Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Stock market crashes are an opportune time to buy. High quality companies, such as Maxim Integrated Products, Inc., are impacted by general market panic and sell-off, but the fundamentals of these companies stay the same. In other words, now is the time to buy strong, well-proven stocks at an attractive discount.

See our latest analysis for Maxim Integrated Products

Maxim Integrated Products, Inc. designs, develops, manufactures, and markets a range of linear and mixed-signal integrated circuits in the United States, China, the rest of Asia, Europe, and internationally. Formed in 1983, and led by CEO Tunç Doluca, the company now has 7.15k employees and has a market cap of US$16b, putting it in the large-cap stocks category. Size matters. The bigger the company is, the more well-resourced it is. The more money it produces from its operations which means it is less reliant on external funding. When times are bad in the market, being self-sufficient is extremely important as you can continue to operate at your own pace. Therefore, large cap companies are a great bet to invest in when you're heading to the bottom of the cycle.

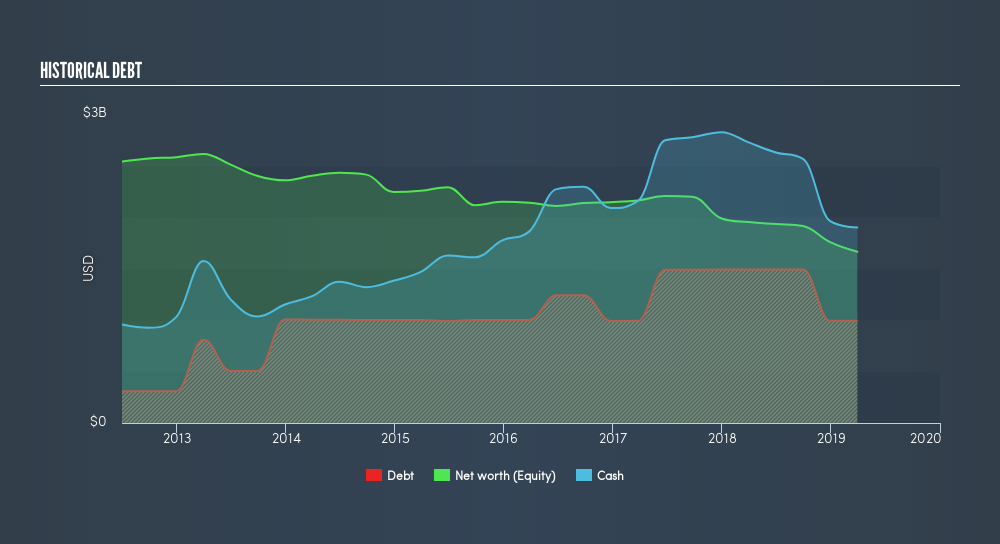

With US$992m debt on its books, Maxim Integrated Products has to pay interest periodically. This means it needs to have enough cash on hand to meet these upcoming expenses. With interest income higher than interest payments, meeting these short-term debt obligations isn't a problem for Maxim Integrated Products. Moreover, its cash flows from operations copiously covers it debt by 79%, above the safe minimum of 20%. Not to mention, it meets the basic liquidity requirement with current assets exceeding liabilities, which further builds on its financial strength in the face of a volatile market.

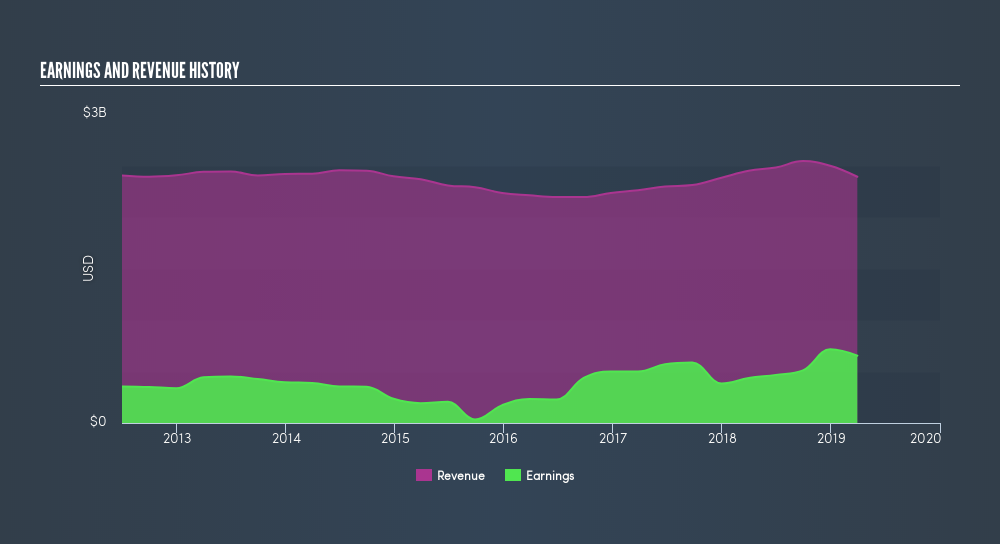

MXIM’s profit growth over the previous five years has been positive, with an average annual rate of 21%, outperfoming the market growth rate of 13%. It has also returned an ROE of 39% recently, above the industry return of 14%. Characteristics I value in a long term investment are proven in Maxim Integrated Products, and I can continue to sleep easy at night with the stock as part of my portfolio.

Next Steps:

Based on these three factors, MXIM makes for a strong long-term investment in the face of a fickle stock market. If you’re a risk averse investor, lining your portfolio with proven companies you’re willing to buy more and more of as the price falls, is a good strategy to build your wealth over the long run. This is the beginning of your research, but before you decide to buy MXIM, I highly urge you to understand more about the company, in particular, in these following areas:- Future Outlook: What are well-informed industry analysts predicting for MXIM’s future growth? Take a look at our free research report of analyst consensus for MXIM’s outlook.

- Valuation: What is MXIM worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MXIM is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives