- United States

- /

- Semiconductors

- /

- NasdaqGM:MRAM

While institutions invested in Everspin Technologies, Inc. (NASDAQ:MRAM) benefited from last week's 14% gain, individual investors stood to gain the most

Key Insights

- The considerable ownership by individual investors in Everspin Technologies indicates that they collectively have a greater say in management and business strategy

- A total of 13 investors have a majority stake in the company with 50% ownership

- Insiders have been selling lately

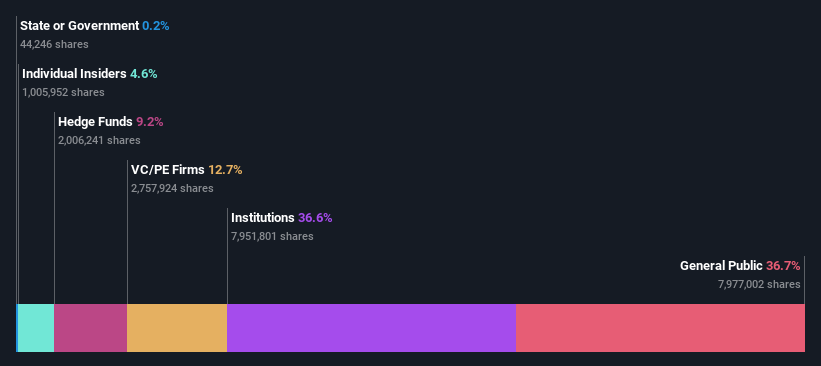

Every investor in Everspin Technologies, Inc. (NASDAQ:MRAM) should be aware of the most powerful shareholder groups. We can see that individual investors own the lion's share in the company with 37% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Following a 14% increase in the stock price last week, individual investors profited the most, but institutions who own 37% stock also stood to gain from the increase.

In the chart below, we zoom in on the different ownership groups of Everspin Technologies.

Check out our latest analysis for Everspin Technologies

What Does The Institutional Ownership Tell Us About Everspin Technologies?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

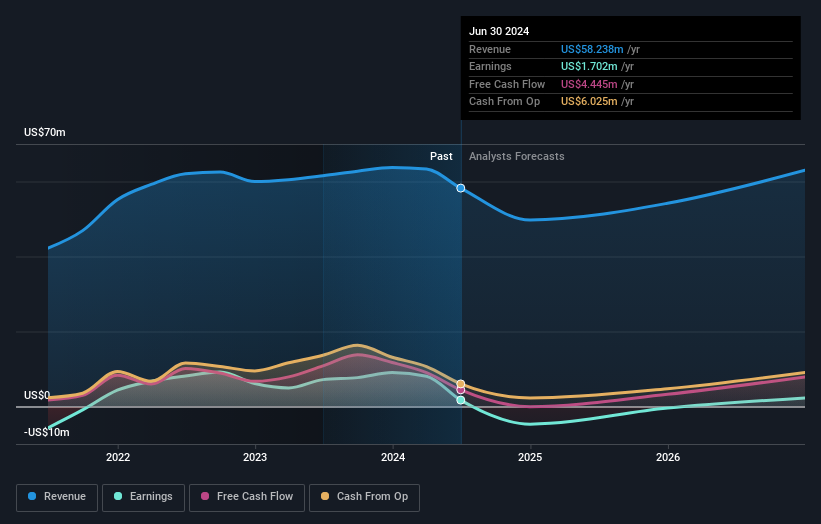

As you can see, institutional investors have a fair amount of stake in Everspin Technologies. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Everspin Technologies' historic earnings and revenue below, but keep in mind there's always more to the story.

It looks like hedge funds own 9.2% of Everspin Technologies shares. That catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create near term value for shareholders. AWM Investment Company Inc is currently the largest shareholder, with 9.2% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 7.0% and 5.7%, of the shares outstanding, respectively. In addition, we found that Sanjeev Aggarwal, the CEO has 0.8% of the shares allocated to their name.

A closer look at our ownership figures suggests that the top 13 shareholders have a combined ownership of 50% implying that no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Everspin Technologies

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own some shares in Everspin Technologies, Inc.. In their own names, insiders own US$5.5m worth of stock in the US$119m company. It is good to see some investment by insiders, but we usually like to see higher insider holdings. It might be worth checking if those insiders have been buying.

General Public Ownership

With a 37% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Everspin Technologies. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With a stake of 13%, private equity firms could influence the Everspin Technologies board. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Everspin Technologies , and understanding them should be part of your investment process.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Everspin Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MRAM

Everspin Technologies

Manufactures and sells magnetoresistive random access memory (MRAM) technologies in the United States, Japan, Hong Kong, Germany, Singapore, China, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026