- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

KLA (KLAC): Assessing Valuation After a Powerful Multi‑Year Rally and Recent Share Price Cooling

Reviewed by Simply Wall St

KLA (KLAC) has been on a strong multi year run, and its recent share performance keeps it firmly on the radar for semiconductor investors looking for durable earnings power and cash generation.

See our latest analysis for KLA.

At around $1,208 per share, KLA has cooled slightly in the last month, but its roughly 90 percent year to date share price return and near 400 percent five year total shareholder return show powerful, still intact momentum.

If KLA’s run has you thinking about where the next big compounding story might come from, it is worth scanning other high growth tech and chip names through high growth tech and AI stocks.

With shares hovering near record highs and trading at a premium to many peers, the key question now is whether KLA’s valuation still leaves upside for patient investors or if the market is already discounting years of future growth.

Most Popular Narrative Narrative: 6.2% Undervalued

Compared with KLA’s last close at $1,208.08, the most widely followed narrative points to a modestly higher fair value anchored in multi year demand tailwinds.

The advanced packaging market is experiencing early stage, secular growth fueled by adoption of 2.5D/3D architectures and HBM, driving KLA's advanced packaging revenue target for 2025 up nearly 80% year over year with expectations that this trend is "closer to the beginning than the end"; this directly expands KLA's addressable market and should provide multi year upside to revenue.

Curious what kind of revenue runway and margin profile could justify paying up here, even after a massive rally? Want to see the full playbook behind that fair value call and how future earnings power is modeled? The detailed narrative lays out the growth cadence, profitability shift, and valuation multiple that have to fall into place for this price to make sense.

Result: Fair Value of $1,287.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper than expected pullback in China demand or escalating tariffs could pressure KLA’s margins and derail the current fair value upside case.

Find out about the key risks to this KLA narrative.

Another View: Cash Flows Point to a Richer Valuation

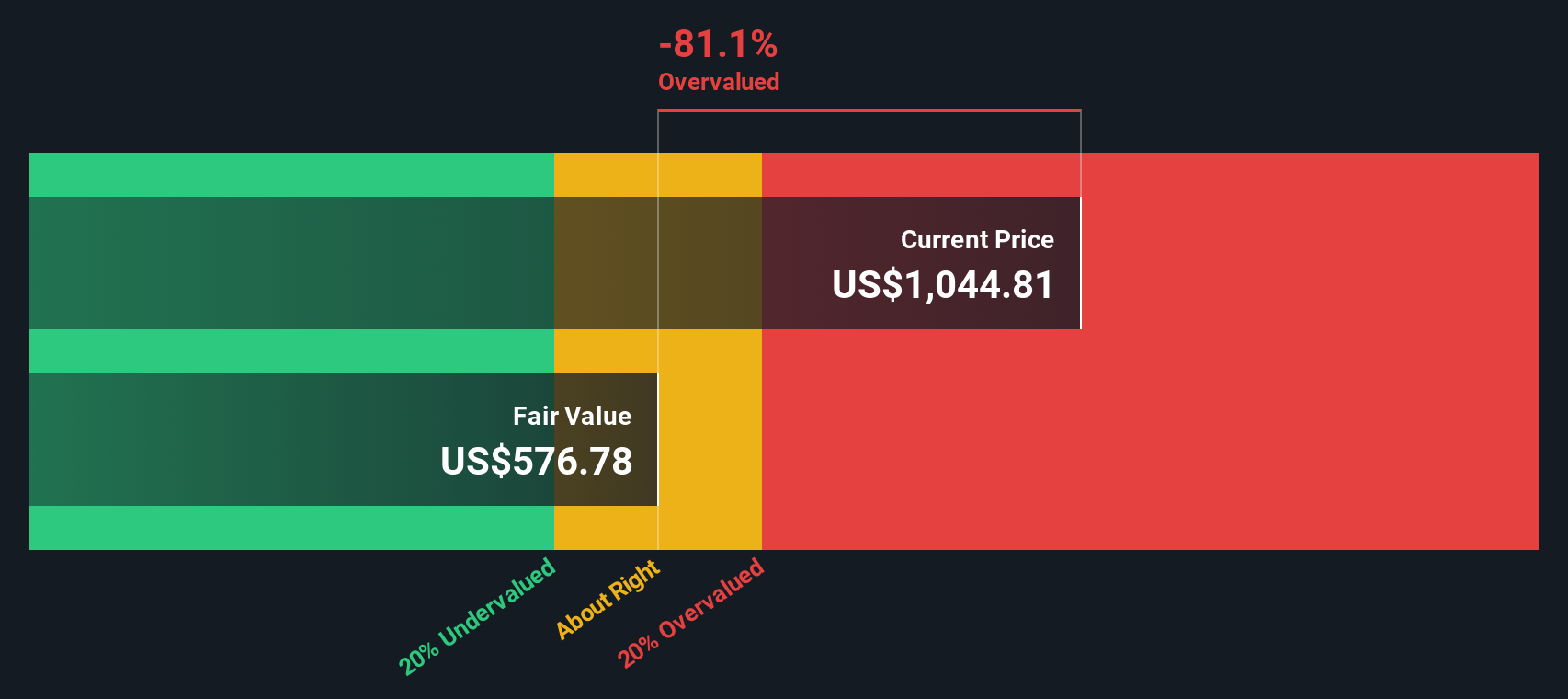

While the narrative based on future earnings suggests KLA is about 6 percent undervalued, our DCF model paints a different picture, with fair value closer to $653 per share. This implies the stock is trading well above intrinsic value and leaves far less margin for error.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KLA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KLA Narrative

If you are skeptical of these assumptions or simply prefer to dive into the numbers yourself, you can craft a personalized narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Looking for more investment ideas you do not want to miss?

Do not stop with KLA when you can quickly scan fresh opportunities across the market using powerful, pre built Simply Wall Street screeners tuned to different strategies.

- Capitalize on small company momentum by reviewing these 3572 penny stocks with strong financials. These pair tiny share prices with surprisingly resilient fundamentals and room to run.

- Position ahead of the next tech wave by targeting these 26 AI penny stocks. These combine AI exposure with compelling growth characteristics and differentiated business models.

- Explore potential bargains by focusing on these 912 undervalued stocks based on cash flows, where current prices are compared with projected cash flows to help identify a wider margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026