- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

How Analyst Upgrades and Surging Revenue Projections at Lam Research (LRCX) Have Changed Its Investment Story

Reviewed by Simply Wall St

- Lam Research reported quarterly earnings this past Wednesday, with analysts' expectations pointing to revenue of US$5.01 billion, reflecting a 29.3% year-on-year increase, notably stronger than last year's growth.

- Analyst optimism about Lam Research has been connected to rising demand for wafer fabrication equipment, driven by major technology customers and global semiconductor expansion.

- We'll examine how analyst confidence, bolstered by anticipated revenue growth and strong industry demand, could influence Lam Research's investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lam Research Investment Narrative Recap

Owning Lam Research means believing in the continued expansion of global semiconductor manufacturing and elevated demand for advanced wafer fabrication equipment. The recent earnings news, with revenue growth in line with analyst expectations, reinforces optimism around industry trends but does not materially alter the short-term catalyst: the company's ability to capture rising equipment demand from large technology firms. The biggest risk remains exposure to shifts in international trade policies and restrictions affecting sales to China, a key customer base.

Among Lam Research’s recent announcements, the unveiling of its Akara® conductor etch tool stands out. This innovation is relevant for investors watching the rapid technology shifts driving increased deposition and etch requirements, a central revenue catalyst as chip complexity grows and customers seek productivity enhancements. Meanwhile, a more competitive product lineup could help offset risk factors stemming from regional demand swings.

However, investors should be aware that while momentum supports industry growth, possible restrictions on shipments to Chinese memory customers...

Read the full narrative on Lam Research (it's free!)

Lam Research's narrative projects $21.9 billion revenue and $6.2 billion earnings by 2028. This requires 8.5% yearly revenue growth and a $1.5 billion earnings increase from $4.7 billion today.

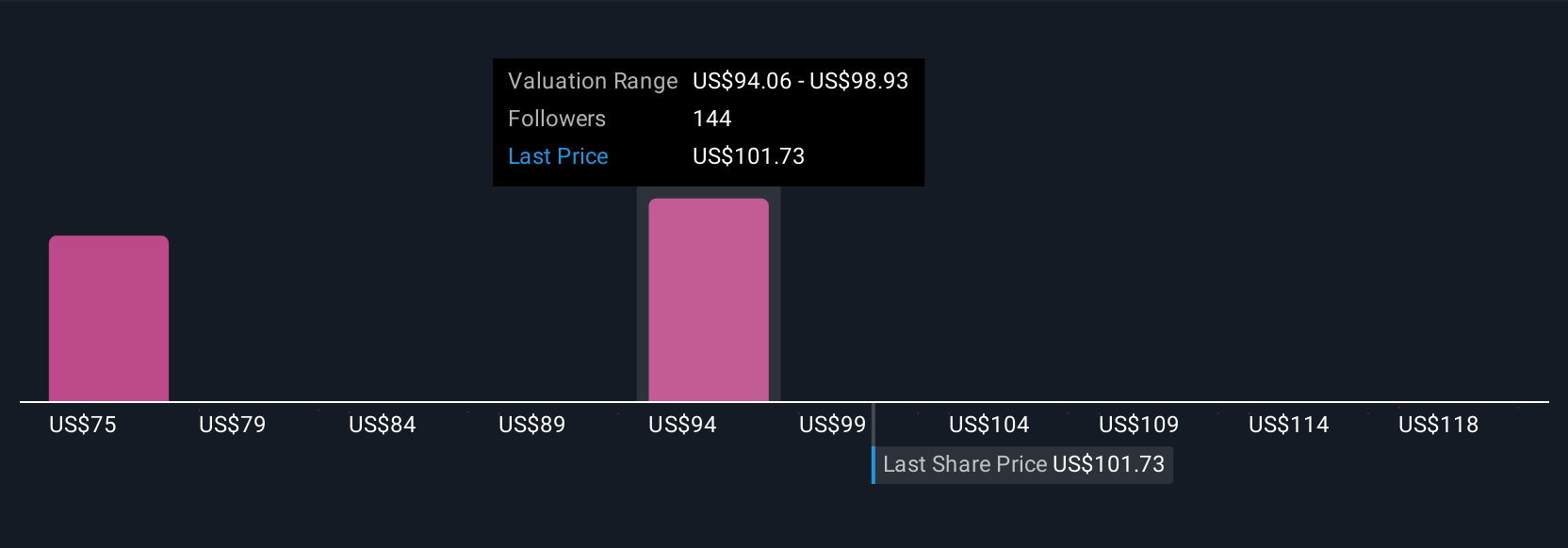

Uncover how Lam Research's forecasts yield a $98.72 fair value, in line with its current price.

Exploring Other Perspectives

Ten Simply Wall St Community members estimated Lam Research’s fair value between US$74 and US$125 per share. Their diverse outlooks highlight the importance of the company’s exposure to Chinese end markets, which can move expectations sharply. Explore these viewpoints to understand how risks and catalysts can drive a wide range of outcomes.

Explore 10 other fair value estimates on Lam Research - why the stock might be worth 25% less than the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives