- United States

- /

- Semiconductors

- /

- NasdaqCM:LAES

Will SEALSQ’s (LAES) Post-Quantum Expansion Redefine Its Competitive Edge in Secure Hardware?

Reviewed by Sasha Jovanovic

- SEALSQ Corp unveiled an integrated strategy following its acquisition of IC’Alps, outlining a multi-phase roadmap for post-quantum secure hardware, partnerships across defense, finance, energy, and a significant capital raise to accelerate commercialization in the U.S. market.

- This marks a pivotal move as SEALSQ positions itself as the only provider capable of delivering secure hardware solutions for quantum-resistant applications across catalog, custom, and IP-based integrated circuits, all backed by recent industry collaborations and expansion into next-generation satellite and blockchain technologies.

- We’ll explore how SEALSQ’s unique end-to-end post-quantum security offering, underscored by its IC’Alps integration, influences its investment case.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is SEALSQ's Investment Narrative?

If you’re considering SEALSQ, the investment case really hinges on belief in the explosion of demand for quantum-secure chips and the firm’s ability to turn its ambitious roadmap into real commercial traction. SEALSQ’s acquisition of IC’Alps is huge, it positions the company as an end-to-end provider of post-quantum hardware at just the time major sectors like defense, finance, and energy are seeking next-generation security. The latest announcements, especially the integration strategy and new U.S. capital, could accelerate near-term catalysts such as rapid product launches, key partnerships, and growth in U.S. market share, which previously rested mostly on future potential. However, the core risks remain unresolved: SEALSQ is unprofitable, has had shareholder dilution, a volatile share price, and a very new board. The capital raise addresses funding but heightens concerns around dilution and price swings. In sum, the news could move near-term milestones but doesn’t erase existing risks around execution, profitability, and dilution.

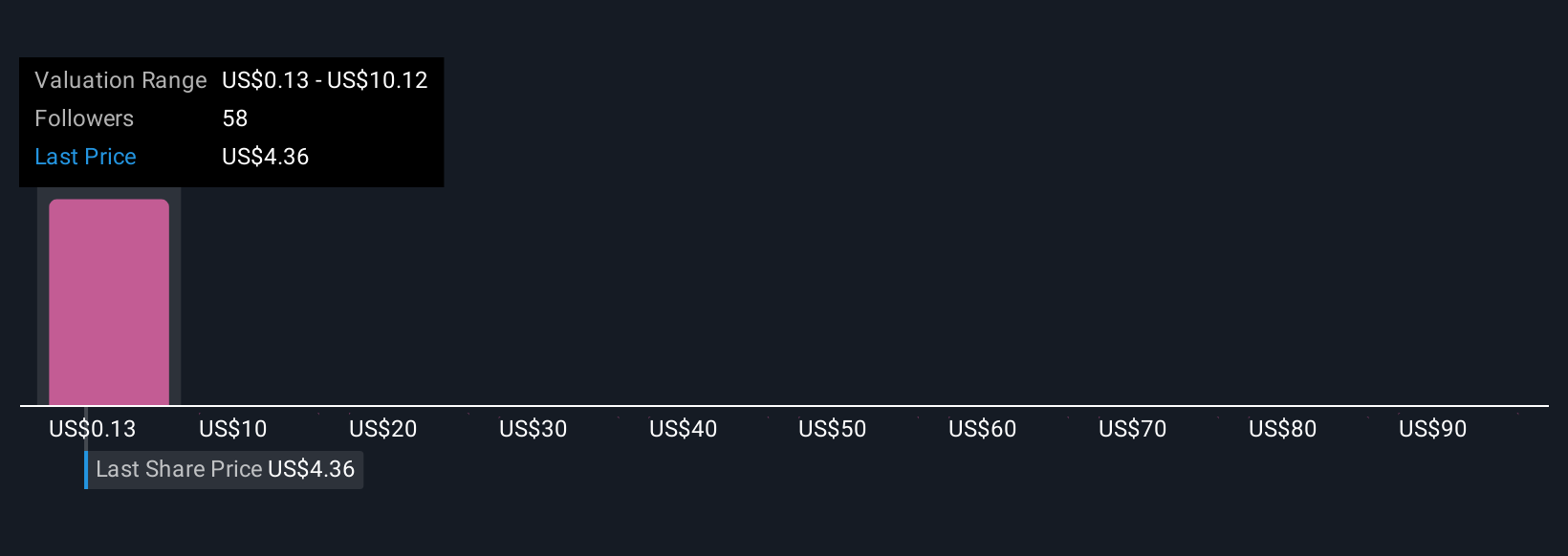

But against this, investors should carefully weigh the potential effects of dilution. Insights from our recent valuation report point to the potential overvaluation of SEALSQ shares in the market.Exploring Other Perspectives

Explore 24 other fair value estimates on SEALSQ - why the stock might be a potential multi-bagger!

Build Your Own SEALSQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEALSQ research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SEALSQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEALSQ's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LAES

SEALSQ

Designs, develops, and markets semiconductors in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives