- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Is KLA’s Rally Sustainable After 73% Jump and Positive Earnings Outlook?

Reviewed by Bailey Pemberton

If you have been eyeing KLA and wondering whether now is the right time to make a move, you are definitely not alone. The stock’s recent trajectory has grabbed the attention of many investors, especially with an impressive 21.7% jump over the past month and a soaring 73.0% gain year-to-date. For anyone tracking growth potential or simply curious about changes in risk sentiment, these figures speak volumes. The effects of broader semiconductor industry optimism and investor confidence in chip equipment makers like KLA have clearly been at play, fueling the kind of momentum that can quickly catch on.

Of course, watching a stock climb nearly 280% over three years and over 440% in the last five tends to inspire a closer look at what’s driving those gains and whether they are set to last. With a recent close at $1,101.55, the big question isn’t just whether KLA can keep rising, but whether it is still attractively valued after such a remarkable run. Based on a straightforward evaluation, KLA scores a 2 out of 6 on the value score, meaning it’s considered undervalued in two out of six industry-standard checks. Not exactly a slam dunk, but not a red flag either.

In the next section, we’ll break down KLA’s valuation using established approaches like price-to-earnings and price-to-book ratios, and explore what they actually tell us in today's market. But don’t worry, there is an even sharper way to get the full picture, and we will get to that by the end of the article.

KLA scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KLA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For KLA, the DCF model begins with the company’s latest twelve months Free Cash Flow (FCF), which stands at $3.72 billion. Analysts provide estimates up to five years out, predicting steady growth. By 2030, Simply Wall St extrapolates that KLA’s annual FCF could reach about $6.30 billion. These figures indicate substantial projected expansion, informed by both analyst and automated modeling.

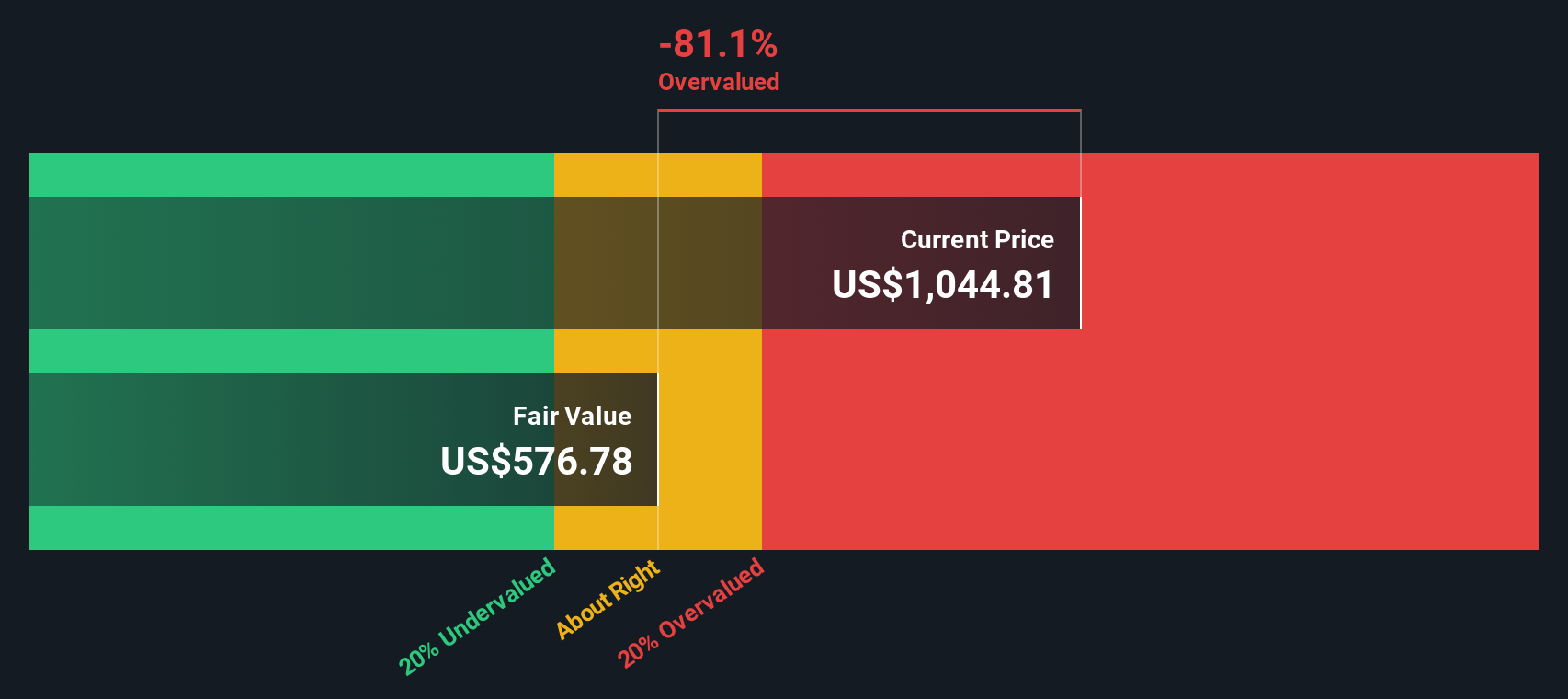

Even with this healthy cash flow outlook, the DCF model places KLA’s fair value at $613.71 per share. With the current market price around $1,101.55, this suggests the stock is trading at a 79.5% premium to its estimated intrinsic value. In other words, DCF calculations indicate KLA is sharply overvalued based on its likely future cash generation, despite robust growth forecasts in the semiconductor sector.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests KLA may be overvalued by 79.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: KLA Price vs Earnings

For profitable companies like KLA, the Price-to-Earnings (PE) ratio is a foundational metric for valuation. Because it compares the company’s market price to its actual earnings, the PE gives investors a sense of how much they are paying for each dollar of profit. Companies with reliable profitability are best suited to this approach. This makes it especially relevant for a semiconductor leader like KLA.

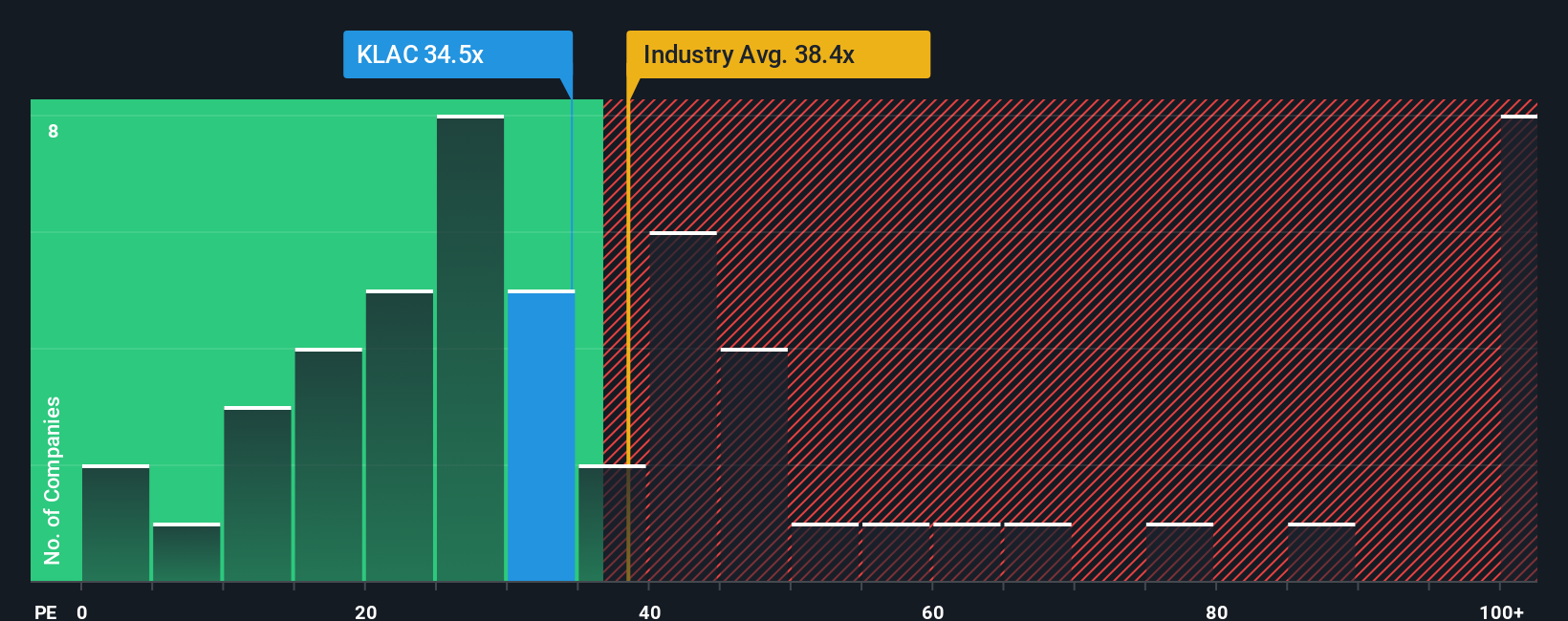

Interpretation of any PE ratio depends on growth expectations and market risk. A higher PE can be justified if investors expect strong future earnings growth or view the company as lower risk. In contrast, a lower PE may reflect slower growth or higher uncertainty. As of now, KLA trades at a PE of 35.7x. For perspective, this is just below the semiconductor industry’s average of 37.0x and beneath the peer group average of 39.9x.

Instead of just comparing KLA to its industry or peers, Simply Wall St has developed a “Fair Ratio” metric. This incorporates not just company size or sector but also factors like earnings growth, profit margins, and risks, which leads to a more tailored benchmark. For KLA, the Fair Ratio comes in at 31.5x. This suggests that KLA’s current valuation is somewhat higher than what would be warranted based on these various considerations. Because the difference between KLA’s current PE and the Fair Ratio is more than 0.10, KLA appears slightly overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KLA Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your investment story: it’s where you bring together your view on a company’s future, such as its revenues, profit margins, and fair value, and tie those numbers to the business context you believe in. Narratives offer a powerful, user-friendly approach to investing because they connect the company story to tailor-made financial forecasts, letting you see whether today’s share price matches your assumptions.

On Simply Wall St's Community page, used by millions worldwide, Narratives make it easy for you to build or explore these stories, check your numbers, and compare the resulting Fair Value to the current market price to help decide when to buy or sell. In addition, Narratives are dynamic: whenever fresh information like earnings or news emerges, the Narrative updates automatically, keeping your view relevant and actionable.

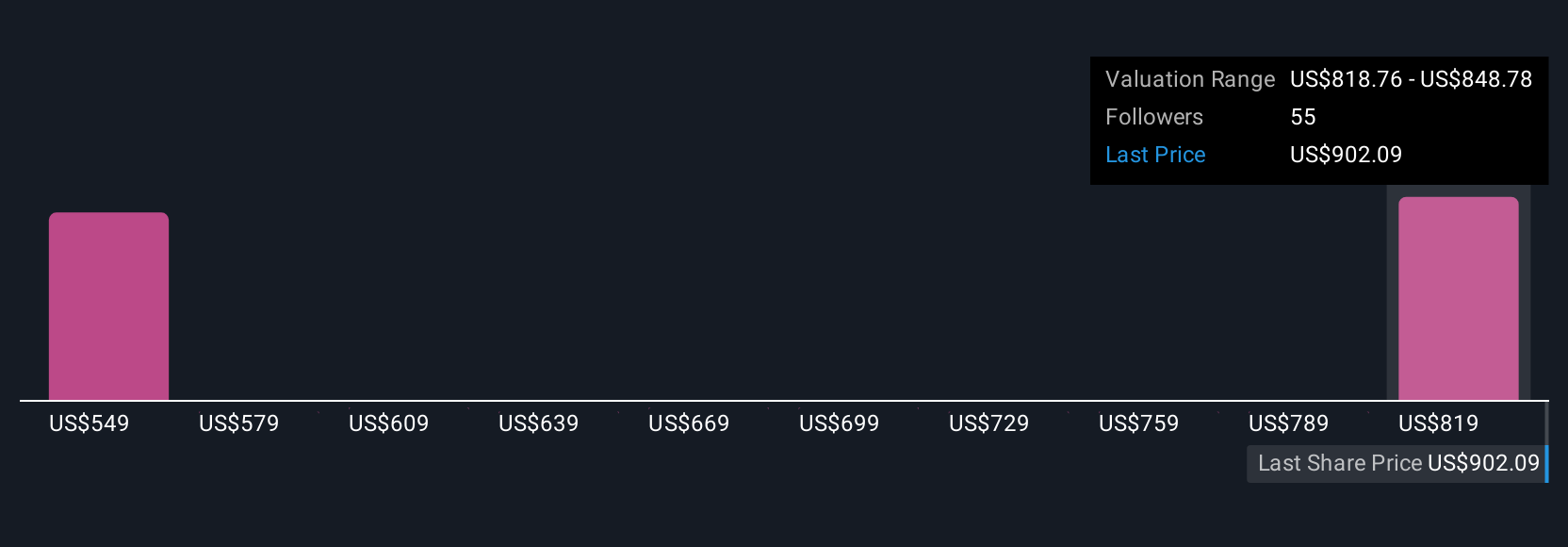

For KLA, one Narrative might envision AI and advanced packaging sparking robust growth and a fair value as high as $1,075. Another could highlight risks like cyclical headwinds or margin pressure, resulting in a fair value closer to $745. Narratives let you merge your insights with live data to make smarter, more confident decisions about when and why to invest.

Do you think there's more to the story for KLA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives