- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

How Investors May Respond To Marvell Technology (MRVL) Board Changes and Data Center Leadership Shift

Reviewed by Simply Wall St

- Marvell Technology recently appointed Rajiv Ramaswami, President and CEO of Nutanix, to its Board of Directors and promoted Chris Koopmans to President and COO with Sandeep Bharathi now leading the Data Center Group, both reporting directly to CEO Matt Murphy.

- These leadership changes bring deep technology industry experience and may strengthen Marvell’s ability to execute its data center and cloud-focused growth initiatives.

- We’ll explore how the addition of Rajiv Ramaswami to the board could influence Marvell’s investment case around data center transformation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Marvell Technology Investment Narrative Recap

To be a shareholder in Marvell Technology today, you need to believe in the continued surge of demand for AI and cloud infrastructure, as the bulk of Marvell’s revenues rely on the data center segment. The recent addition of Rajiv Ramaswami to the board and key leadership promotions should deepen expertise, but the biggest short-term catalyst, the rapid adoption of Marvell’s custom silicon programs, remains unchanged; meanwhile, the critical risk continues to be volatility in hyperscale customer demand and shifts in technology architecture.

The appointment of Rajiv Ramaswami, given his background as CEO of Nutanix and prior senior roles at VMware and Broadcom, stands out as particularly relevant, as it directly aligns with Marvell’s ambitions to accelerate growth in data center and cloud-focused initiatives. His experience can enhance Marvell’s board oversight as the company pursues high-volume custom AI silicon programs and develops next-generation networking technologies, delivering on the important catalyst of addressing exponential AI-driven market demand.

On the flip side, investors should be aware of the company’s heavy revenue reliance on just a few hyperscale customers, which means ...

Read the full narrative on Marvell Technology (it's free!)

Marvell Technology's outlook points to $11.8 billion in revenue and $2.5 billion in earnings by 2028. Achieving this would require 21.9% annual revenue growth and a $3.0 billion earnings increase from the current -$491.5 million.

Exploring Other Perspectives

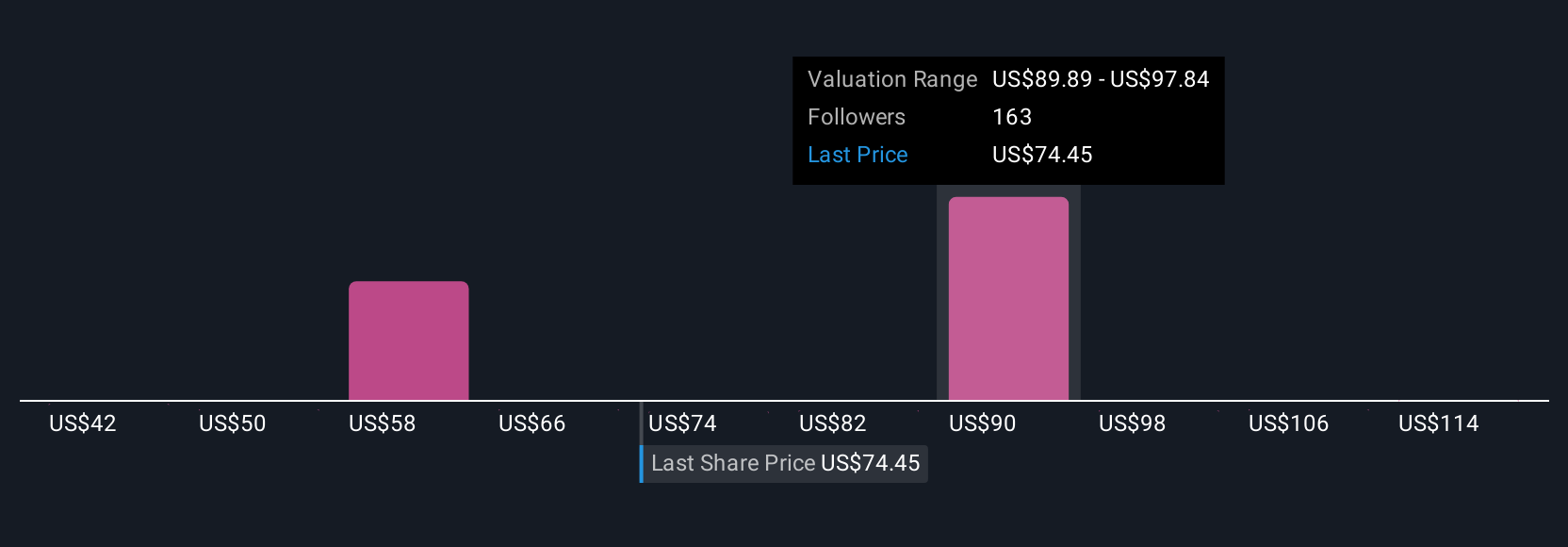

With 20 Simply Wall St Community member estimates ranging from US$42.16 to US$121.49, market opinion is widely split. Many are sharply focused on how Marvell’s growth depends on continued AI demand, so it’s worth exploring different viewpoints before making any decisions.

Build Your Own Marvell Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marvell Technology research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marvell Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marvell Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives