- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Assessing Lam Research Stock After a 109% Year-to-Date Surge and Supply Chain Improvements

Reviewed by Bailey Pemberton

If you’re debating what to do with Lam Research stock, you’re far from alone. With the price up a staggering 109.4% year to date and notching nearly 18.2% gains in just the last month, this chip equipment giant has been turning heads on Wall Street and Main Street alike. Even over the last three years, shares have delivered a 286.7% return, underscoring both resilience and growth potential for patient investors. So what’s fueling this momentum?

Recently, industry chatter has zeroed in on the supply chain’s gradual normalization and increased demand for advanced chip manufacturing gear. Both are clear tailwinds for Lam’s outlook. News of strategic wins with next-gen chipmakers and heightened investment in semiconductor infrastructure has played a part in lifting sentiment, offering investors hope that Lam’s best days could still be ahead. These shifts have contributed to changing risk perceptions, which is reflected in the stock’s impressive price surge.

But before you get carried away by the headline numbers, let’s zoom out for a reality check. Based on mechanical valuation metrics, Lam Research earns a value score of 2 out of 6. That means it’s only undervalued on 2 of the 6 main checks investors use to gauge a bargain. That’s a good reason to dig deeper. Let’s unpack what makes a company truly undervalued by walking through the main approaches investors rely on, before we get to a more nuanced way of thinking about valuation at the end of this article.

Lam Research scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lam Research Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular way to estimate a company's intrinsic value by forecasting its future cash flows and then discounting them back to today's terms. In essence, it takes an informed guess at how much money Lam Research is likely to generate over time, then assesses what those future dollars are worth right now.

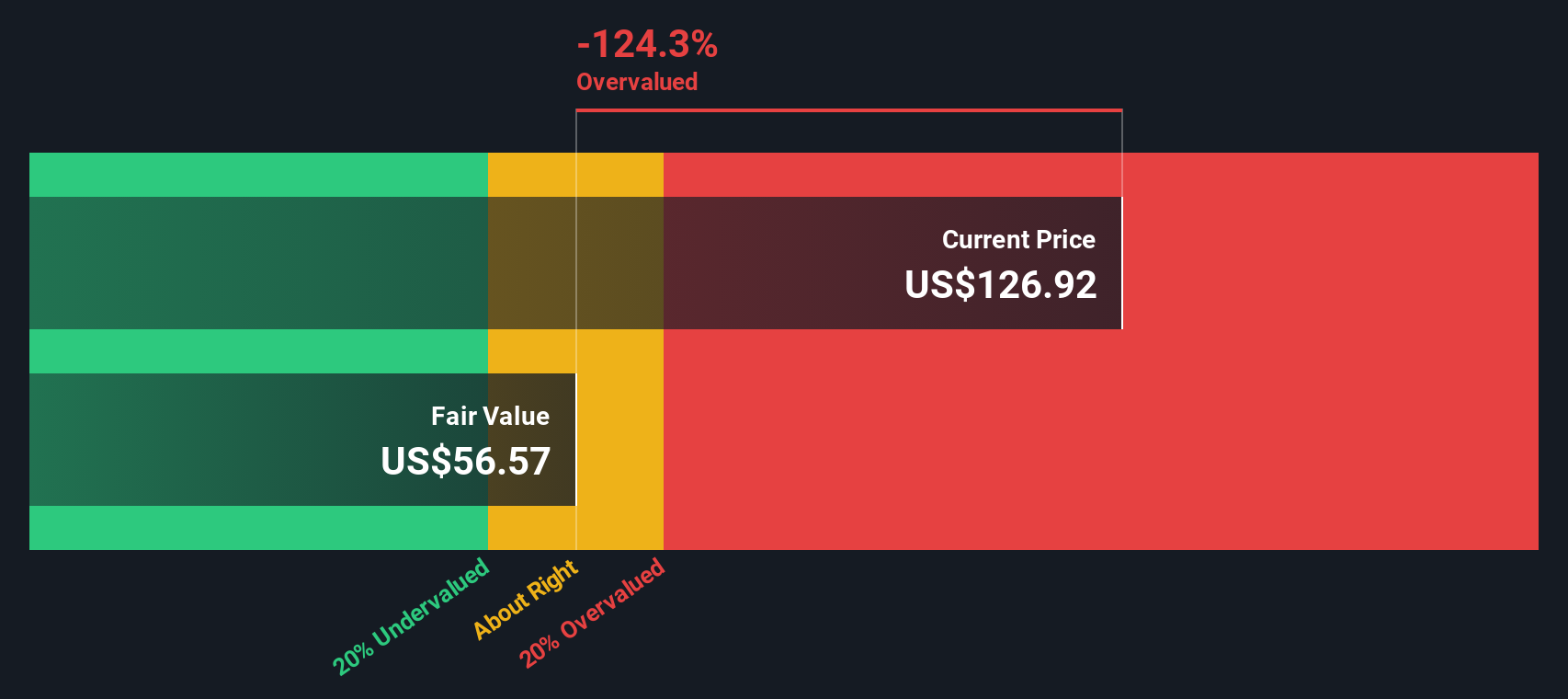

Currently, Lam Research generates Free Cash Flow (FCF) of about $5.73 billion. Analysts project this will grow steadily over the next decade, with FCF reaching roughly $7.91 billion by 2030. It is important to note that the first five years of forecasts are based on analyst estimates, while Simply Wall St extrapolates further projections for a total ten-year outlook. All of these cash flows are in US dollars.

Using these cash flow projections and the 2 Stage Free Cash Flow to Equity model, the DCF analysis results in an intrinsic fair value of $65.90 per share. This represents a significant discount of 130.2% when compared to Lam Research's current market price, suggesting that the stock is trading far above its calculated worth based on future cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lam Research may be overvalued by 130.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lam Research Price vs Earnings

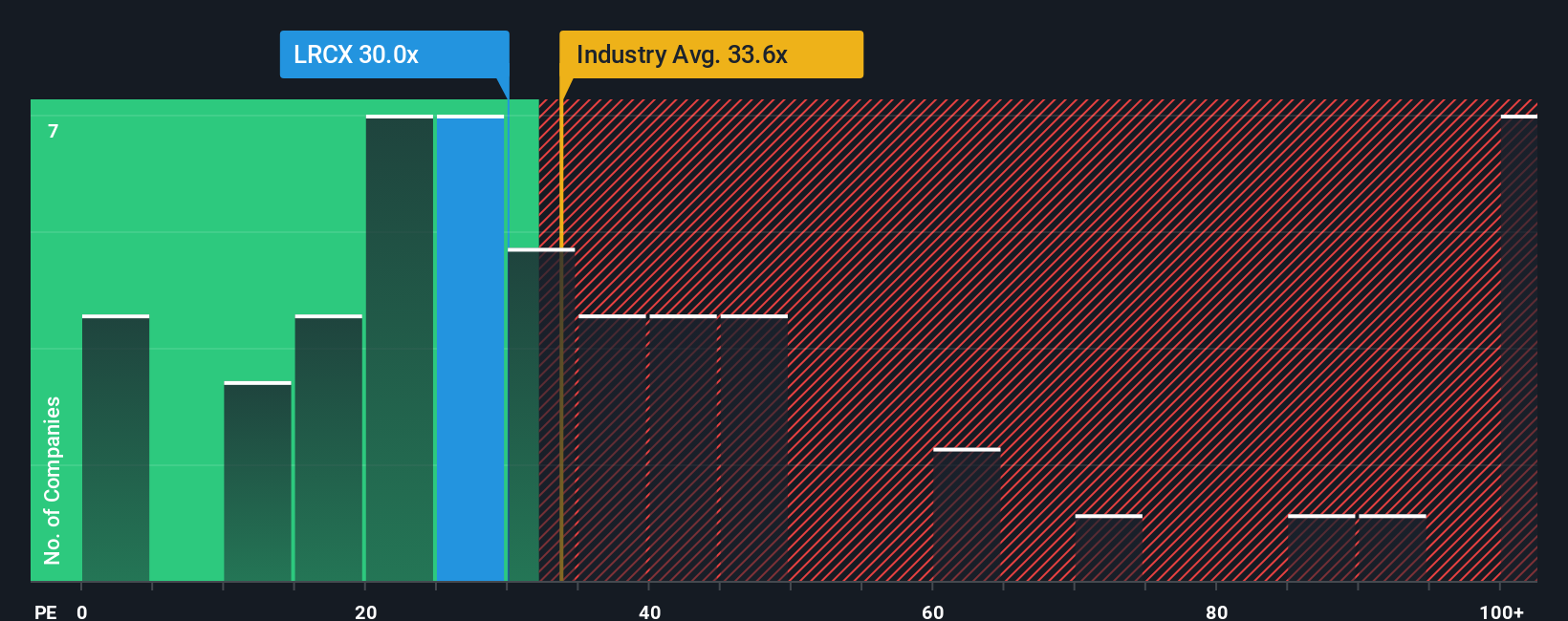

The Price-to-Earnings (PE) ratio is a time-tested tool when assessing profitable companies like Lam Research, as it expresses how much investors are willing to pay today for one dollar of current earnings. This metric is particularly relevant for established, consistently profitable businesses, helping investors compare valuations across peers and the broader industry.

It is important to remember that a “fair” PE ratio is shaped by several factors. High growth expectations and lower perceived risks can justify a higher PE, while limited growth or elevated risks should command a discount. In essence, the multiple reflects not just current performance, but also the market’s outlook for future growth and stability.

Currently, Lam Research trades at a PE ratio of 32.87x. For context, the semiconductor industry average sits at 39.53x and close competitors average 40.22x. While those numbers provide a quick yardstick, they do not tell the whole story about what is fair given Lam’s specific profile.

Simply Wall St’s proprietary “Fair Ratio” digs deeper by blending factors such as the company’s growth prospects, industry dynamics, profit margins, market capitalization, and risk profile. This holistic view offers a more nuanced benchmark than relying solely on peers or sector norms. For Lam, the Fair Ratio is calculated at 32.65x, which is almost identical to its actual PE multiple.

Given this close alignment, Lam Research appears to be trading at just about fair value based on earnings fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

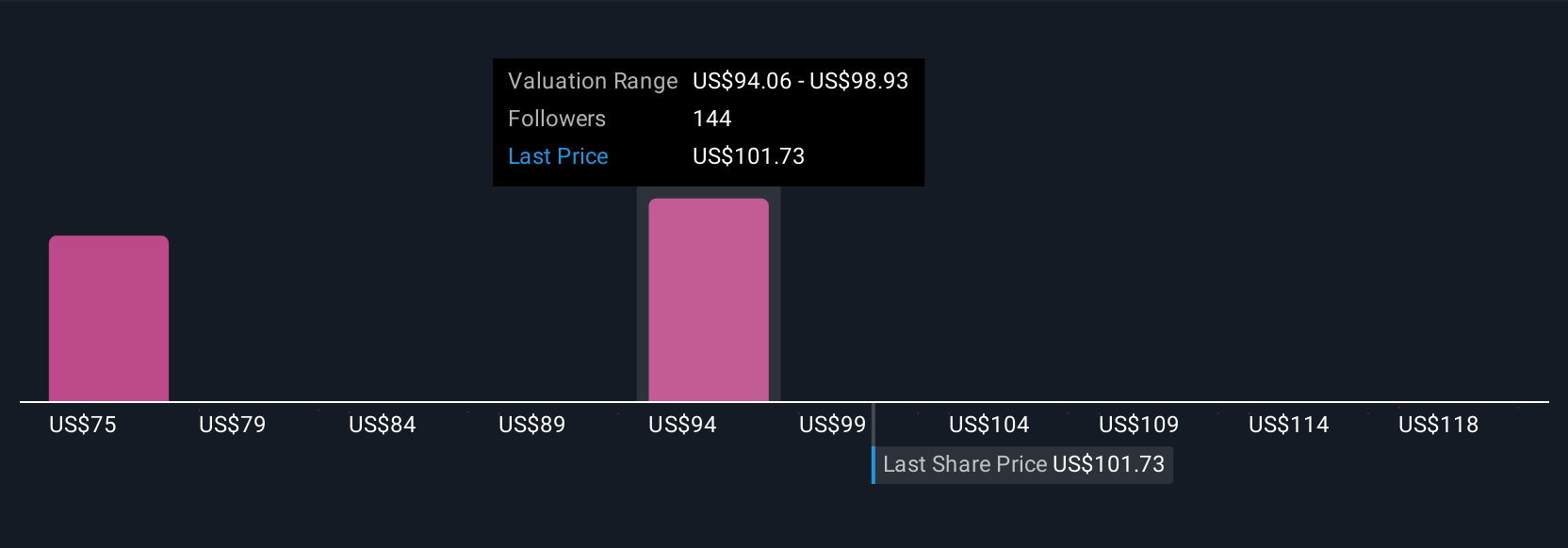

Upgrade Your Decision Making: Choose your Lam Research Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story—your perspective on a company’s future—tied directly to the numbers you believe will play out, such as Lam Research’s potential revenues, margins, or growth rates. Instead of relying solely on mechanical metrics, Narratives allow you to connect Lam’s business drivers and risks to your own financial forecasts, then see the fair value those beliefs generate. This makes investing more personal and dynamic, as Narratives can be easily created or explored by anyone on Simply Wall St’s Community page, used by millions of investors just like you. Narratives clarify when to buy or sell by showing if your fair value is above or below the current price, and they automatically update when new information such as earnings or news arrives. For Lam Research, you might find bullish investors forecasting future earnings near the high end of analyst estimates and arriving at a fair value above $135, while more cautious users expect lower margins or sales, resulting in valuations close to $80. The key is that both perspectives are grounded in transparent, numbers-driven reasoning.

Do you think there's more to the story for Lam Research? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives