- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell’s New AI Connectivity Solution Might Change The Case For Investing In MRVL

Reviewed by Sasha Jovanovic

- Earlier this month, Marvell Technology announced the expansion of its connectivity portfolio with new active copper cable (ACC) linear equalizers designed to boost bandwidth, efficiency, and reach for next-generation AI data centers.

- This addition leverages Marvell’s expertise in PAM4 and analog devices, supporting faster, power-efficient copper interconnects and strengthening the company’s position in the increasingly demanding AI infrastructure market.

- We’ll now examine how this product portfolio growth in AI connectivity solutions could influence Marvell’s broader investment outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Marvell Technology Investment Narrative Recap

For investors considering Marvell Technology, the core thesis hinges on the company’s success in capitalizing on accelerating demand for advanced connectivity and custom silicon solutions across AI and data centers. While Marvell’s recent launch of ACC linear equalizers strengthens its foothold in AI infrastructure, it does not materially reduce the near-term risk of revenue volatility resulting from concentrated exposure to hyperscale cloud customers and project-specific wins.

Among the company’s recent announcements, the expansion of its share repurchase program by up to US$5,000 million stands out, reinforcing a commitment to shareholder returns even as R&D outlays remain elevated. This focus on capital return highlights the balance Marvell must maintain as it invests heavily to stay ahead in a competitive and rapidly evolving sector.

By contrast, investors should be aware that Marvell’s revenue concentration in major data center customers exposes the business to...

Read the full narrative on Marvell Technology (it's free!)

Marvell Technology's narrative projects $12.1 billion in revenue and $2.9 billion in earnings by 2028. This requires 18.7% yearly revenue growth and an earnings increase of about $3.0 billion from current earnings of -$103.4 million.

Uncover how Marvell Technology's forecasts yield a $89.67 fair value, in line with its current price.

Exploring Other Perspectives

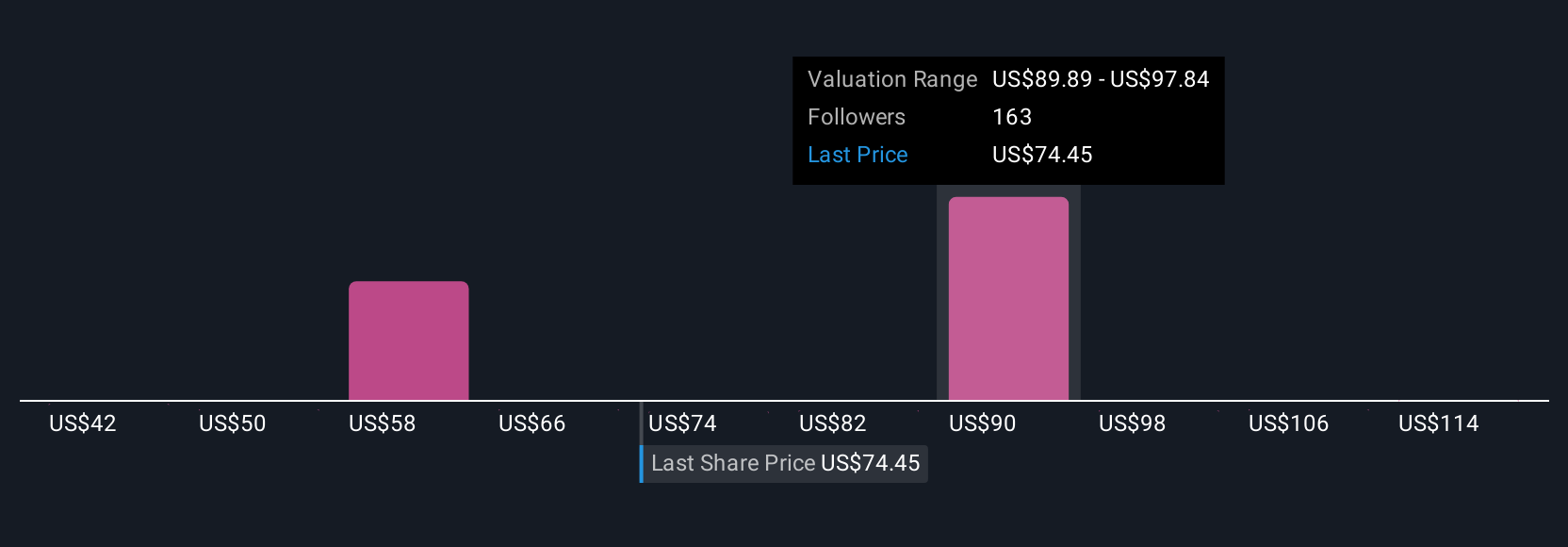

Twenty-four fair value estimates from the Simply Wall St Community range from US$48.74 to US$112.78, reflecting differing investor outlooks on Marvell’s prospects. With continued industry demand for advanced AI networking, your own perspective on revenue concentration risk could impact how you view the company’s future.

Explore 24 other fair value estimates on Marvell Technology - why the stock might be worth as much as 27% more than the current price!

Build Your Own Marvell Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marvell Technology research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marvell Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marvell Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives