia, Europe, and beyond.

- Significantly, NVIDIA's ecosystem is expanding through both customer adoption and deepened partnerships, helping major technology, industrial, and telecom leaders harness the computing power required for next-generation AI and secure a larger share of the growing AI value chain.

- We'll examine how these AI infrastructure partnerships reinforce NVIDIA's investment narrative, particularly its growing role as the foundational provider for global AI transformation.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

NVIDIA Investment Narrative Recap

To be a shareholder in NVIDIA, an investor must believe in the company’s central role powering the global AI infrastructure buildout, driven by ongoing adoption from industry leaders and resilient demand for accelerated computing. The recent news of international partnerships and new client integrations with NVIDIA’s GPU and software platforms does not materially alter the most important near-term catalyst, ongoing AI-driven data center expansion, or the primary risk, which remains sustained US-China export controls and potential restrictions on advanced chip sales. Of all the recent announcements, the €1 billion partnership with Deutsche Telekom to build an industrial AI cloud and data center in Germany is especially relevant. This venture underscores how NVIDIA is capitalizing on a multi-year trend of sovereign and enterprise AI investment, which is a key catalyst underpinning expectations for strong recurring revenue and margin visibility. Yet, in contrast, investors should also be conscious of risks presented by tightening global export controls and regulatory uncertainty impacting NVIDIA’s addressable market, particularly as...

Read the full narrative on NVIDIA (it's free!)

NVIDIA's narrative projects $337.2 billion revenue and $187.9 billion earnings by 2028. This requires 26.8% yearly revenue growth and a $101.3 billion earnings increase from $86.6 billion today.

Uncover how NVIDIA's forecasts yield a $225.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

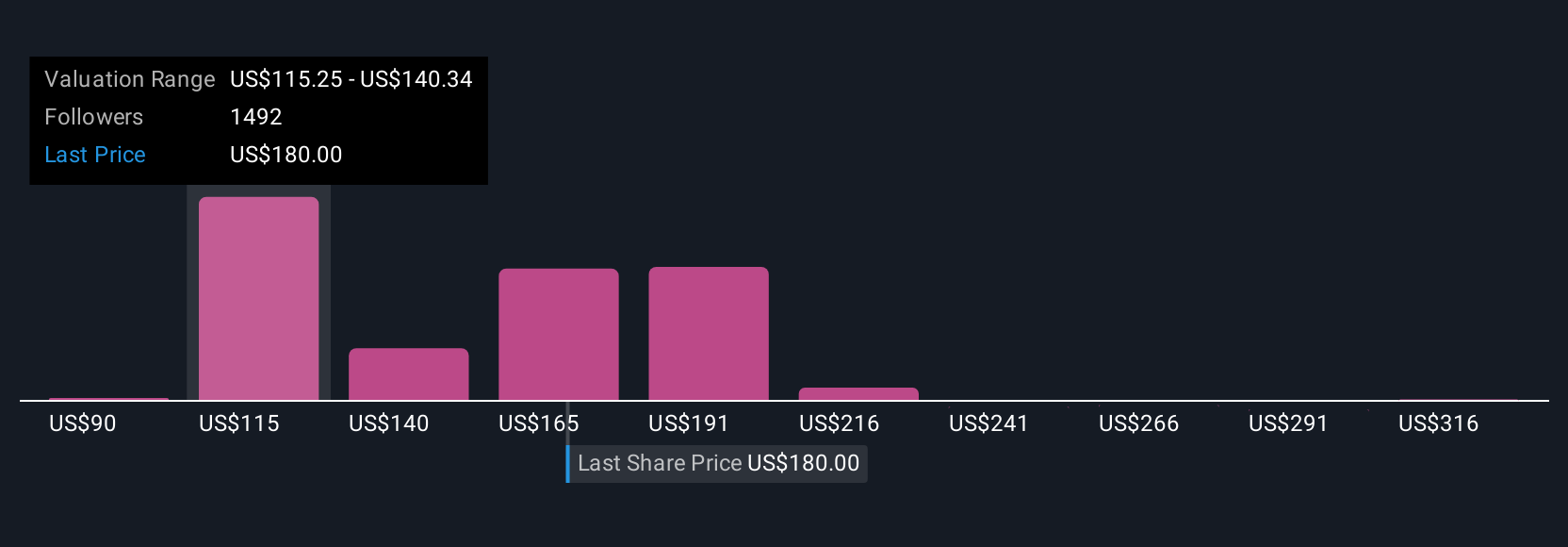

Over 430 members of the Simply Wall St Community have shared fair value estimates for NVIDIA, ranging from US$90.15 to US$341.12 per share. While many see significant long-term catalysts in AI infrastructure, export control risks have broader implications for the company's future revenue and market size, so explore multiple viewpoints before forming your own outlook.

Explore 430 other fair value estimates on NVIDIA - why the stock might be worth as much as 76% more than the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives