- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Will Lam Research’s (LRCX) AI Focus Shift Its Competitive Edge in Semiconductor Equipment?

Reviewed by Sasha Jovanovic

- Earlier this month, Lam Research participated in Semicon West 2025 at the Phoenix Convention Center, with company executives presenting on key sector trends.

- This event highlighted Lam's expanding role in the advanced semiconductor equipment market, especially as demand for AI-centric chip technologies remains robust.

- We’ll explore how optimism in the semiconductor sector, driven by strong AI-related demand, could influence Lam Research’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Lam Research Investment Narrative Recap

To be comfortable as a Lam Research shareholder today, investors need confidence in the sustained demand for advanced semiconductor manufacturing tools, especially those tied to AI and next-generation architectures. Although optimism bolstered by sector-wide momentum was evident at Semicon West, the most important near-term catalyst remains secular AI demand, while the primary risk continues to be customer concentration and cyclicality in WFE investments, areas not immediately altered by recent events. Of recent announcements, Lam’s collaboration with JSR Corporation on advancing dry resist technology for EUV lithography stands out. This development is directly aligned with the growing push for advanced chip architectures, underlining Lam's efforts to capture value as AI-related end-markets evolve. Yet, despite tailwinds, investors should keep in mind the risk from potential shifts in major customer capital expenditures if...

Read the full narrative on Lam Research (it's free!)

Lam Research's outlook anticipates $23.6 billion in revenue and $6.7 billion in earnings by 2028. This requires an annual revenue growth rate of 8.5% and a $1.3 billion increase in earnings from the current $5.4 billion.

Uncover how Lam Research's forecasts yield a $120.82 fair value, a 15% downside to its current price.

Exploring Other Perspectives

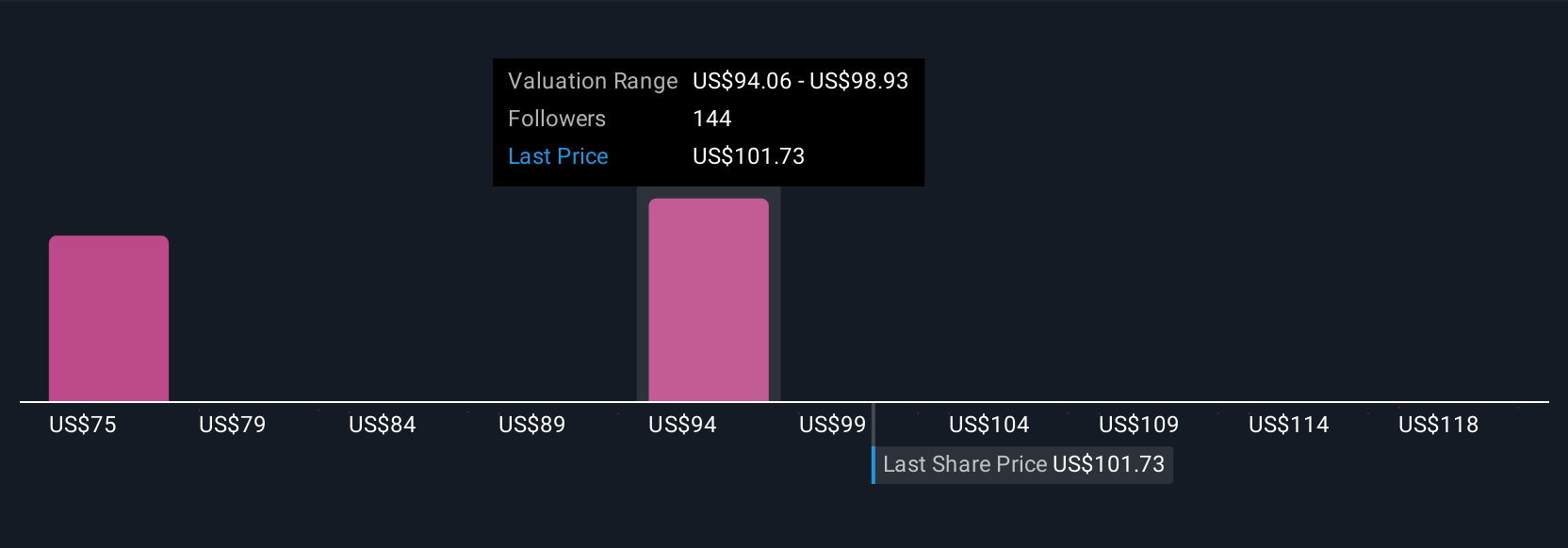

Nineteen private investors in the Simply Wall St Community currently see Lam’s fair value ranging widely from US$58.48 to US$135 per share. While views differ, many are watching how concentrated customer exposure might affect Lam if chip industry order cycles soften.

Explore 19 other fair value estimates on Lam Research - why the stock might be worth as much as $135.00!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives