- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (LRCX): Evaluating Valuation After Record Margins and Strong AI Semiconductor Demand Propel Latest Earnings Beat

Reviewed by Simply Wall St

Lam Research (LRCX) just posted quarterly results that topped Wall Street estimates, reporting record gross and operating margins. The company’s earnings growth has been driven by elevated demand for AI-focused semiconductor equipment.

See our latest analysis for Lam Research.

The momentum behind Lam Research’s stock has been remarkable, with a year-to-date share price return of 116.6% and a total shareholder return above 110% over the last twelve months, thanks to record-setting margins and rapid demand for AI-chip equipment. Strong quarterly results, upbeat forward guidance, and an active share buyback program have all contributed to renewed optimism, even as peers have flagged some sector caution, suggesting that growth potential is still very much in play for the longer term.

If the AI-led surge in semiconductors has you interested, it is the perfect moment to see which other innovators are making waves using our See the full list for free.

After such a strong run-up and a series of record results, are investors looking at a rare chance to buy into Lam Research before its next leg higher, or is the market already pricing in every bit of future growth?

Most Popular Narrative: 19.8% Overvalued

Despite Lam Research’s higher fair value estimate of $130.96, shares most recently closed at $156.90, placing the stock well above this consensus assessment. As valuations stretch, all eyes are on whether bullish expectations can keep pace with price momentum.

Rapidly rising AI workloads and the associated need for higher storage, bandwidth, and processing power are accelerating the adoption of advanced chip architectures (such as gate-all-around, 3D NAND, and advanced packaging). This increases demand for Lam's etch and deposition tools, supporting sustained revenue growth and robust order visibility. Expanding government incentives and a global push for semiconductor self-sufficiency (for example, US and EU CHIPS Acts) are spurring new fab construction and regional equipment investments. This directly contributes to higher system sales and broadens Lam's customer base, reducing revenue cyclicality and regional risk.

Want to see the projections fueling that premium price target? The narrative leans on ambitions for durable growth, margin expansion, and market transformation driven by skyrocketing AI hardware demand. Find out what makes this forecast stand out.

Result: Fair Value of $130.96 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions or sudden slowdowns in memory spending could quickly undermine Lam’s growth thesis and its valuation premium.

Find out about the key risks to this Lam Research narrative.

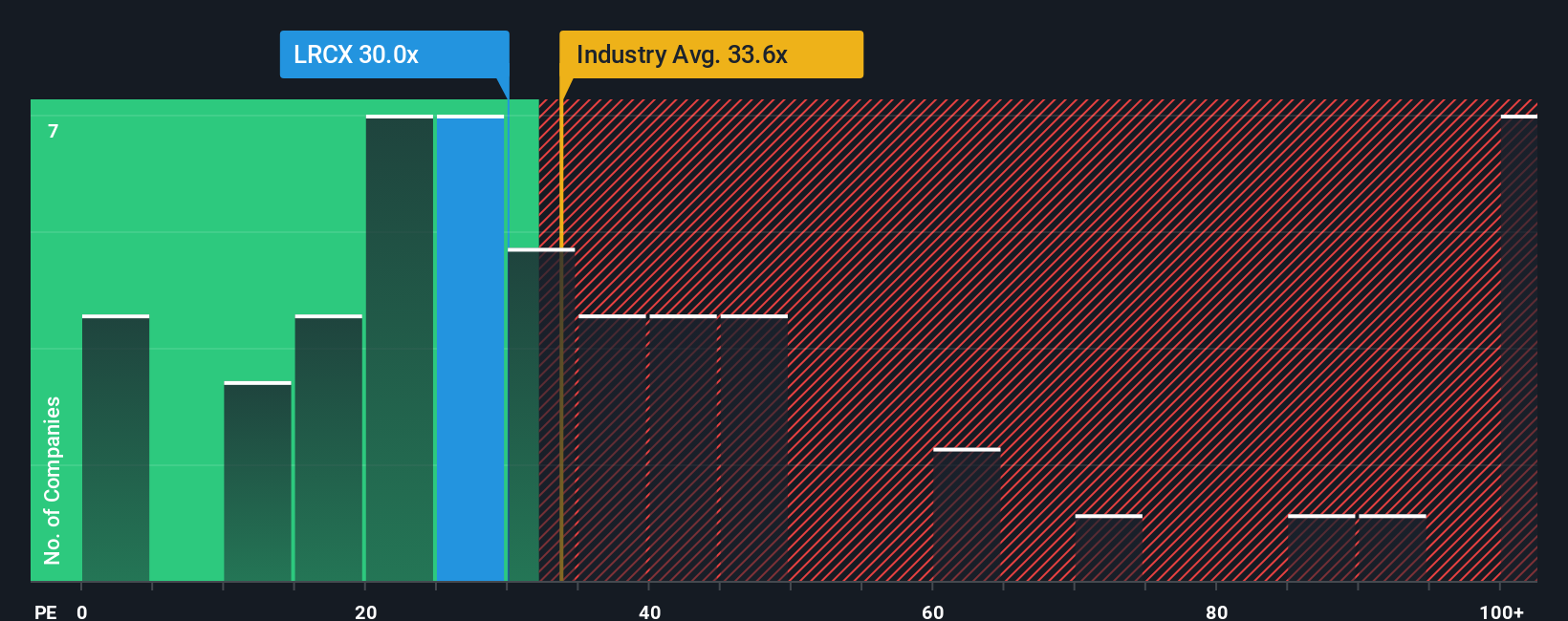

Another View: Multiples Comparison Paints a Different Picture

While one method suggests Lam Research is overvalued, its price-to-earnings ratio of 33.9x comes in lower than the U.S. Semiconductor industry average of 40.3x and peers' 41.2x. This means Lam actually trades at a relative discount versus rivals. However, with a fair ratio of 32.9x, it is only slightly above where the market could eventually settle. Does this relative value tip the scale, or is the margin of safety still too thin?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lam Research Narrative

If you would rather dig into the data yourself or have your own take on Lam Research’s outlook, you can craft a personalized view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lam Research.

Looking for More Investment Opportunities?

Unlock tomorrow’s winners before the crowd catches on. Use these tailored stock lists to target breakthrough growth, stability, and unique market trends that most investors overlook.

- Target strong, sustainable income streams by checking out these 19 dividend stocks with yields > 3%, featuring yields that help make your portfolio work harder for you.

- Boost your exposure to breakthrough innovations driving the future of healthcare with these 34 healthcare AI stocks and tap into sector-defining advancements early.

- Seize potential bargains by scanning for undervalued gems using these 870 undervalued stocks based on cash flows and position yourself ahead of the next market re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion