- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (MCHP): Assessing Valuation After Launch of Next-Gen Automotive Ethernet Solution

Microchip Technology (MCHP) just introduced its LAN866x family of 10BASE-T1S endpoint devices with Remote Control Protocol. The new products target automotive network designers who need simpler, more cost-effective architectures for modern vehicles.

See our latest analysis for Microchip Technology.

Microchip Technology’s latest product launch comes at a turning point for the company, as investors weigh both its promise in automotive innovation and its recent share price volatility. While the stock recently closed at $50.9 and scored a 3.84% gain over the past day, the 30-day share price return of -21.09% and a -21.97% total shareholder return over the last year show momentum is still on the back foot, despite upbeat news. Management’s upcoming presentations at major conferences may reveal how these new products could factor into a longer-term rebound.

If Microchip’s shift toward smarter, connected vehicles has you curious, you might want to check out other leaders in the auto technology space. See the full list in our See the full list for free..

But after significant share price declines and some signs of renewed growth, is Microchip Technology trading at a bargain before its next chapter unfolds? Or is the market already factoring in the company’s future prospects?

Most Popular Narrative: 31.8% Undervalued

Microchip Technology’s most followed narrative suggests its shares offer notable upside compared to the latest closing price. Here is what is driving analyst optimism, along with a fair value well above current levels.

Operational leverage is set to improve as inventory write-offs and factory underutilization charges decline. Management is targeting a return to 65% non-GAAP gross margins. As factory utilization ramps beginning in the December quarter and charges subside, incremental profits are expected to flow disproportionately to operating income and earnings.

Want to unravel the core assumptions powering this bullish outlook? The secret sauce behind the valuation pivots on a powerful profit transformation and sharper margins ahead. Hungry to discover how these projections stack up against sector rivals, and what could really move the needle? The full narrative is where the story clicks into focus.

Result: Fair Value of $74.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly high inventory levels or prolonged weakness in automotive demand could easily undermine the case for a sustained recovery in Microchip’s fundamentals.

Find out about the key risks to this Microchip Technology narrative.

Another View: Market Ratios Tell a Different Story

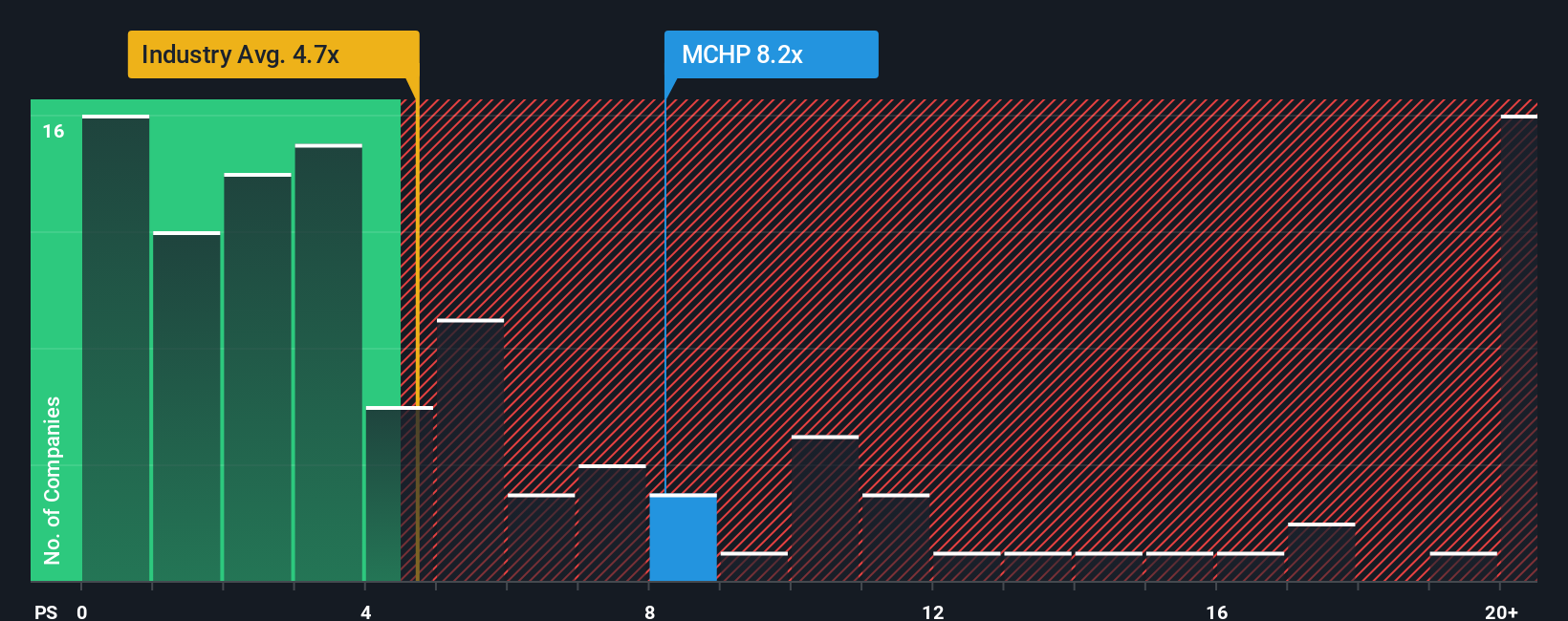

While the fair value estimate suggests Microchip Technology may be undervalued, a look at its price-to-sales ratio provides another perspective. The company’s 6.5x ratio is significantly higher than both the industry average of 4.2x and its own fair ratio of 8.4x. This could indicate that optimism is already reflected in the stock price. Are investors overlooking a potential risk, or does the premium reflect strong market confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microchip Technology Narrative

Prefer your own perspective or want to challenge the consensus? Building your unique Microchip Technology analysis takes just a few minutes. Do it your way.

A great starting point for your Microchip Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for smarter investment decisions by checking out high-potential opportunities outside of Microchip Technology. Miss out, and you could leave the best ideas on the table.

- Boost your income strategy by targeting steady returns with these 17 dividend stocks with yields > 3%, which offers yields above 3% and robust fundamentals.

- Ride the wave of innovation and follow these 25 AI penny stocks, known for breakthroughs in artificial intelligence and next-generation tech.

- Tap into the growth of digital finance with these 81 cryptocurrency and blockchain stocks, driving developments in blockchain and cryptocurrency solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web