- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

How Elevated Analyst Optimism Ahead of Marvell Technology's (MRVL) Earnings Report Reshapes Its Investment Story

Reviewed by Sasha Jovanovic

- Marvell Technology recently attracted attention following industry concern over a data center company's delayed financials, yet still saw analysts revise their earnings expectations upward in anticipation of its December 2, 2025, earnings report.

- Amid sector-wide uncertainty, investor optimism about Marvell's projected year-over-year earnings growth and analyst estimate increases has kept the focus on its business operations and profit potential.

- We'll look at how elevated analyst optimism regarding Marvell's upcoming earnings report could impact the company's future investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Marvell Technology Investment Narrative Recap

To be a shareholder in Marvell Technology, you need to believe in the ongoing acceleration of demand for custom silicon and interconnect solutions in large-scale data centers, underpinned by AI and cloud computing growth. While the recent CoreWeave data center delay introduced industry-wide volatility, it doesn't appear to materially affect Marvell's near-term catalyst: upcoming earnings, which remain the main focus, given strengthened analyst expectations. The biggest risk remains Marvell’s high revenue concentration tied to key cloud customers, making its growth vulnerable to hyperscaler capex shifts.

Among several recent developments, the expansion of Marvell’s connectivity portfolio to include active copper cable equalizers for data centers directly addresses demand for advanced networking to support next-generation AI workloads, closely linking to the short-term growth drivers analysts are monitoring. Improvements in efficiency and performance from such products play a critical role in supporting Marvell’s ongoing profitability and relevance, especially as investor attention turns to business execution ahead of earnings.

By contrast, investors should also consider the implications if hyperscale customers decide to scale back orders or accelerate in-house chip initiatives...

Read the full narrative on Marvell Technology (it's free!)

Marvell Technology's outlook anticipates $12.1 billion in revenue and $2.9 billion in earnings by 2028. This is based on an annual revenue growth rate of 18.7% and a $3.0 billion earnings increase from the current earnings of -$103.4 million.

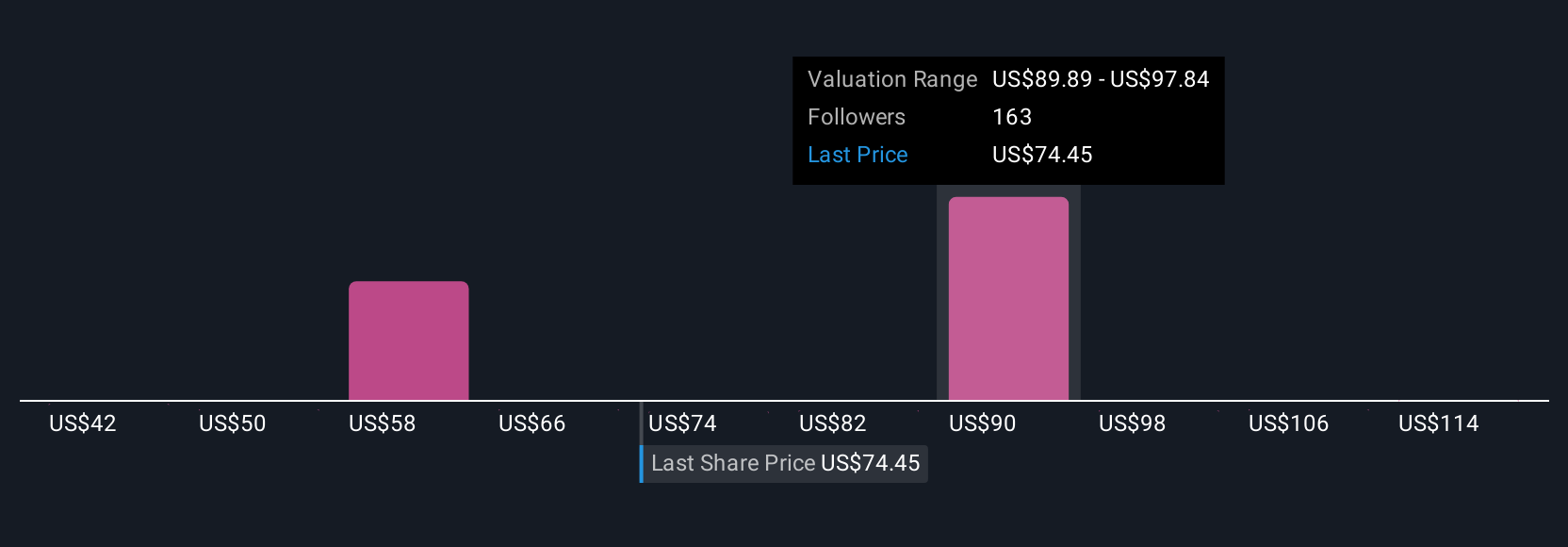

Uncover how Marvell Technology's forecasts yield a $90.07 fair value, in line with its current price.

Exploring Other Perspectives

Twenty-four fair value estimates from the Simply Wall St Community range from US$48.74 to US$112.78, revealing wide disagreement in projected upside or downside. While opinions differ, rapid growth in Marvell’s custom silicon and AI-related design wins continues to shape expectations regarding future revenue expansion and risk exposure.

Explore 24 other fair value estimates on Marvell Technology - why the stock might be worth 45% less than the current price!

Build Your Own Marvell Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marvell Technology research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marvell Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marvell Technology's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives