- United States

- /

- Semiconductors

- /

- NasdaqGS:MXL

Undervalued Small Caps With Insider Activity To Explore In October 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by record highs in major U.S. indices and modestly higher-than-expected inflation, small-cap stocks present intriguing opportunities for investors seeking growth potential amid broader market dynamics. In this environment, understanding what constitutes a promising investment involves evaluating companies with solid fundamentals and strategic insider activity that may indicate confidence in future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.3x | 0.9x | 18.26% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.6x | 18.08% | ★★★★☆☆ |

| PSC | 8.0x | 0.4x | 40.39% | ★★★★☆☆ |

| Citizens & Northern | 13.0x | 2.9x | 42.48% | ★★★★☆☆ |

| Rogers Sugar | 15.7x | 0.6x | 47.26% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 45.18% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 17.65% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -43.36% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 41.17% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company that specializes in providing animal health and mineral nutrition products, with a market capitalization of approximately $0.74 billion.

Operations: The company generates revenue primarily from Animal Health, Mineral Nutrition, and Performance Products segments. Over recent periods, the gross profit margin has shown a trend around 30.80%, with notable fluctuations in net income margins reflecting varying profitability levels. Operating expenses and cost of goods sold significantly impact overall financial performance.

PE: 407.2x

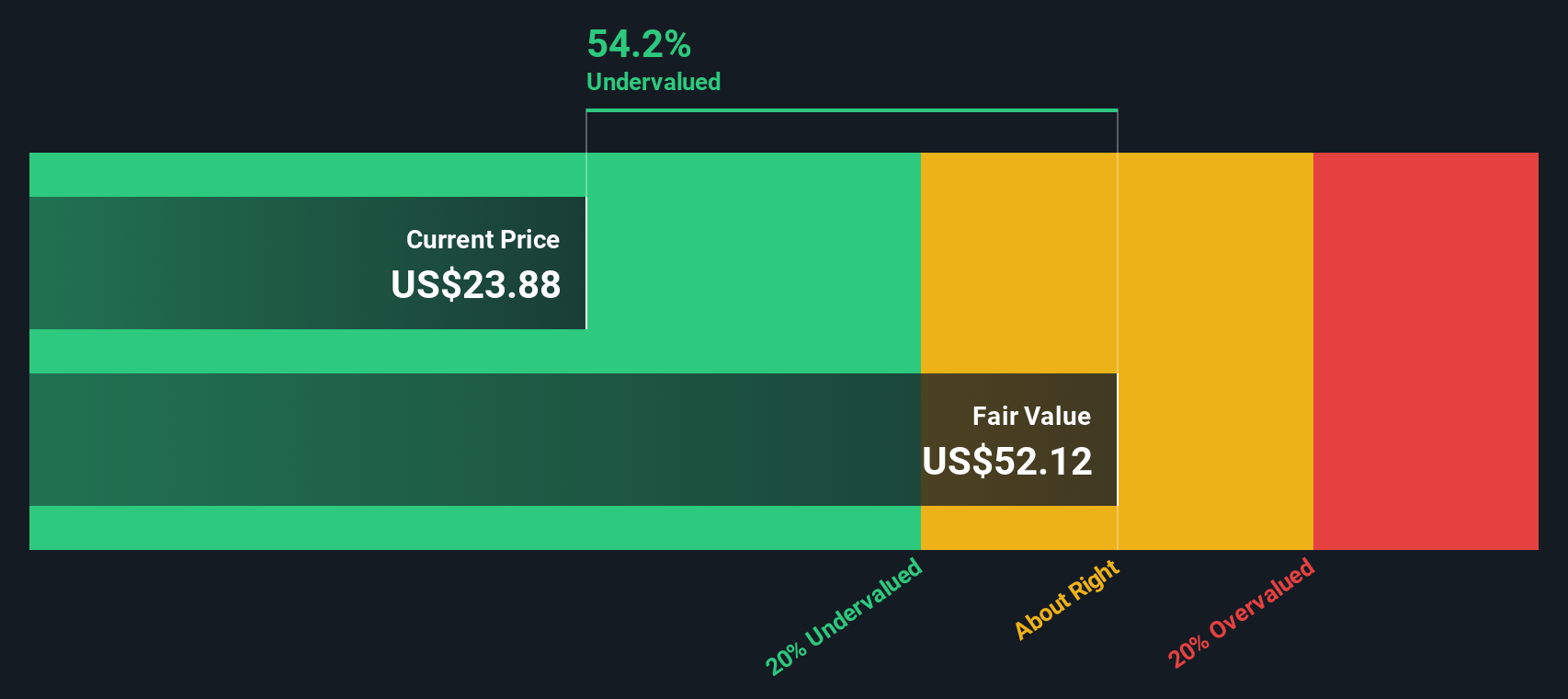

Phibro Animal Health, a smaller company in the animal health sector, recently projected net sales between US$1.04 billion and US$1.09 billion for fiscal 2025, with expected growth driven by its Animal Health segment. Despite a challenging year with net income dropping to US$2.42 million from US$32.61 million previously, insider confidence is evident through recent share purchases by key executives this year. The company's strategic focus on recovery in Mineral Nutrition and Performance Products segments suggests potential future growth opportunities within its industry context.

- Navigate through the intricacies of Phibro Animal Health with our comprehensive valuation report here.

Explore historical data to track Phibro Animal Health's performance over time in our Past section.

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a company that designs, develops, and sells radio-frequency, analog, and mixed-signal integrated circuits for broadband communications and data center markets with a market cap of $2.61 billion.

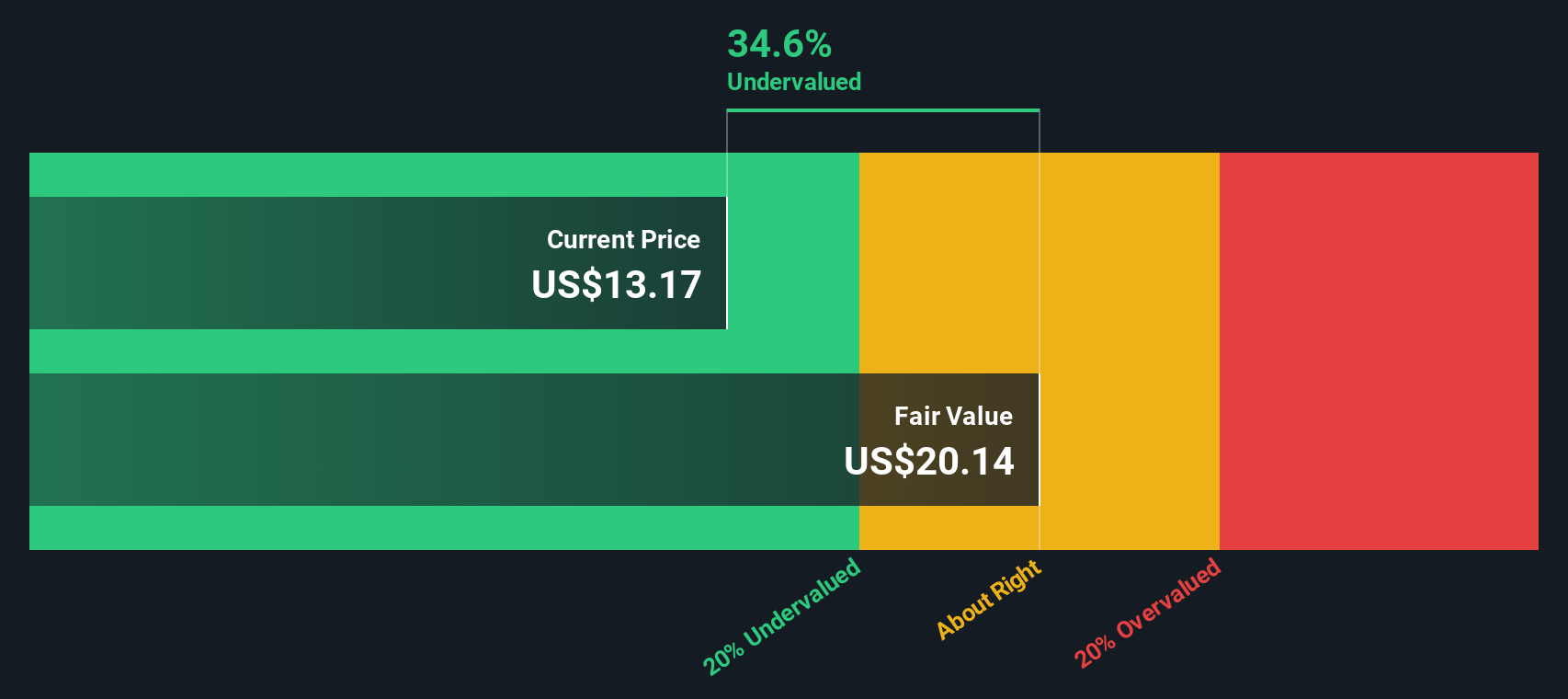

Operations: MaxLinear's revenue primarily comes from its semiconductor segment, with recent figures showing $448.14 million. The company's cost of goods sold (COGS) is $206.21 million, resulting in a gross profit margin of 53.99%. Operating expenses are significant at $382.74 million, contributing to a net income loss of -$189.90 million and a net income margin of -42.38%.

PE: -6.4x

MaxLinear, a small company in the tech industry, recently showcased its MaxAI technology aimed at enhancing network performance and user experience for service providers. Despite facing financial challenges with second-quarter sales dropping to US$91.99 million from US$183.94 million last year, insider confidence is evident as an executive purchased over 108,000 shares valued at approximately US$1.4 million between July and October 2024. This suggests potential optimism about future growth prospects driven by innovative solutions like MaxAI and Panther III's storage acceleration capabilities.

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company specializing in caller identification and spam blocking services, with a market capitalization of approximately SEK 15.36 billion.

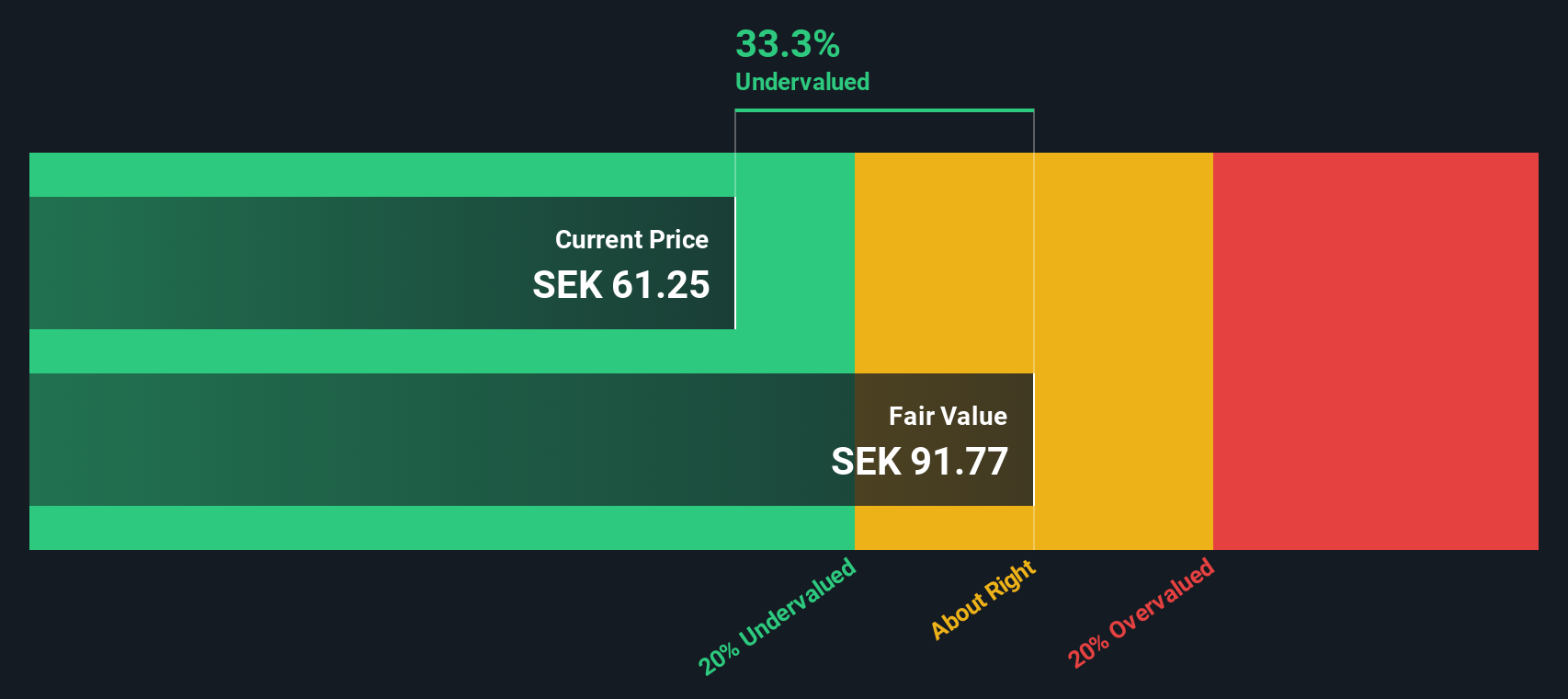

Operations: The company generates revenue primarily from its communications software segment, with recent figures showing SEK 1.72 billion. Its cost of goods sold (COGS) is SEK 418.58 million, resulting in a gross profit margin of 75.64%. Operating expenses include significant allocations for general and administrative purposes, amounting to SEK 646.91 million, impacting net income margins which stand at 27.78%.

PE: 32.0x

Truecaller, a smaller company in the tech space, is capturing attention with its strategic moves despite challenges. Recent insider confidence is evident as they initiated share repurchases in July 2024, aiming to manage obligations efficiently. While earnings for Q2 2024 dipped to SEK 457.87 million from SEK 519.07 million year-on-year, growth prospects remain strong with forecasted earnings expansion of over 21% annually. The company’s partnership with Halan underscores its commitment to enhancing communication security and trust globally.

- Get an in-depth perspective on Truecaller's performance by reading our valuation report here.

Review our historical performance report to gain insights into Truecaller's's past performance.

Next Steps

- Dive into all 191 of the Undervalued Small Caps With Insider Buying we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MXL

MaxLinear

Provides communications systems-on-chip solutions in the United States, Asia, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives