- United States

- /

- Semiconductors

- /

- NasdaqGS:LAES

What You Can Learn From SEALSQ Corp's (NASDAQ:LAES) P/S After Its 26% Share Price Crash

SEALSQ Corp (NASDAQ:LAES) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 494%.

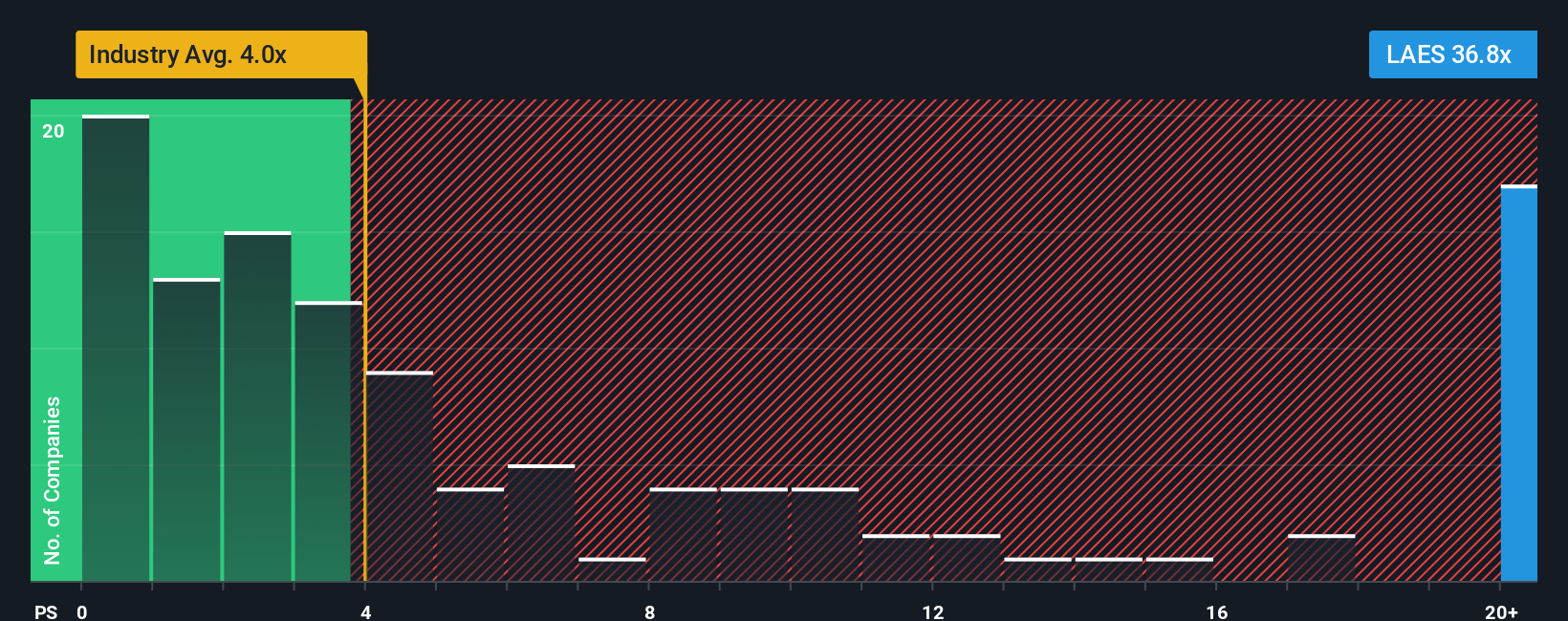

Although its price has dipped substantially, SEALSQ's price-to-sales (or "P/S") ratio of 36.8x might still make it look like a strong sell right now compared to other companies in the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 4x and even P/S below 1.9x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SEALSQ

What Does SEALSQ's P/S Mean For Shareholders?

SEALSQ could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think SEALSQ's future stacks up against the industry? In that case, our free report is a great place to start.How Is SEALSQ's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as SEALSQ's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 68% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

With this information, we can see why SEALSQ is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

SEALSQ's shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of SEALSQ's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You need to take note of risks, for example - SEALSQ has 3 warning signs (and 2 which are concerning) we think you should know about.

If you're unsure about the strength of SEALSQ's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LAES

SEALSQ

Designs, develops, and markets semiconductors in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.