- United States

- /

- Semiconductors

- /

- NasdaqGS:MKSI

MKS (MKSI) Sees 18% Stock Price Rise Last Quarter

Reviewed by Simply Wall St

MKS (MKSI) reported a remarkable price increase of 18% in the last quarter, likely fueled by its impressive second-quarter financial results, which showed a notable rise in both revenue and net income. The announcement of a quarterly dividend may have further increased investor confidence. Despite being removed from multiple Russell indexes, the company's robust earnings and steady market conditions, with major U.S. stock indexes reaching record highs, appeared to support its upward trajectory. While the broader stock market experienced growth, MKS's earnings report provided a compelling factor in its positive performance.

We've discovered 1 risk for MKS that you should be aware of before investing here.

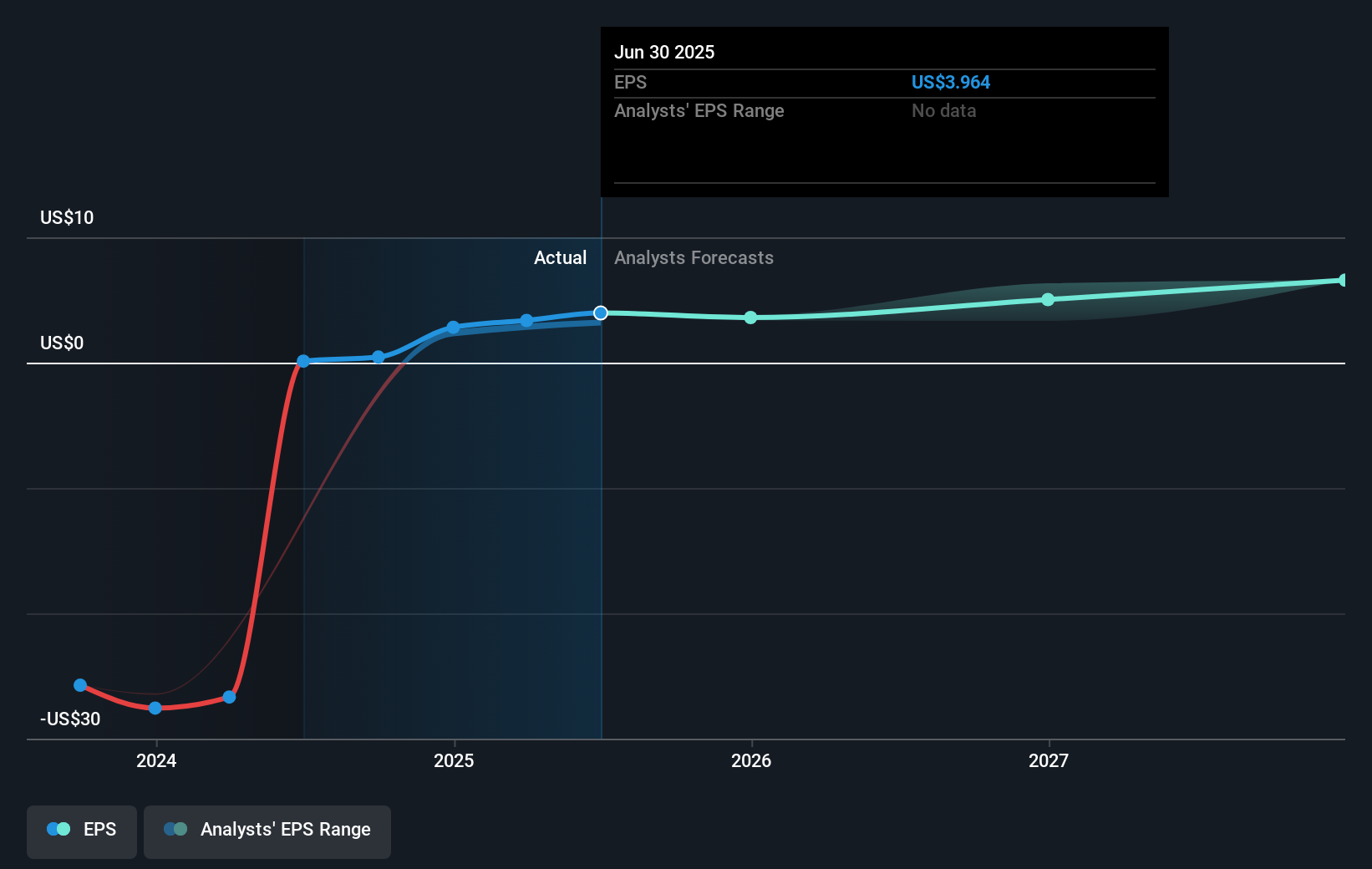

The recent 18% share price increase for MKS Instruments can significantly influence the broader narrative surrounding the company's future potential. The impressive financial results from the second quarter, including revenue of US$3.74 billion and net income of US$267 million, alongside the quarterly dividend announcement, could bolster investor confidence and impact revenue and earnings forecasts favorably. Analysts' consensus price target of US$122.31 suggests a potential upside of approximately 10.6% from the current share price of US$110.60. However, the market's enthusiasm for MKS should be tempered with an understanding of cyclical risks and industry challenges that remain.

Over the past three years, MKS's total shareholder return, including dividends, amounted to 21.49%. This longer-term performance provides context for the company's trajectory, although it underperformed compared to the broader semiconductor industry, which showed a higher return of 44.5% over the last year. Despite this, the company's strategic positioning in AI and semiconductor advancements could support future growth, albeit with some volatility expected due to trade risks and competition. Considering these factors, investors should evaluate the company's current valuation and its alignment with their expectations, acknowledging the risks inherent in its business model and industry landscape.

Examine MKS' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKSI

MKS

Provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, China, South Korea, Japan, Taiwan, Singapore, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives