- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (MRVL): Assessing Valuation After Analyst Upgrades and Expansion in AI Data Center Solutions

Reviewed by Kshitija Bhandaru

Marvell Technology (MRVL) is back in focus after unveiling new active copper cable linear equalizers designed for next-generation AI data centers. The move comes alongside upbeat analyst commentary related to growing revenues and momentum in its data center business.

See our latest analysis for Marvell Technology.

Shares have bounced sharply in the past month, with Marvell notching a 28% one-month share price return and up 18% over the last quarter, after a year of mixed results and headline-grabbing progress in AI data center offerings. The long-term story speaks to momentum, with total shareholder return over the past three years sitting above 130% and five-year returns also impressive, even as year-to-date share price performance remains down. Recent launches and analyst optimism suggest investors are warming up to Marvell’s growth narrative again.

If you’re keen to spot the next semiconductor winner riding the AI wave, it’s worth checking out See the full list for free..

With Marvell’s fundamentals back in the spotlight and recent analyst upgrades fueling a strong rally, the key question remains: does the current price leave room for significant upside, or is the market already accounting for all the good news?

Most Popular Narrative: 1.6% Undervalued

According to the most widely followed narrative, Marvell Technology’s fair value sits just above its last close at $89.67 compared to $88.23. This signals the company could be trading at a modest discount if the underlying story plays out as expected.

“The company's success in securing multigenerational design wins with hyperscalers and ramping up a robust pipeline (over 50 new custom silicon opportunities representing $75 billion in lifetime value) positions Marvell to grow its data center market share from 13% to 20% of a fast-expanding $94B TAM by 2028, driving recurring and expanding revenue.”

How is Marvell’s fair value built? The secret lies in ambitious forecasts for revenue growth, margin expansion, and substantial profit increases. The narrative relies on optimistic projections and a future multiple that could surprise many. Discover the full set of underlying assumptions and see why the valuation may attract attention.

Result: Fair Value of $89.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on hyperscale data center customers and unpredictable custom project demand could quickly challenge Marvell’s growth assumptions if market conditions shift.

Find out about the key risks to this Marvell Technology narrative.

Another View: What Do Sales Ratios Tell Us?

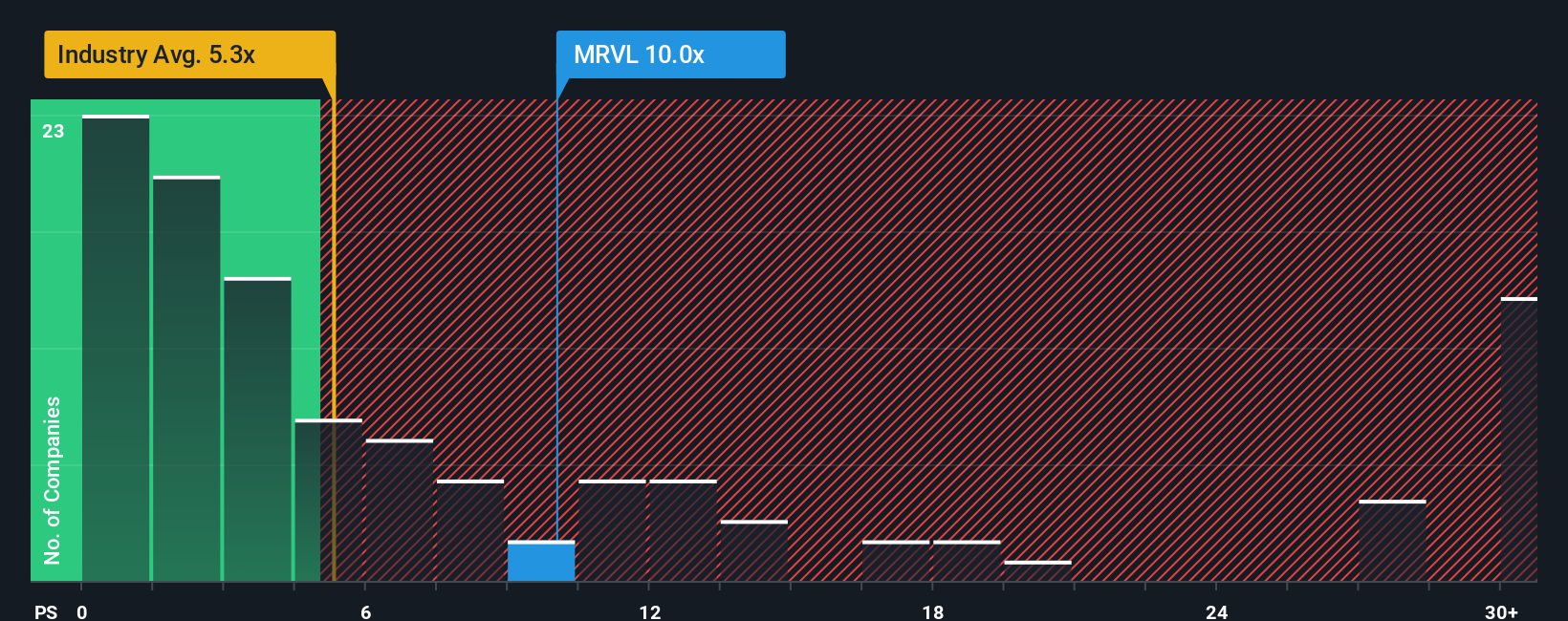

While fair value estimates suggest Marvell is undervalued, a quick look at its price-to-sales ratio offers a different reality. At 10.5x, Marvell trades well above both the US Semiconductor industry average of 5.3x and its peer average of 9.8x, landing right next to its fair ratio of 10.6x. This elevated starting point leaves little margin for error. Could the market’s optimism be setting investors up for disappointment if growth expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marvell Technology Narrative

If this perspective does not align with your views, or you want to dive into the numbers yourself, you can craft your personal Marvell Technology narrative from scratch in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Marvell Technology.

Looking for More Investment Ideas?

Take advantage of powerful investment angles with our free screeners, and never miss the opportunity to act on market-shaping trends across high-potential sectors.

- Boost your search for robust income streams by reviewing these 20 dividend stocks with yields > 3%, which consistently deliver yields above 3% and attract income-focused investors.

- Spot tomorrow’s innovators by checking out these 24 AI penny stocks, which are applying artificial intelligence breakthroughs to transform industries and gain a market edge.

- Get ahead of the curve with these 874 undervalued stocks based on cash flows, identified through their strong cash flow signals and overlooked market potential, and positioned for possible upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives