- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Monolithic Power Systems (MPWR) Reports Earnings Growth With Quarterly Sales At US$665 Million

Reviewed by Simply Wall St

Monolithic Power Systems (MPWR) has experienced a notable 12% price increase over the past quarter, which may have been bolstered by its strong Q2 and six-month earnings announcement, revealing significantly higher sales and net income compared to the previous year. In addition, the company's declared dividend and a partnership with ECARX Holdings potentially enhanced its market appeal. However, broader economic factors, such as a weak job market and concerns over new tariffs, pressured tech stocks. Despite being removed from certain indices, MPWR's financial resilience seemed to support its upward trajectory, counterbalancing broader market challenges.

The recent developments at Monolithic Power Systems, such as the Q2 earnings announcement and the partnership with ECARX Holdings, could influence its strategic shift toward full-service silicon solutions and global diversification, potentially enhancing revenue, margins, and operational efficiency. Over the past five years, the company's total return, including dividends, was an impressive 161.00%, demonstrating substantial longer-term gains despite recent market challenges.

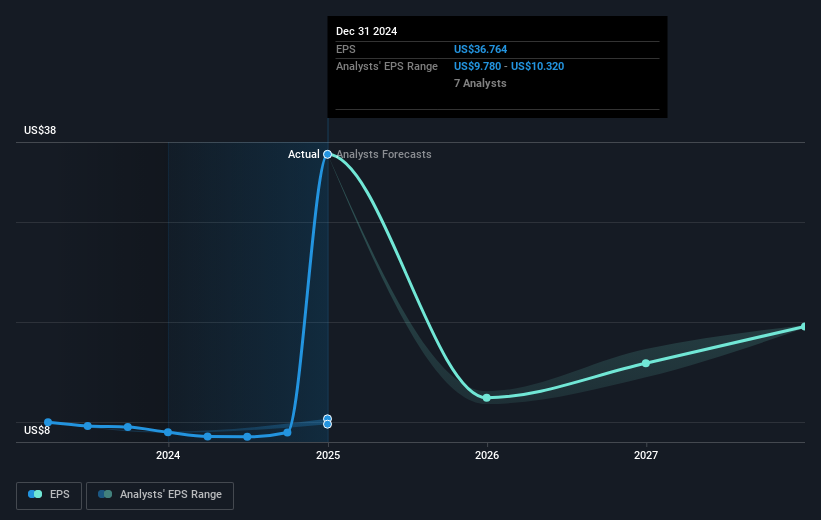

In the past year, however, MPWR underperformed both the U.S. Market return of 16.8% and the U.S. Semiconductor industry return of 45.6%. This disparity may point to shifting industry dynamics and competitive pressures that could impact future earnings forecasts. Analysts project MPWR's earnings to decline by 14.5% per year over the next three years, but the expected revenue growth of 13% per year remains above the U.S. market average of 9.2% annually.

Currently trading at US$711.24, MPWR shares are priced below the consensus price target of US$809.92, representing a discount of approximately 13.87%. The narrative of transitioning to full-service solutions and geographic diversification might indicate potential for closing this gap, depending on future financial performance. Additionally, volatility from tariff-related risks and inventory management remains a crucial factor affecting these projections.

Assess Monolithic Power Systems' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives