- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

We Take A Look At Why KLA Corporation's (NASDAQ:KLAC) CEO Compensation Is Well Earned

The performance at KLA Corporation (NASDAQ:KLAC) has been quite strong recently and CEO Rick Wallace has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 02 November 2022. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Our analysis indicates that KLAC is potentially undervalued!

How Does Total Compensation For Rick Wallace Compare With Other Companies In The Industry?

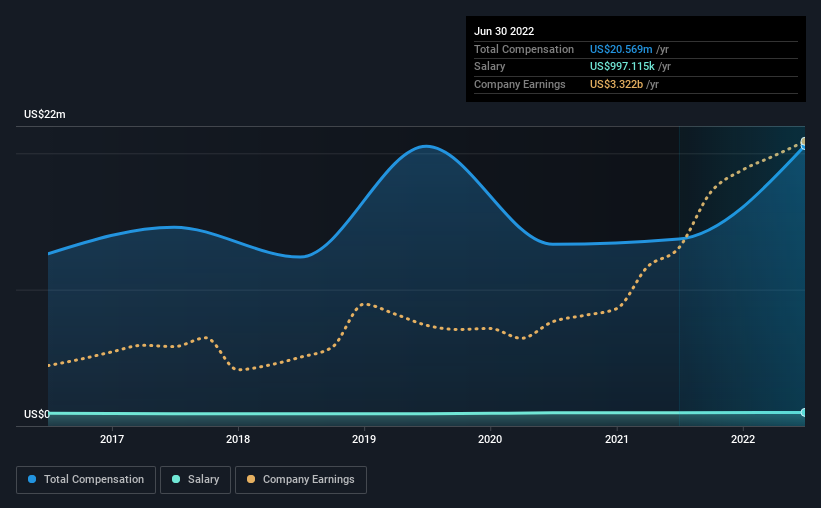

According to our data, KLA Corporation has a market capitalization of US$43b, and paid its CEO total annual compensation worth US$21m over the year to June 2022. We note that's an increase of 50% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$997k.

In comparison with other companies in the industry with market capitalizations over US$8.0b, the reported median total CEO compensation was US$19m. So it looks like KLA compensates Rick Wallace in line with the median for the industry. Moreover, Rick Wallace also holds US$16m worth of KLA stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$997k | US$975k | 5% |

| Other | US$20m | US$13m | 95% |

| Total Compensation | US$21m | US$14m | 100% |

Talking in terms of the industry, salary represented approximately 12% of total compensation out of all the companies we analyzed, while other remuneration made up 88% of the pie. A high-salary is usually a no-brainer when it comes to attracting the best executives, but KLA paid Rick Wallace a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

KLA Corporation's Growth

KLA Corporation's earnings per share (EPS) grew 46% per year over the last three years. It achieved revenue growth of 33% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has KLA Corporation Been A Good Investment?

We think that the total shareholder return of 85%, over three years, would leave most KLA Corporation shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

KLA prefers rewarding its CEO through non-salary benefits. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for KLA you should be aware of, and 1 of them is a bit concerning.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade KLA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KLAC

KLA

Engages in the design, manufacture, and marketing of process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives