- United States

- /

- Semiconductors

- /

- NasdaqGS:MKSI

MKS Instruments, Inc. (NASDAQ:MKSI): How To Win In A Volatile Market

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

MKS Instruments, Inc. is a financially healthy and robust stock with a proven track record of outperformance. We all know MKS Instruments, and having this large-cap to cushion your portfolio during a volatile period in the stock market isn't a bad idea. Today I will give a high-level overview of the stock, and why I believe it's still attractive.

See our latest analysis for MKS Instruments

MKS Instruments, Inc. provides instruments, subsystems, and process control solutions that measure, monitor, deliver, analyze, power, and control critical parameters of manufacturing processes worldwide. Formed in 1961, and led by CEO Gerald Colella, the company provides employment to 4.85k people and with the company's market capitalisation at US$4.0b, we can put it in the mid-cap group. Size matters. The bigger the company is, the more well-resourced it is. The more money it produces from its operations which means it is less reliant on external funding. When times are bad in the market, being self-sufficient is extremely important as you can continue to operate at your own pace. Therefore, large cap companies are a great bet to invest in when you're heading to the bottom of the cycle.

MKS Instruments currently has US$987m debt on its books which requires regular servicing. This means it needs to have sufficient cash-on-hand to meet upcoming interest expenses. With an interest coverage ratio of 30.49x, MKS Instruments produces sufficient earnings (EBIT) to cover its interest payments. Anything above 3x is considered safe practice. Furthermore, its operating cash flows amply covers its total debt by 37%, which is higher than the bare minimum requirement of 20%. Its cash and short-term investment is also sufficient to cover other upcoming liabilities, which means MKSI is financially robust in the face of a volatile market.

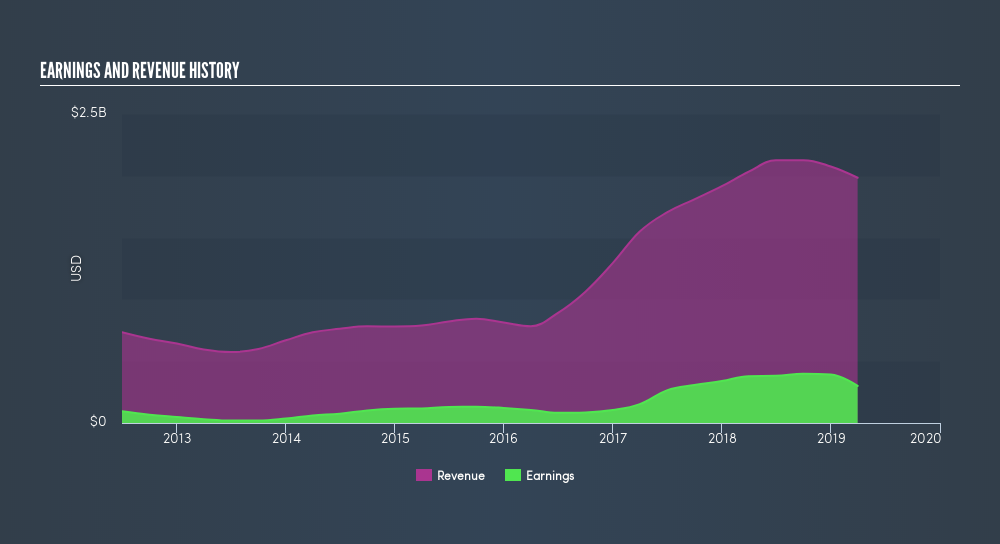

MKSI’s profit growth over the previous five years has been positive, with an average annual rate of 35%, outperfoming the industry growth rate of 27%. It has also returned an ROE of 16% recently, above the industry return of 14%. Characteristics I value in a long term investment are proven in MKS Instruments, and I can continue to sleep easy at night with the stock as part of my portfolio.

Next Steps:

Whether you're convinced or not, the key takeaway here is that every stock gets hit in a bear market, but not every stock deserves the blow. When prices are dropping like flies, now is the time to do your research and buy at a discount. MKS Instruments tick the boxes in terms of its scale, financial health and proven track record, but there are a few other things I have yet to consider. Below I've compiled a list of factors for you to continue your reading before you buy:- Future Outlook: What are well-informed industry analysts predicting for MKSI’s future growth? Take a look at our free research report of analyst consensus for MKSI’s outlook.

- Valuation: What is MKSI worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MKSI is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MKSI

MKS

Provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, China, South Korea, Japan, Taiwan, Singapore, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives