- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (MU): Is the Recent Surge Justified by Its Valuation?

Reviewed by Simply Wall St

Micron Technology (MU) has seen its stock gain momentum recently, with shares moving higher over the past month. Investors are paying close attention to the company’s strong performance metrics and long-term returns.

See our latest analysis for Micron Technology.

Micron Technology’s share price has been on an impressive run, climbing nearly 40% in the last month and more than doubling so far this year. This surge in momentum comes as a result of strengthened industry demand and signals growing optimism about the company’s outlook. Notably, long-term investors have also been rewarded, with the three-year total shareholder return topping 311%.

If you’re interested in what else is gaining steam in tech and AI, it’s a good moment to check out See the full list for free.

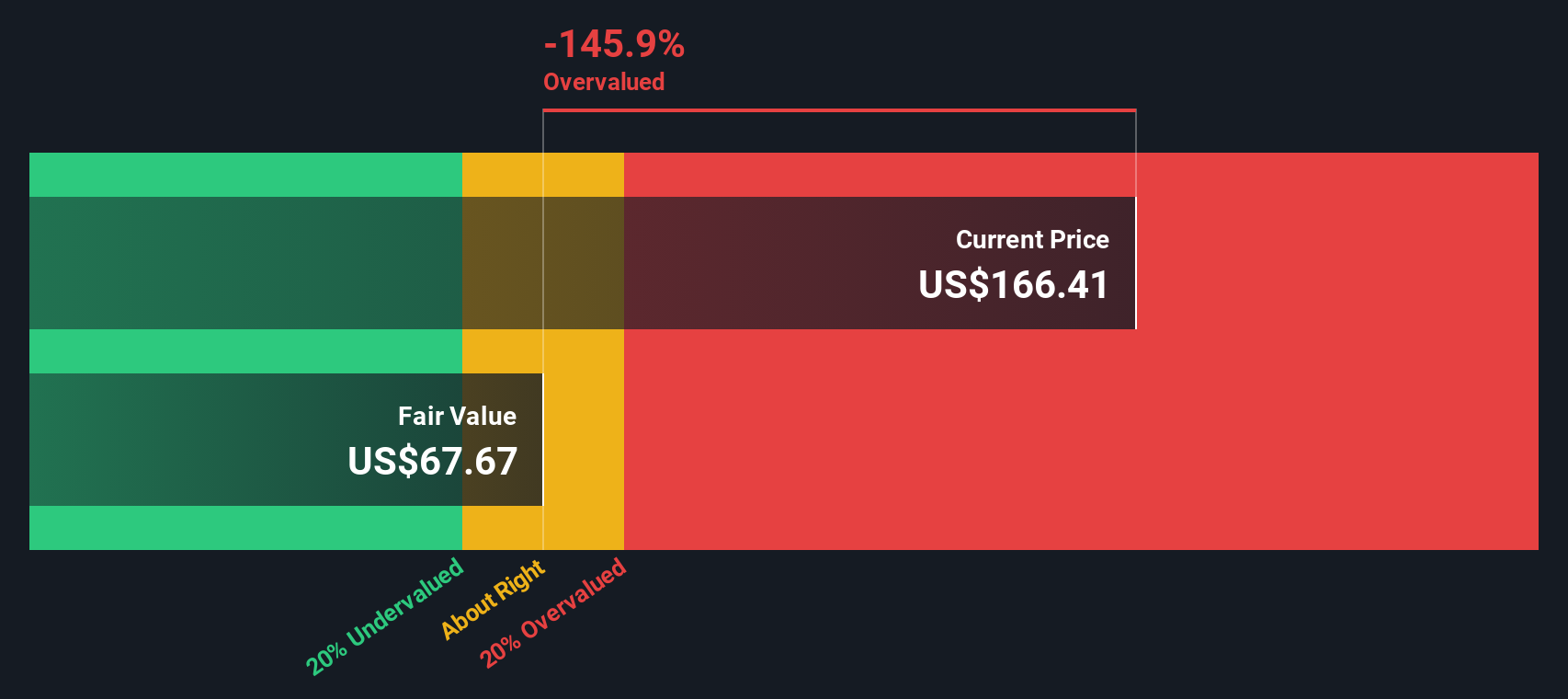

Yet with shares soaring and the current price even topping some analysts’ targets, investors have to ask themselves if Micron remains undervalued or if the market has already taken all its future growth potential into account.

Most Popular Narrative: 7% Overvalued

The most widely discussed narrative, created by BlackGoat, places Micron's fair value below the last close price. This raises tough questions about whether market optimism has pushed shares too far above fundamentals. While buyers are excited by AI demand, the story behind this valuation goes much deeper than just recent price action.

The AI Supercycle: This is the most powerful catalyst. The demand for next-generation HBM is unprecedented. Micron has successfully passed NVIDIA's quality verification for its HBM3E products, becoming a key supplier for the next-generation "Blackwell" AI accelerator. The company is now shipping high-volume HBM to four major customers across both GPU and ASIC platforms. With its entire 2025 production capacity already sold out, analysts project the HBM market will grow from roughly $30 billion in 2025 to a staggering $100 billion by 2030, representing a massive runway for growth.

Wondering what bold financial predictions support this valuation? The narrative’s core is a dramatic forecast for growth, profit margins, and future multiples rarely seen in this industry. The numbers fueling this analysis might surprise you. Curious about the specific assumptions driving this judgment? See the full breakdown in the narrative.

Result: Fair Value of $203.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the industry's history of sharp cycles and the potential for renewed geopolitical pressures, which could quickly alter Micron’s outlook.

Find out about the key risks to this Micron Technology narrative.

Another View: SWS DCF Model Sends a Sharper Warning

While the narrative-driven approach suggests Micron is slightly overvalued at current prices, our SWS DCF model takes a stricter stance. According to this method, the stock trades well above its intrinsic fair value of $107.72. This means Micron appears notably overvalued if future cash flows disappoint. Which model should investors trust when the results diverge so widely?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Micron Technology Narrative

If you think there's a different story to tell or want to dive into the details yourself, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always look beyond the headlines. If you want your portfolio to capture tomorrow's biggest winners, don't miss these hand-picked opportunities from the Simply Wall St Screener.

- Capture high yields by reviewing these 17 dividend stocks with yields > 3%, which are doling out strong dividends and providing robust income streams for shareholders.

- Spot the next market disruptors and fuel your strategy with innovation by targeting these 27 AI penny stocks that feature cutting-edge advancements in artificial intelligence.

- Supercharge your returns by checking out these 873 undervalued stocks based on cash flows, packed with stocks that might be flying under the radar but offer compelling value based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives