- United States

- /

- Semiconductors

- /

- NasdaqGS:MXL

Three Undervalued Small Caps In United States With Insider Action

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.5%, contributing to a substantial 33% increase over the past year, with earnings forecasted to grow by 16% annually. In this dynamic environment, identifying stocks that are potentially undervalued yet exhibit insider activity can be a strategic approach for investors seeking opportunities in the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.5x | 2.2x | 47.67% | ★★★★★☆ |

| Columbus McKinnon | 21.8x | 1.0x | 40.71% | ★★★★★☆ |

| Citizens & Northern | 12.9x | 2.9x | 43.07% | ★★★★☆☆ |

| German American Bancorp | 14.2x | 4.7x | 46.69% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -107.10% | ★★★☆☆☆ |

| HighPeak Energy | 12.4x | 1.6x | 33.44% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -34.31% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -792.81% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -215.87% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

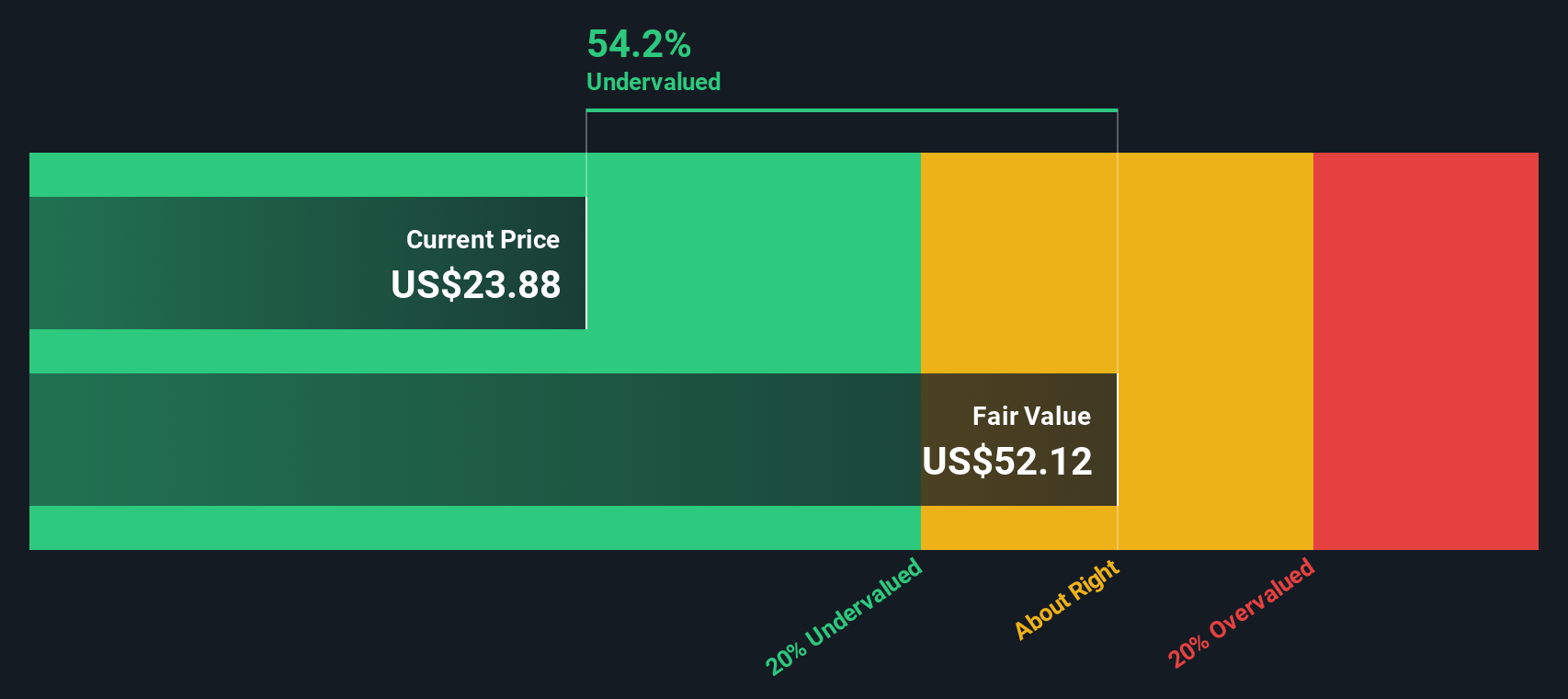

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company that specializes in animal health products, mineral nutrition, and performance products with a market cap of approximately $0.58 billion.

Operations: The company generates revenue primarily from Animal Health, Mineral Nutrition, and Performance Products segments. Over recent periods, the gross profit margin has shown fluctuations with a notable increase to 32.82% in June 2024. Operating expenses have consistently risen, impacting net income margins which decreased to 0.24% by June 2024.

PE: 393.8x

Phibro Animal Health, a smaller U.S. company, recently faced challenges with net income dropping to US$2.42 million for the year ending June 30, 2024, from US$32.61 million previously. Despite this dip, insider confidence is evident through recent share purchases in July and August 2024. The company forecasts earnings growth driven by its Animal Health segment and anticipates net sales between US$1.04 billion to US$1.09 billion for fiscal year 2025, suggesting potential recovery ahead.

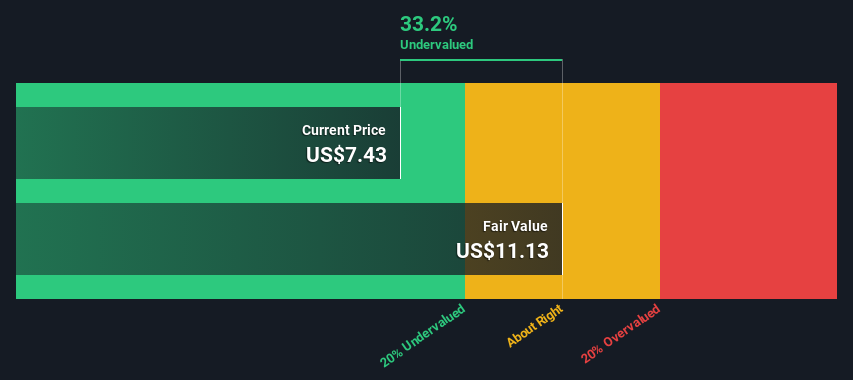

Reservoir Media (NasdaqGM:RSVR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Reservoir Media is a music company engaged in music publishing and recorded music operations, with a market cap of approximately $0.47 billion.

Operations: The company generates revenue primarily from Music Publishing and Recorded Music, with Music Publishing being the larger segment. Over recent periods, gross profit margin has shown an upward trend, reaching 62.48% as of June 2024. Operating expenses are significant and include costs such as General & Administrative Expenses and Depreciation & Amortization.

PE: 27120.1x

Reservoir Media, a smaller company in the U.S., has recently caught attention due to its perceived undervaluation. Irenic Capital Management LP highlighted this on September 30, 2024, suggesting a strategic review to boost shareholder value. Despite reporting a net loss of US$0.35 million for Q1 ending June 30, 2024, sales increased to US$34.32 million from the previous year. The company maintains its revenue guidance between US$148 million and US$152 million for the fiscal year ending March 31, 2025.

- Unlock comprehensive insights into our analysis of Reservoir Media stock in this valuation report.

Explore historical data to track Reservoir Media's performance over time in our Past section.

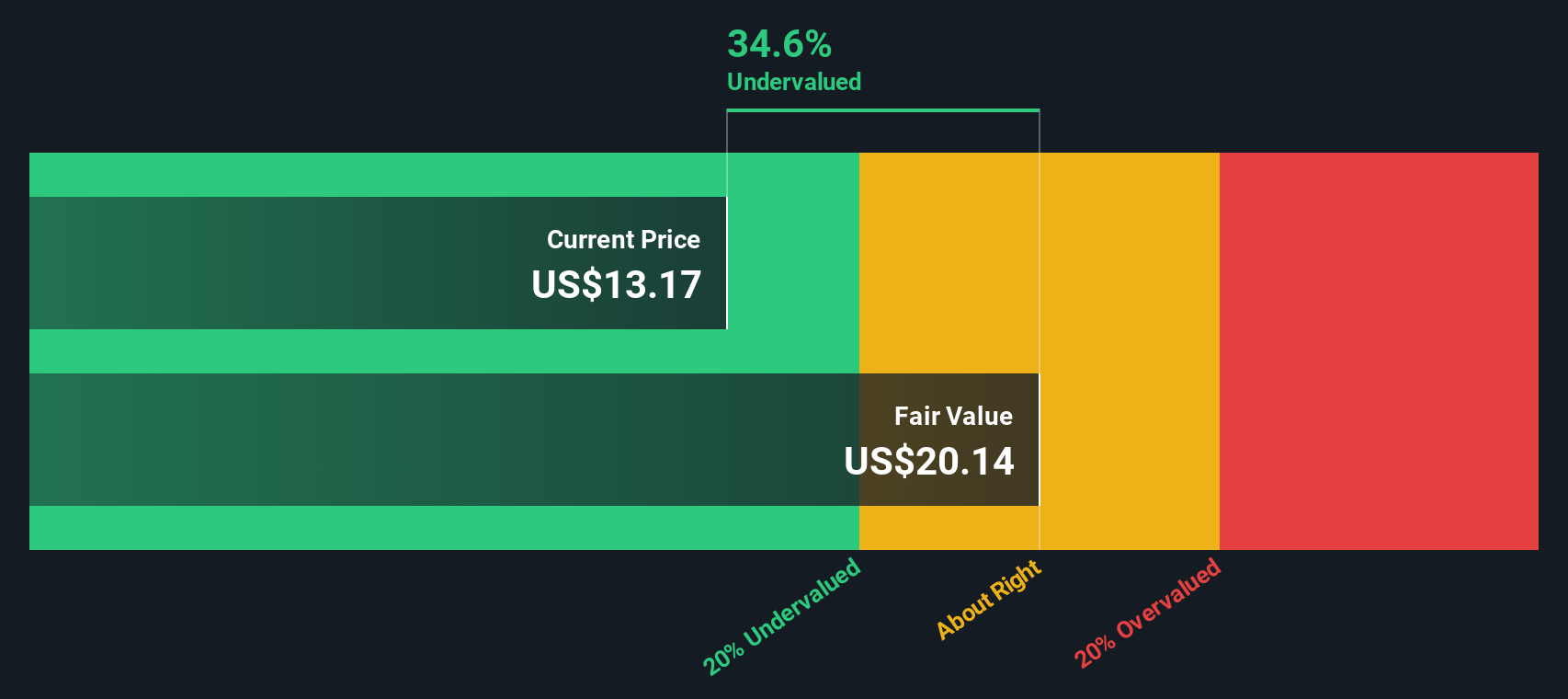

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a semiconductor company that designs and supplies integrated radio-frequency, analog, and mixed-signal semiconductor solutions for broadband communications applications, with a market cap of $2.11 billion.

Operations: MaxLinear's revenue primarily comes from its semiconductors segment, with a recent gross profit margin of 53.99%. The company's cost structure includes significant operating expenses, notably in research and development and general administrative areas.

PE: -6.3x

MaxLinear's recent developments highlight its innovative strides with the introduction of MaxAI™, a framework enhancing user experience and network performance, particularly beneficial for Multiple System Operators. Despite facing financial challenges, including a net loss of US$39 million in Q2 2024 compared to the previous year, insider confidence is evident with Co-Founder Kishore Seendripu purchasing over 108,000 shares valued at approximately US$1.4 million. This purchase suggests potential optimism about future growth prospects amidst current volatility and funding risks.

- Click to explore a detailed breakdown of our findings in MaxLinear's valuation report.

Evaluate MaxLinear's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 54 Undervalued US Small Caps With Insider Buying by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MXL

Good value with reasonable growth potential.