- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

KLA (KLAC) Sees 10% Share Price Rise Over Past Week

Reviewed by Simply Wall St

KLA (KLAC) experienced a 10% rise in its share price over the past week, a significant move that reflects the company's alignment with broader market trends. During this period, major U.S. stock indexes, including the Dow Jones and Nasdaq, reached record highs, buoyed by expected interest rate cuts from the Federal Reserve. This market positivity, along with favorable inflation data, likely contributed to KLA's stock performance. Concurrently, KLA's advancements in technology and innovation, although not mentioned in recent news, would complement market movements by attracting investor interest. Overall, the company's share price rise aligns with the optimistic market sentiment and broader tech sector gains.

Buy, Hold or Sell KLA? View our complete analysis and fair value estimate and you decide.

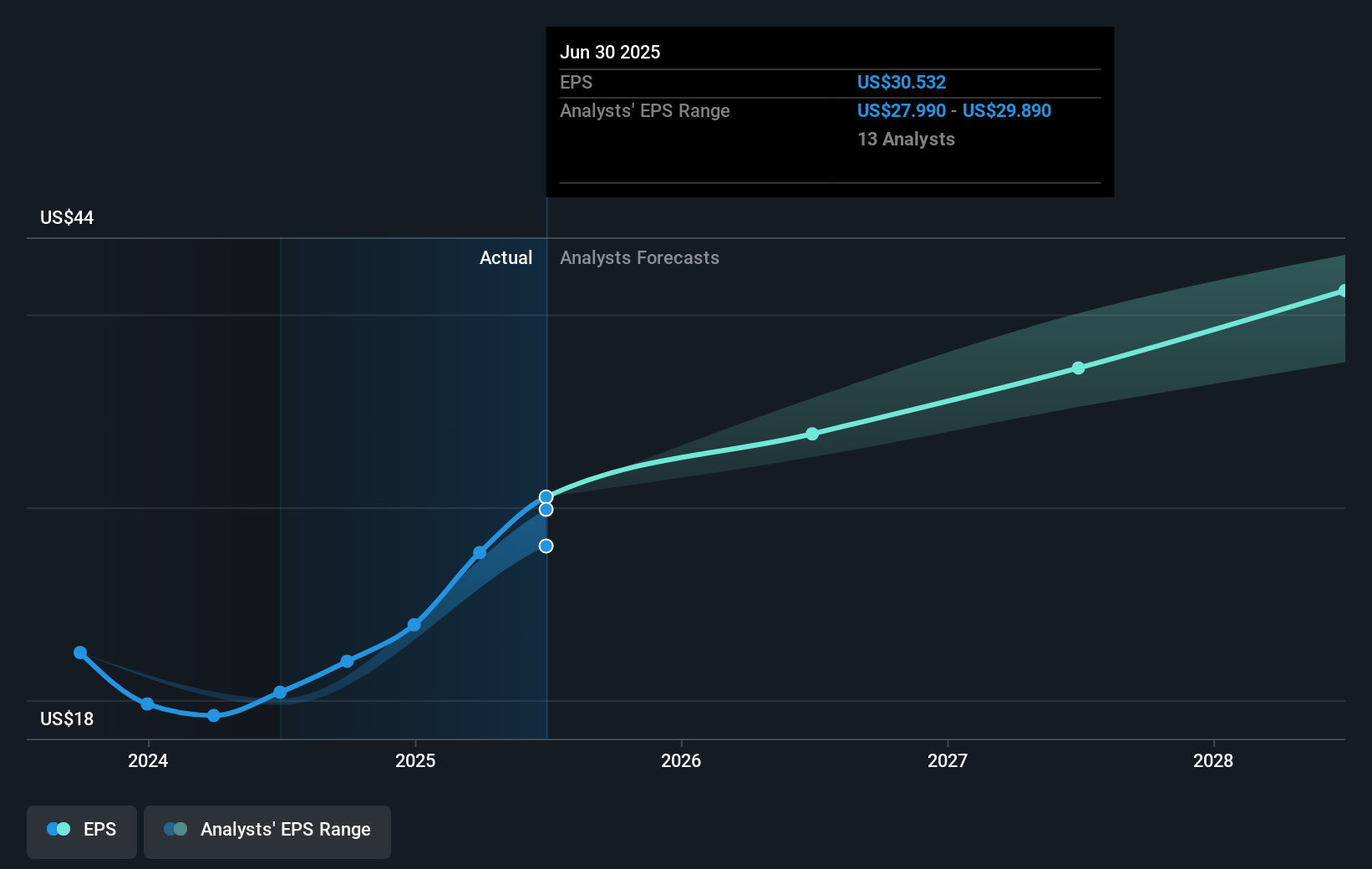

The recent uptick in KLA's share price, driven by anticipated interest rate cuts and positive market conditions, aligns well with their narrative of leveraging AI and advanced packaging for future growth. This short-term optimism echoes KLA’s broader strategic focus, potentially bolstering confidence in their innovation-driven revenue drivers. However, tariff exposures and fluctuating demand still present risks that might impact the forecasted revenue growth of 6.9%, profit margins, and earnings target of US$5.3 billion by 2028. Concurrently, KLA's technological advancements solidify their market position, making these predictions credible, barring significant economic disruptions.

KLA shares have seen a remarkable increase over the past five years, delivering a total return, inclusive of dividends, of 445.56%. This strong performance reflects the company's ability to harness industry trends, positioning it significantly above the US market's return of 19.1% over the past year. Yet, KLA underperformed the US Semiconductor industry, which saw a 45.1% return in the same one-year period. This disparity emphasizes both strengths in long-term returns and the competitive challenges within the semiconductor sector.

Moreover, KLA's current share price of $932.63 slightly exceeds the consensus analyst price target of $929.68, indicating a minimal discount. This minimal variance suggests that the stock is presently viewed as fairly valued relative to analyst expectations. The market's immediate response to the anticipated economic conditions and KLA’s strategic initiatives underscores a positive short-term outlook yet demands careful scrutiny of external risks to sustain projected growth. Investors should monitor how these factors might alter long-term revenue or earnings estimates and assess the company’s capacity to navigate potential headwinds efficiently.

Understand KLA's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives