- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

A Quick Analysis On Monolithic Power Systems' (NASDAQ:MPWR) CEO Compensation

This article will reflect on the compensation paid to Michael Hsing who has served as CEO of Monolithic Power Systems, Inc. (NASDAQ:MPWR) since 1997. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Monolithic Power Systems

How Does Total Compensation For Michael Hsing Compare With Other Companies In The Industry?

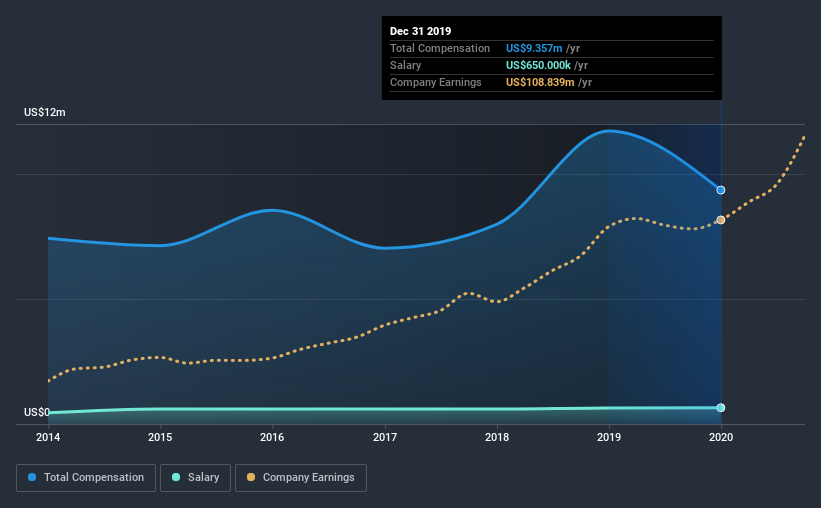

Our data indicates that Monolithic Power Systems, Inc. has a market capitalization of US$14b, and total annual CEO compensation was reported as US$9.4m for the year to December 2019. We note that's a decrease of 20% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$650k.

In comparison with other companies in the industry with market capitalizations over US$8.0b , the reported median total CEO compensation was US$11m. So it looks like Monolithic Power Systems compensates Michael Hsing in line with the median for the industry. What's more, Michael Hsing holds US$342m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$650k | US$644k | 7% |

| Other | US$8.7m | US$11m | 93% |

| Total Compensation | US$9.4m | US$12m | 100% |

Speaking on an industry level, nearly 15% of total compensation represents salary, while the remainder of 85% is other remuneration. It's interesting to note that Monolithic Power Systems allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Monolithic Power Systems, Inc.'s Growth

Monolithic Power Systems, Inc.'s earnings per share (EPS) grew 27% per year over the last three years. In the last year, its revenue is up 27%.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Monolithic Power Systems, Inc. Been A Good Investment?

We think that the total shareholder return of 163%, over three years, would leave most Monolithic Power Systems, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Michael is compensated close to the median for companies of its size, and which belong to the same industry. Few would be critical of the leadership, since returns have been juicy and EPS are moving in the right direction. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Monolithic Power Systems that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Monolithic Power Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion