- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Why Monolithic Power Systems (MPWR) Is Up 6.4% After Strong Earnings and New Automotive AI Partnership

Reviewed by Simply Wall St

- Monolithic Power Systems recently posted its second-quarter 2025 results, reporting US$664.57 million in sales and US$133.73 million in net income, both up significantly compared to the prior year.

- Alongside strong earnings, the company announced a new partnership targeting automotive intelligence and AI applications, highlighting MPS's transformation from a traditional chip supplier to a full-service silicon solutions provider.

- We'll explore how the robust sales growth and new automotive AI alliance could influence Monolithic Power Systems' investment narrative going forward.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Monolithic Power Systems Investment Narrative Recap

To be a shareholder in Monolithic Power Systems, you need confidence in the company's transformation from a chip supplier to a full-service silicon solutions provider, with ongoing momentum in automotive and AI. The recent strong earnings and optimistic revenue guidance for Q3 strengthen the outlook for near-term revenue growth, but uncertainty remains around the pace of enterprise data sector ramp, which is still the key short-term catalyst and risk. If that ramping fails to materialize as quickly as anticipated, there could be an impact on growth projections, but nothing in this news event materially changes that risk.

Among the latest announcements, the new partnership with ECARX Holdings stands out for its focus on automotive intelligence and AI applications. This move aligns directly with MPS's efforts to expand its footprint in high-growth verticals, such as automotive and robotics, which was also referenced as a core engine for potential future gains in both sales and market share.

But before getting carried away with the positive momentum, investors should be aware that the biggest risk still revolves around...

Read the full narrative on Monolithic Power Systems (it's free!)

Monolithic Power Systems is expected to achieve $3.7 billion in revenue and $938.6 million in earnings by 2028. This outlook assumes a 16.0% annual revenue growth rate, but a significant earnings decline of approximately $861 million from current earnings of $1.8 billion.

Uncover how Monolithic Power Systems' forecasts yield a $809.92 fair value, a 3% upside to its current price.

Exploring Other Perspectives

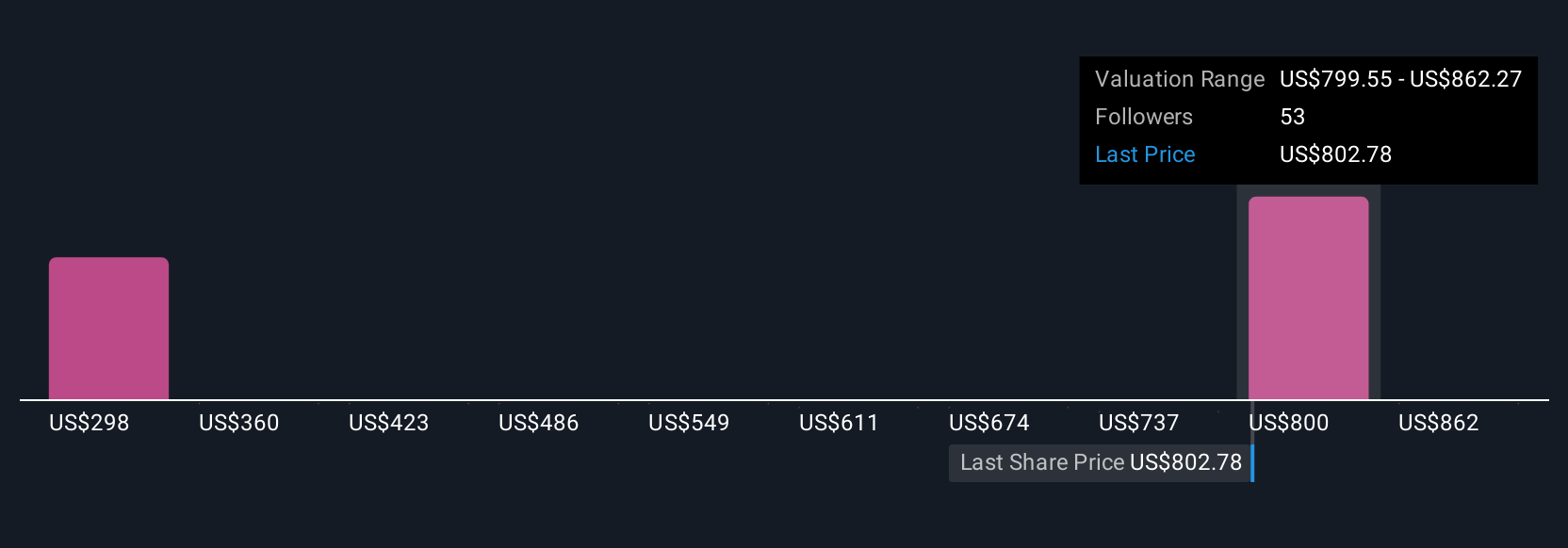

Thirteen fair value estimates from the Simply Wall St Community put Monolithic Power Systems’ worth anywhere between US$300,030 and US$925,000. With strong recent sales growth in key segments, opinions vary widely on how current momentum could influence long-term performance, explore multiple views to see how others are assessing the future potential.

Explore 13 other fair value estimates on Monolithic Power Systems - why the stock might be worth as much as 18% more than the current price!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives