- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Does Micron’s 35% Rally in 2025 Justify Its Current Valuation After CHIPS Act Developments?

Reviewed by Simply Wall St

Wondering what to do with your Micron Technology stock right now? You are far from alone. Micron has been one of the most closely watched names in semiconductors, especially as its share price has soared 35% so far this year. But with the company seemingly riding a wave of policy headlines and shifting market sentiment, it is a timely moment to reconsider whether the current price is fair, high, or still undervalued.

Not long ago, Micron shares jumped on optimism around the CHIPS Act and renewed U.S. government investment in domestic production. Even as news swirled about possible government equity stakes in the industry, investors took comfort from signals that larger players like Micron would be left to chart their own course. In addition, the freeze on certain tech export restrictions to China was seen as another positive for Micron’s global outlook. This combination has created both opportunity and volatility.

Looking further back, the numbers tell a compelling growth story: a 26% jump in annual net income, 16% revenue growth, and a five-year return topping 160%. Yet with Micron’s valuation seen as undervalued on 3 out of 6 common checks, giving it a value score of 3, there is ongoing debate about whether the recent momentum has already been priced in or if more upside remains.

Let’s examine those valuation methods to see what is behind the numbers, and later on, I will share a perspective that could help you see Micron’s worth in an entirely new light.

Micron Technology delivered 15.0% returns over the last year. See how this stacks up to the rest of the Semiconductor industry.Approach 1: Micron Technology Cash Flows

A Discounted Cash Flow (DCF) model is a tool investors use to determine a company's intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. It helps answer the question: what is Micron Technology really worth based on what it can earn in the future?

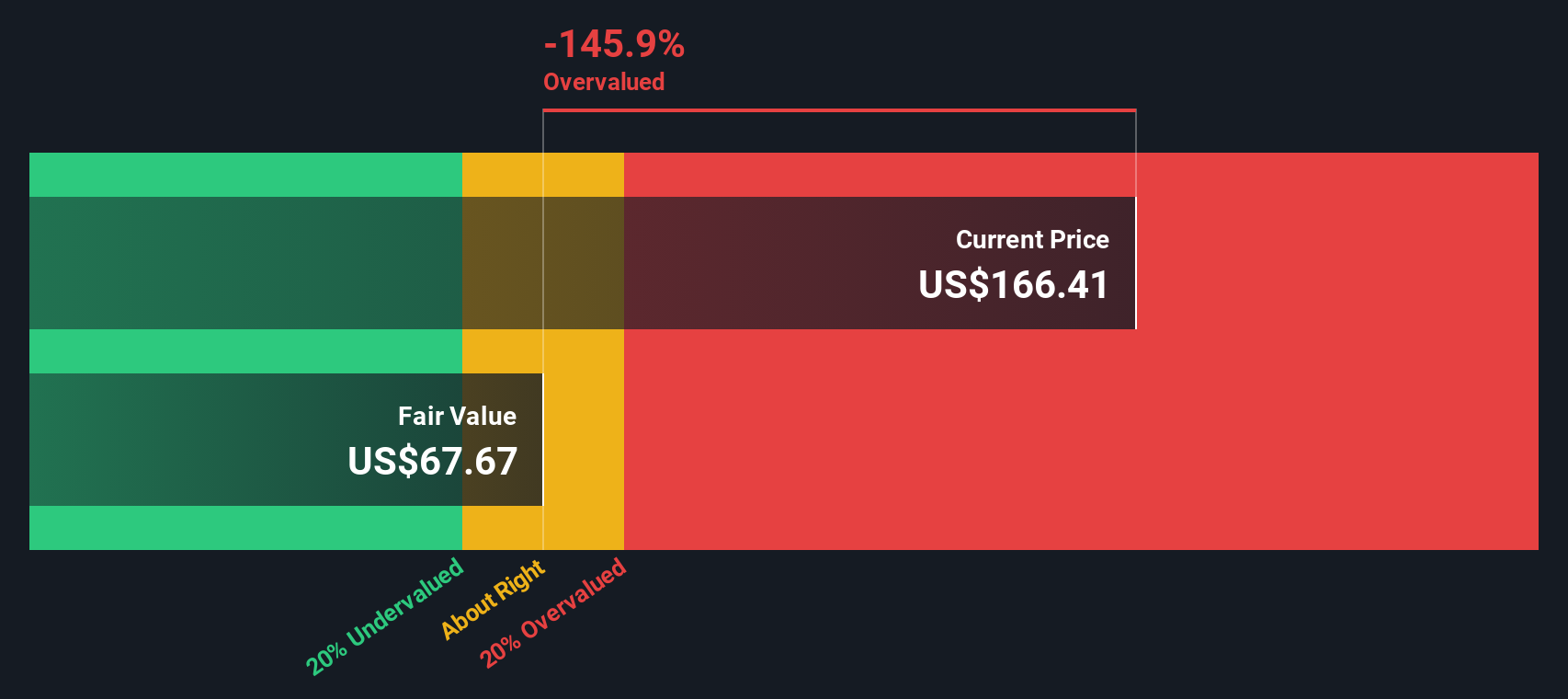

Currently, Micron’s Free Cash Flow stands at $1.44 billion, providing a solid platform for forward-looking analysis. According to expert and analyst projections, Micron’s annual FCF is expected to grow steadily, reaching approximately $8.09 billion by 2029. The DCF model, using a 2 Stage Free Cash Flow to Equity approach, maps out this growth over the next decade while taking into account variables such as revenue momentum and industry economics.

After analyzing the data, the estimated intrinsic value for Micron is $69.09 per share. However, with the current share price trading about 70.3% above that DCF-based value, the model indicates the stock is significantly overvalued according to this method.

Result: OVERVALUED

Approach 2: Micron Technology Price vs Earnings

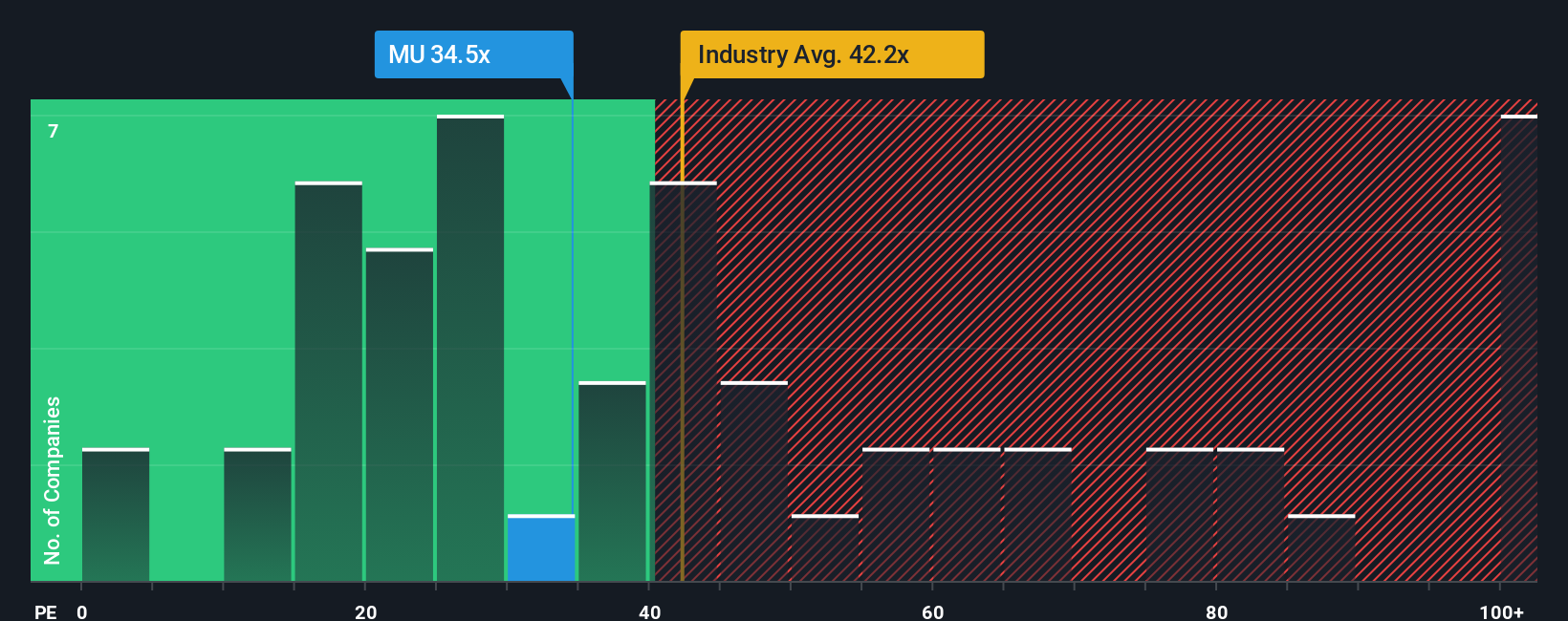

The Price-to-Earnings (PE) ratio is a widely used yardstick for valuing companies that are solidly profitable, such as Micron Technology. It shows how much investors are currently paying for each dollar of earnings, making it especially relevant for established firms with predictable profit streams.

Generally, a “normal” PE ratio can be higher for fast-growing, lower-risk companies. In contrast, slower growth or greater uncertainty often warrant a lower PE. Investors watch this benchmark closely because it quickly encapsulates both sentiment toward the company’s prospects and how it compares to its sector peers.

Micron’s current PE ratio stands at 21.2x, which is notably below the semiconductor industry average of 30.1x and far lower than the peer group average of 53.8x. To add further context, Simply Wall St’s proprietary Fair Ratio for Micron, which considers earnings growth, sector dynamics, profitability, and risk, is set at 48.0x. This comparison suggests Micron is trading at a considerable discount to where its valuation could arguably sit based on these comprehensive factors.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Micron Technology Narrative

Beyond the numbers, Narratives offer a simple yet powerful way to frame your investment decisions in Micron Technology by connecting the company’s story with financial forecasts to calculate a fair value.

A Narrative is your unique perspective, expressing what you believe will drive Micron’s future, such as AI growth, new technologies, or shifts in market demand. These beliefs are translated into estimates for revenue, earnings, profit margins, and an ultimate fair value.

This approach is made accessible through the Simply Wall St platform and its community. It allows millions of investors to create and compare Narratives for Micron, grounded in both personal conviction and expert analysis.

With Narratives, you can clearly see when your fair value estimate supports buying, holding, or selling. When news or earnings emerge, these Narratives update in real time, ensuring your decisions always reflect the latest information.

For example, one investor’s Narrative values Micron as high as $160 per share based on aggressive AI adoption and margin expansion. Another sees a fair value as low as $95 per share due to competition and cyclical risks, empowering you to choose the story and assumptions that fit your outlook best.

Do you think there's more to the story for Micron Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives