- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (MU): Rethinking Valuation After a 64% Three-Month Surge in the Share Price

Reviewed by Simply Wall St

Micron Technology (MU) has quietly turned into one of the market’s stronger performers, with the stock up about 64% over the past 3 months and roughly doubling over the past year.

See our latest analysis for Micron Technology.

The latest leg higher, including a 6.99% 1 day share price return to around $265.92 and a 17.71% 1 month share price return, reinforces a powerful uptrend that mirrors Micron’s improving growth narrative and shifting market sentiment around memory demand.

If Micron’s surge has you rethinking your watchlist, this could be a good moment to scout other high growth tech and AI names via high growth tech and AI stocks.

With Micron now brushing against fresh highs and trading only modestly below analyst targets, investors face a key question: is this rally still underestimating its AI memory upside, or is the market already pricing in years of future growth?

Most Popular Narrative: 30.4% Overvalued

According to the narrative by BlackGoat, Micron’s fair value of about $203.92 sits well below the recent $265.92 close, framing a punchy valuation gap driven by aggressive AI cycle assumptions.

The AI Supercycle: This is the most powerful catalyst. The demand for next-generation HBM is unprecedented. Micron has successfully passed NVIDIA's quality verification for its HBM3E products, becoming a key supplier for the next-generation "Blackwell" AI accelerator. The company is now shipping high-volume HBM to four major customers across both GPU and ASIC platforms. With its entire 2025 production capacity already sold out, analysts project the HBM market will grow from roughly $30 billion in 2025 to a staggering $100 billion by 2030, representing a massive runway for growth.

Want to see how this supercycle story justifies today’s premium price tag? The narrative quietly leans on powerful revenue compounding and a richer profit profile than Micron’s past. Curious which profitability shift and future earnings multiple are doing the heavy lifting in that fair value math? Follow through to see the full playbook behind those assumptions.

Result: Fair Value of $203.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to watch for classic memory oversupply cycles and escalating competition from Samsung and SK Hynix that could squeeze Micron’s margins.

Find out about the key risks to this Micron Technology narrative.

Another View on Valuation

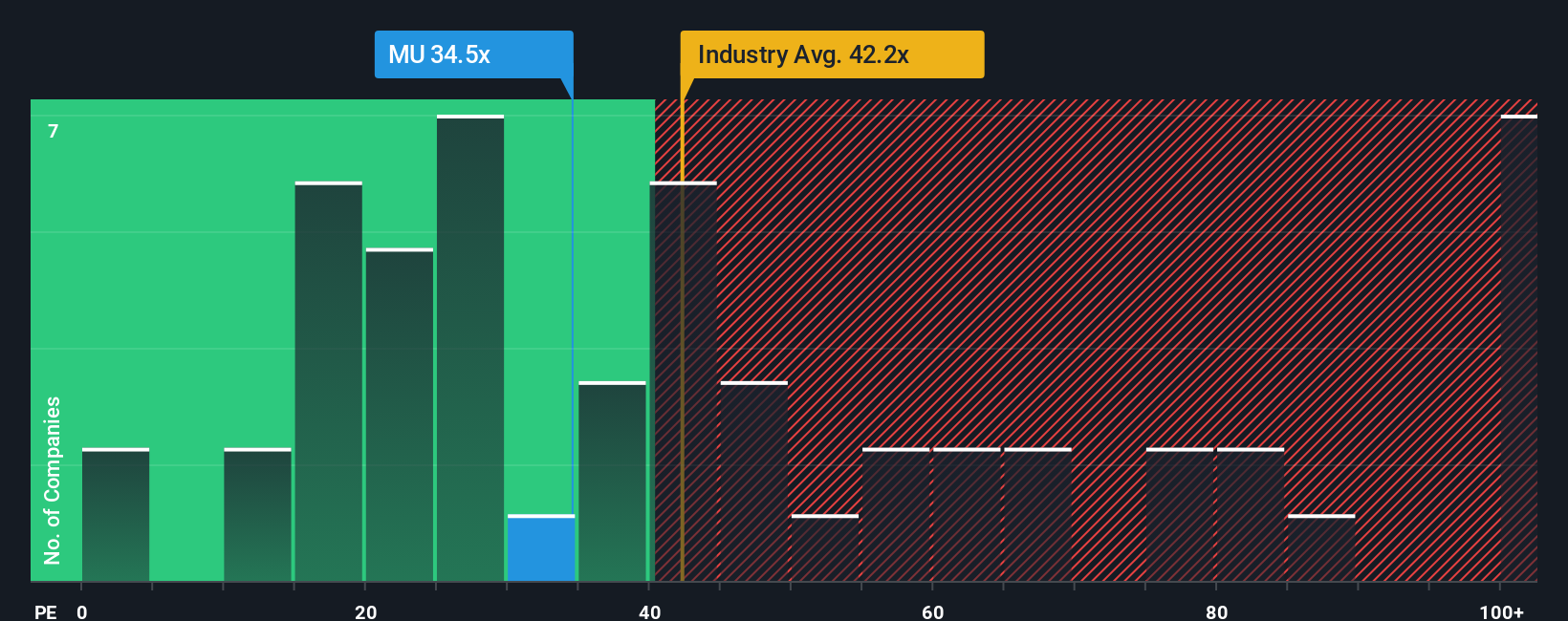

While BlackGoat sees Micron as roughly 30% overvalued, our ratio work sends a different signal. The current 25.1x earnings multiple sits well below the US semiconductor average of 36.8x, the peer average of 80.6x, and a fair ratio of 46.2x, which hints at potential upside if sentiment stays supportive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Micron Technology Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized Micron thesis in minutes: Do it your way.

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning for opportunities other investors might be missing using targeted stock screeners tailored to your strategy.

- Look for potential multi-baggers early by focusing on these 3624 penny stocks with strong financials that already show robust fundamentals instead of chasing past high performers.

- Explore the AI shift by targeting these 25 AI penny stocks that combine rapid growth with scalable business models, rather than relying on hype.

- Strengthen your income stream by concentrating on these 13 dividend stocks with yields > 3% that may help support returns in a range of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion