- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is Lam Research’s Surge Justified After Recent AI Partnerships and 104% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Lam Research is really worth its sky-high price right now? Let's break down whether this chip innovator's rally is built on real value or just hype.

- The stock has soared 104.7% year-to-date and an impressive 113.9% over the last 12 months. However, it dipped 7.0% just this past week, hinting at shifting risk and growth perceptions.

- Much of this move has been fueled by ongoing excitement around AI-driven semiconductor demand and recent headlines about Lam's expanding partnerships with leading chipmakers, which have kept investors paying close attention. News of global equipment orders, plus Lam's growing role in new fabrication plants, have supported optimism even as volatility creeps in.

- Currently, Lam Research scores 3 out of 6 on our undervaluation checks. This means the picture is mixed, depending on which lens you use. We will dive into the usual valuation methods next, and be sure to stick around for a smarter way to assess value that will be revealed at the end.

Approach 1: Lam Research Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates a company's true worth by projecting its future cash flows and discounting them back to today's dollars. This method focuses on Lam Research's ability to generate Free Cash Flow (FCF) over time and helps assess whether the current stock price reflects genuine value.

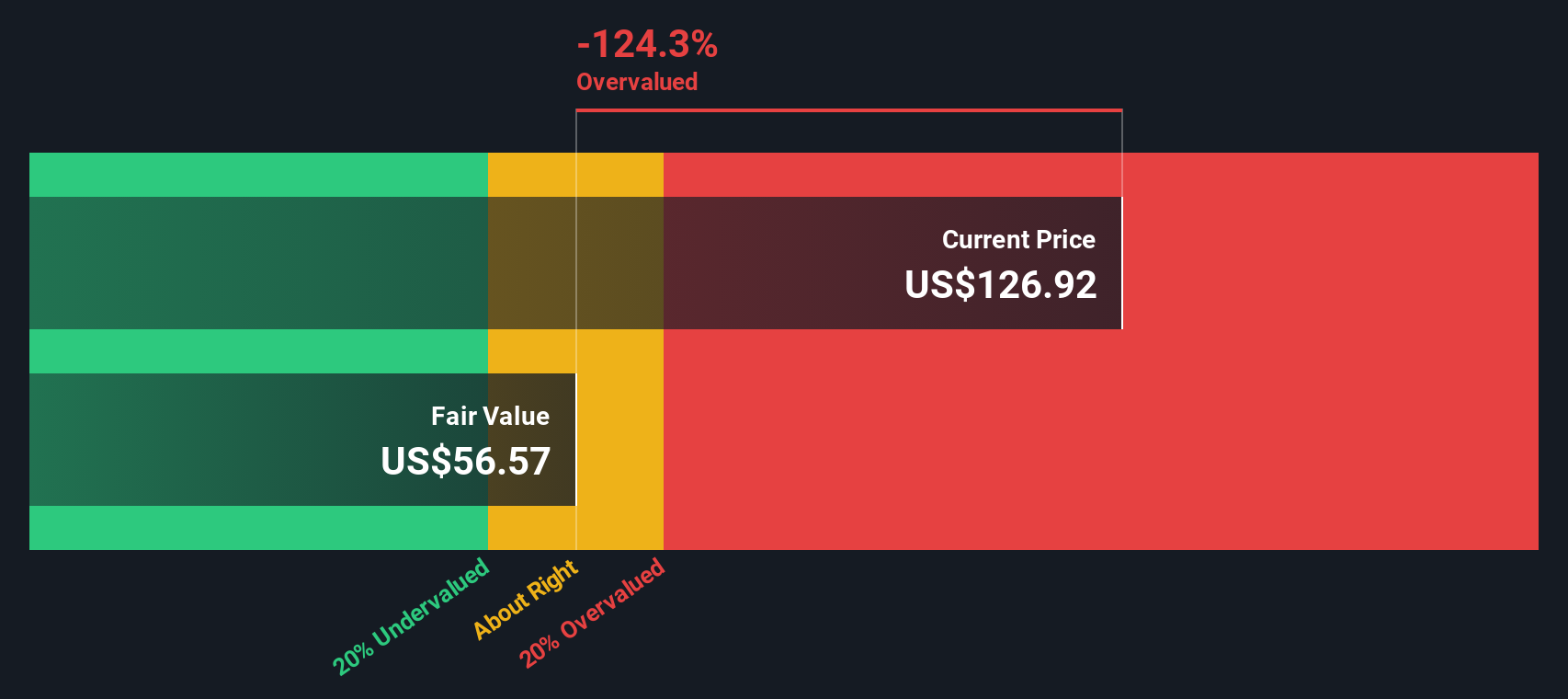

For Lam Research, current Free Cash Flow stands at $5.73 billion, with analysts projecting steady annual growth in the coming years. Looking forward, estimates peg FCF at $7.91 billion by 2030, drawing on both analyst consensus and further extrapolations. The model captures expectations for growth driven by industry demand and company execution, though it does assume that long-range forecasts hold true.

Based on these projections, the DCF analysis calculates an intrinsic value for Lam Research of $63.46 per share. Compared to its present share price, this implies the stock is 133.6% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lam Research may be overvalued by 133.6%. Discover 878 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lam Research Price vs Earnings

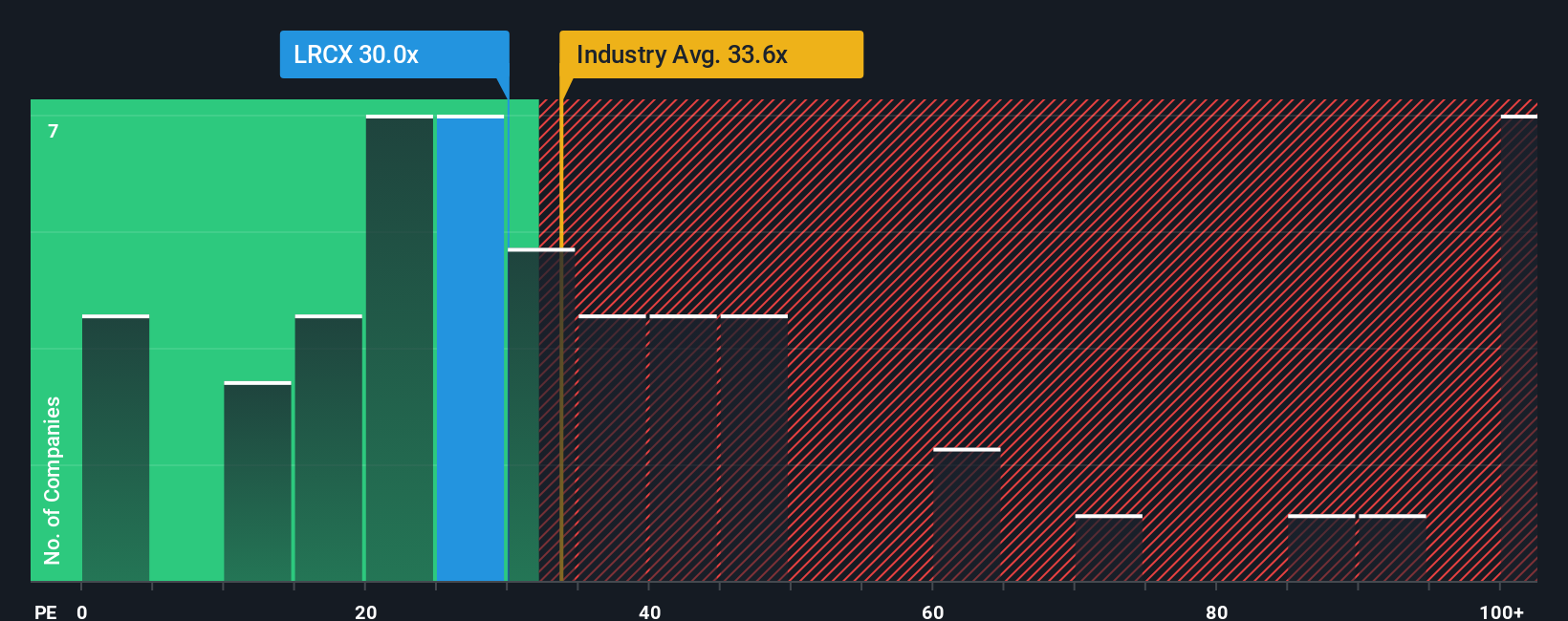

The Price-to-Earnings (PE) ratio is widely regarded as the standard valuation multiple for established, profitable companies like Lam Research. This metric compares a company's share price to its per-share earnings, which makes sense for investors aiming to gauge how much they are paying for each dollar of current profits.

However, there is no single “normal” PE ratio. High-growth companies or firms with lower risk profiles typically trade at higher multiples, as investors expect profits to expand and are willing to pay a premium for that future potential. On the other hand, riskier or stagnating companies often command lower PE ratios.

Currently, Lam Research trades at a 32.0x PE ratio. For context, the average semiconductor peer sits at 35.8x, and the broader industry average is 34.2x. This means Lam’s shares are slightly cheaper than both direct peers and the rest of the industry when using this profit multiple.

To refine this perspective, Simply Wall St uses a proprietary “Fair Ratio.” Unlike a standard peer or industry comparison, the Fair Ratio accounts for Lam’s specific earnings growth outlook, profit margins, market capitalization, and sector-specific risks. This approach provides a more tailored reflection of what investors might reasonably pay for the stock.

For Lam Research, the Fair Ratio is calculated at 34.0x, which is only slightly above the current PE. The minimal difference between the current and fair multiple suggests the stock is trading very close to its fundamentally justified valuation level.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lam Research Narrative

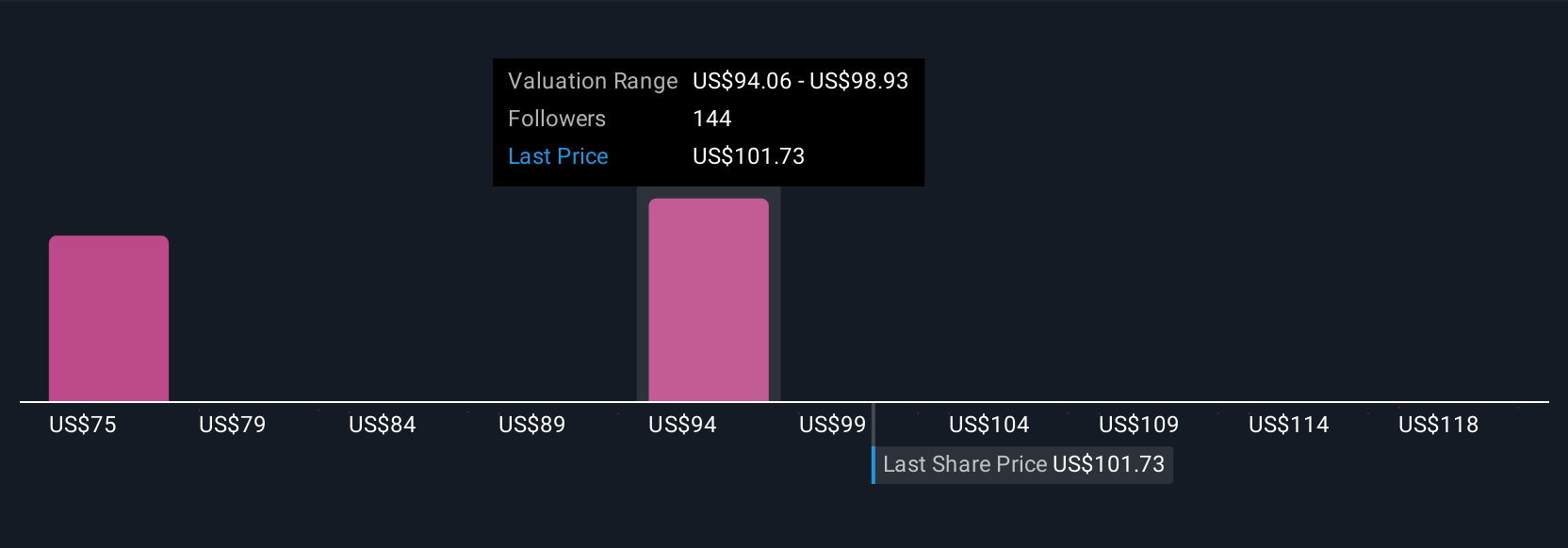

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about Lam Research, connecting what you believe about the business, such as future revenue, margins, and risk, with a clear financial forecast and a calculated fair value.

Instead of just focusing on static numbers, Narratives help you anchor your investment view to both current company data and your own expectations, making the process more personal and flexible. These Narratives are available to everyone, right within the Simply Wall St Community page, and they are used by millions of investors as an accessible, easy-to-use tool.

The real power of Narratives is that they allow you to compare your estimated Fair Value with the latest share price, making buy, hold, or sell decisions far more transparent. In addition, Narratives update automatically whenever new earnings results or breaking news comes in, so your story and numbers always reflect the freshest information.

For example, some investors see Lam Research’s fair value as high as $200 by forecasting sustained AI-driven revenue growth and margin expansion, while others, more cautious about competition and cyclicality, set their fair value at $80. This shows how Narratives capture a wide range of views and enable you to invest with conviction in your own story.

Do you think there's more to the story for Lam Research? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives