- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

What Microchip Technology (MCHP)'s Upgraded Outlook and New Power Products Mean For Shareholders

Reviewed by Sasha Jovanovic

- In recent days, Microchip Technology raised its third-quarter financial guidance, highlighted stronger-than-expected bookings and backlog, and introduced new energy-efficient power monitors that aim to cut power consumption in portable devices by half.

- Separately, Kioxia confirmed its PCIe/NVMe SSDs are interoperable with Microchip’s Adaptec SmartRAID 4300 accelerators, underlining Microchip’s role in supporting next-generation data center infrastructure.

- We’ll now examine how Microchip’s upgraded guidance and product launches may influence its existing investment narrative and future expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Microchip Technology Investment Narrative Recap

To own Microchip Technology, you need to believe its recovery in industrial, automotive and data center demand can turn current losses and high leverage into sustainable profitability. The upgraded third quarter guidance supports that recovery narrative in the near term, but does little to resolve the underlying risk of elevated debt and interest costs limiting flexibility if conditions soften.

The launch of the PAC1711 and PAC1811 low power monitors fits neatly into Microchip’s push toward higher value content in power efficient, connected devices. If end market demand for edge and data center applications continues to recover, this kind of specialized analog and embedded offering could help support margin improvement as factory underutilization charges ease.

Yet beneath the improving guidance, Microchip’s sizable debt load and weak interest coverage are still issues investors should understand in more detail before...

Read the full narrative on Microchip Technology (it's free!)

Microchip Technology's narrative projects $6.6 billion revenue and $1.4 billion earnings by 2028. This requires 15.9% yearly revenue growth and about a $1.6 billion earnings increase from -$178.4 million today.

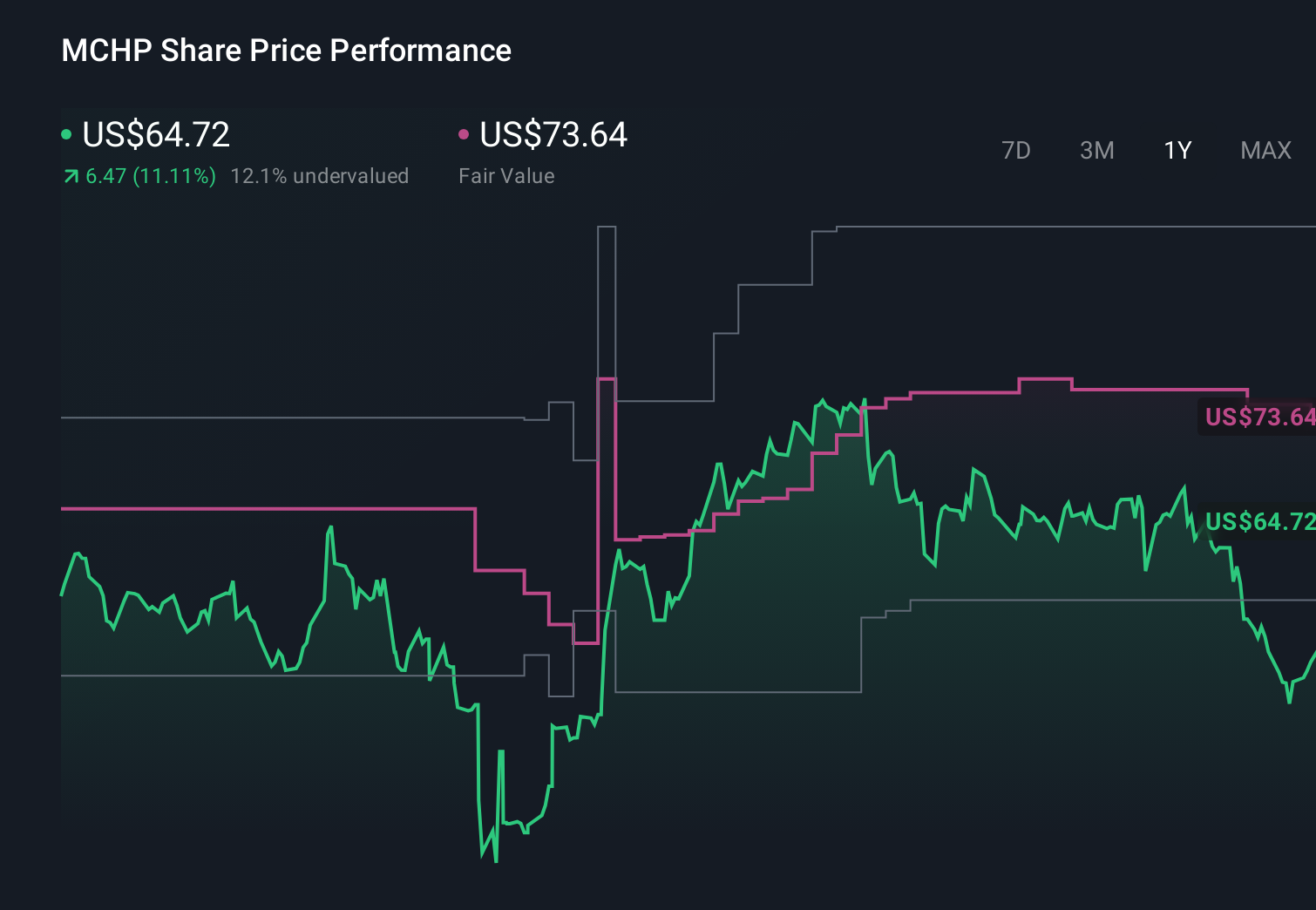

Uncover how Microchip Technology's forecasts yield a $73.92 fair value, a 14% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 6 fair value estimates for Microchip range from US$22.39 to US$90. With such a spread, it is worth weighing how Microchip’s high leverage and interest burden could affect future financial resilience and your own expectations for the business.

Explore 6 other fair value estimates on Microchip Technology - why the stock might be worth as much as 39% more than the current price!

Build Your Own Microchip Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microchip Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Microchip Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microchip Technology's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion